Weekly Key Insights: Strong PPI Report Drove Stocks Down

On Tuesday, February 13th, the release of hot US Consumer Price Index (CPI) inflation data had a significant impact on both stocks and bonds. The month-on-month CPI showed a higher-than-expected increase of 0.3% compared to the projected 0.2%, while the core CPI rose by 0.4% instead of the anticipated 0.3%. The core services, including shelter, experienced a substantial increase of 0.7%, and medical costs also rose by 0.7%.

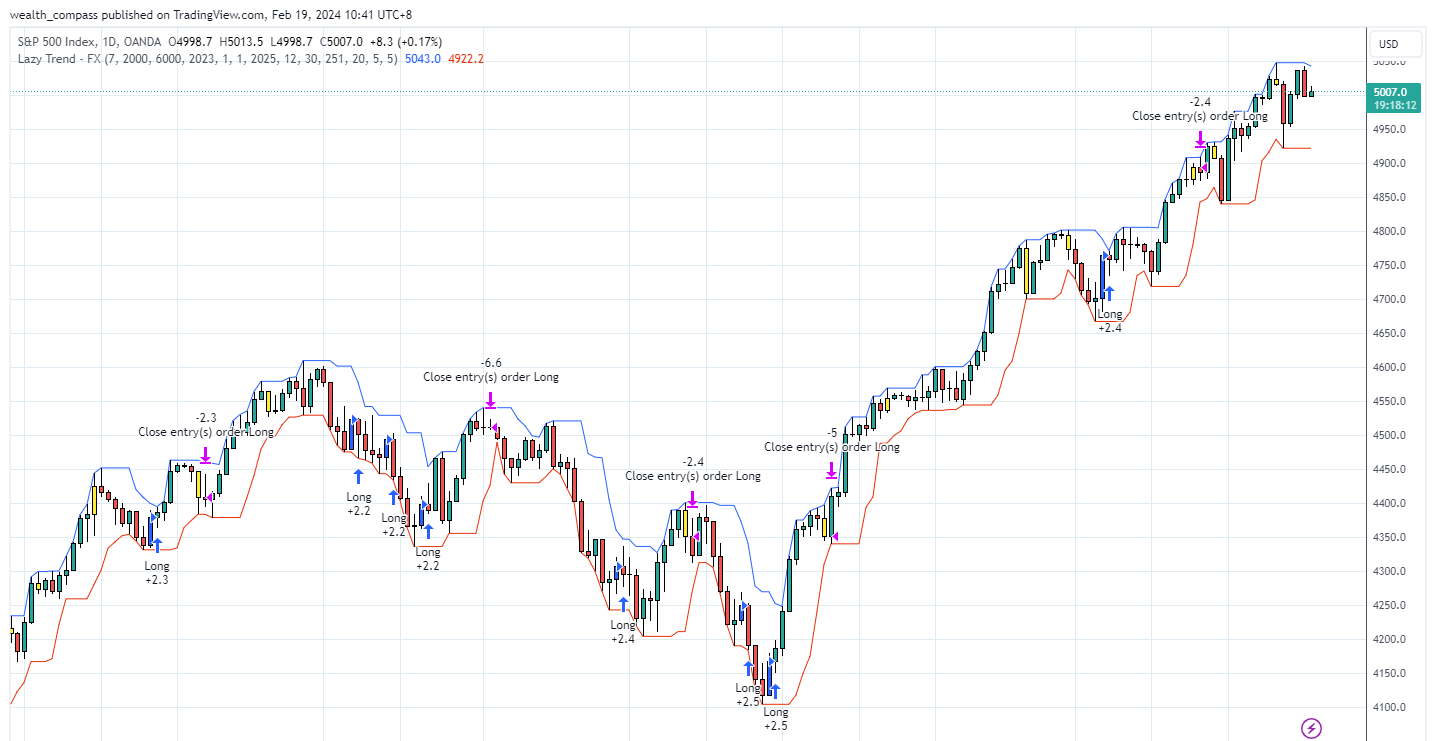

The S&P 500 index experienced its worst CPI-related decline since September 2022, falling by 1.4%. Rate-sensitive stocks such as homebuilders and banks were particularly affected, and even mega tech stocks like Tesla suffered losses. However, the S&P 500 is still trading near its historical high right now.

On Friday, February 16th, the US Producer Price Index (PPI) was released, indicating a higher-than-expected increase in both the headline and core inflation rates. This further highlighted the persistent nature of inflation.

Delay in US Rate Cut Puts Pressure on Gold

Gold prices experienced stabilization towards the end of the week after witnessing a decline below a crucial support level following the release of the US inflation data on Tuesday. The delay in the timing of the first US rate cut prompted a recovery in gold prices, surpassing the $2,000 mark once again. The revised expectation now places the first rate cut at the June 12 Federal Open Market Committee (FOMC) meeting.

ARM Holding: Unprecedented Rally Challenges Market Expectations

ARM Holding has experienced a remarkable surge in its share price over the past two weeks, reaching levels not seen since the dot-com bubble.

On February 8th, ARM Holding shares soared by 60% following the release of better-than-expected third-quarter earnings and an optimistic full-year revenue forecast. The Q3 earnings of $824 million exceeded the estimated $762 million, while the Q4 forecast of $850 million to $900 million surpassed the projected $779 million. The positive outlook was primarily driven by the high demand for artificial intelligence (AI) devices and smartphone cores.

ARM Holding has promising growth prospects, including intellectual property rights and the more profitable V9 technology, as well as a positive guidance outlook. The company currently maintains a net profit margin of approximately 40% and expects a 22% growth rate for the fiscal year. However, questions arise as to whether these factors justify its current valuation.

The significant increase in share price led to ARM Holding being valued at more than twice the forward operating earnings of Nvidia. After the 35% post-earnings rally, ARM Holding's valuation stands at 39.5 times EV/Sales, which is twice the valuation of the S&P 500 stock with the highest EV/Sales ratio (Prologis at 19.8x) and significantly higher than Nvidia's EV/Sales ratio of 18.7x.