Weekly Market Digest: Apple Reported A Decline In Sales

In case you missed it:

🏘 Keppel REIT (SGX: K71U) Reported 10% Drop In Distribution Income

👓 Weekly Market Digest: Apple Reported A Decline In Sales

Apple reported a decline in sales

Apple Inc. experienced a decline in sales for the fourth consecutive quarter, marking the longest period of slowdown since 2001. The company is currently grappling with sluggish demand and a challenging smartphone market in China. These results indicate that Apple is facing a more significant slowdown in China than initially anticipated.

The Chinese government has implemented iPhone bans in certain workplaces, and the introduction of a new phone by Huawei Technologies Co. has intensified competition. Prior to Apple’s report, the S&P 500 index recorded a gain of nearly 2%, marking its strongest session since April. Investor attention is now likely to shift towards the upcoming US jobs report, which is expected to reveal a slowdown in monthly payroll growth from 336,000 to 180,000.

Fed maintained benchmark interest rate

The Federal Reserve has indicated that the recent increase in long-term Treasury yields has diminished the need for further interest rate hikes. However, Chair Jerome Powell has not ruled out the possibility of another rate hike to address inflation concerns. While Powell mentioned the potential for policymakers to raise rates at their next meeting, he also acknowledged that they may have completed their tightening efforts.

He stated that he was not yet confident in determining whether the current monetary policy is sufficiently restrictive to bring inflation back to the Fed’s target of 2%. The central bank decided to maintain the target range for its benchmark interest rate at 5.25% to 5.5% for the second consecutive meeting. As a result, the S&P 500 index increased as Treasury yields in the US declined.

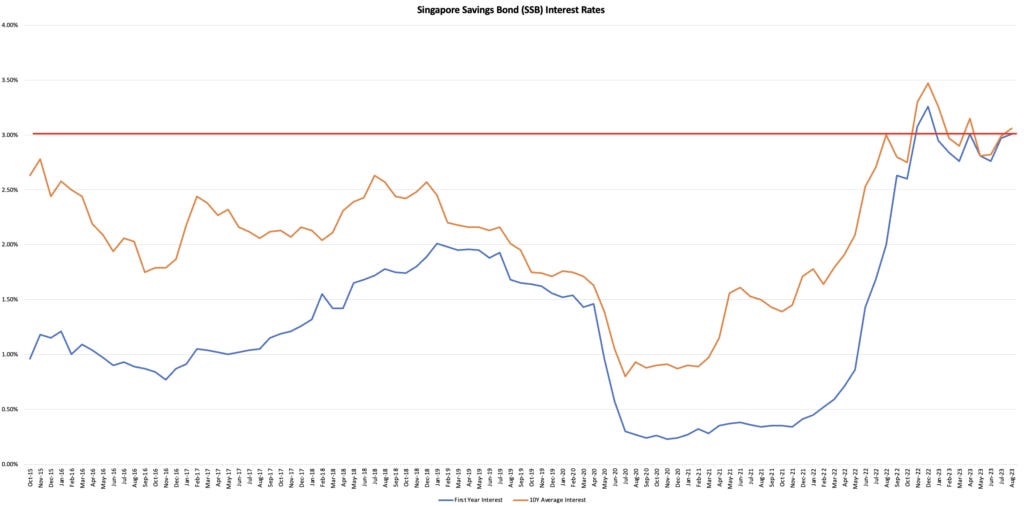

Singapore Savings Bonds (SSB)’s rate increased to 3.4%

The interest rate for SSB changes every month with each issue, and this month the interest rate continue to go up slightly to 3.4%. If you invest $1,000 in this issue of Singapore Savings Bonds and hold it for the full 10 years, you’ll get $340 in interest. That’s not a bad return for a risk-free investment.