UOB (SGX: U11) has recently announced its 1H 2024 report. In this article, we will deep dive into its performances.

Financial Highlights

The numbers speak for themselves. UOB's fee income contribution reached a record 18% of total income in the second quarter of 2024 - the highest level since 2022. This points to a remarkable resurgence in the bank's wealth management franchise, with wealth contributions surging 22% year-over-year.

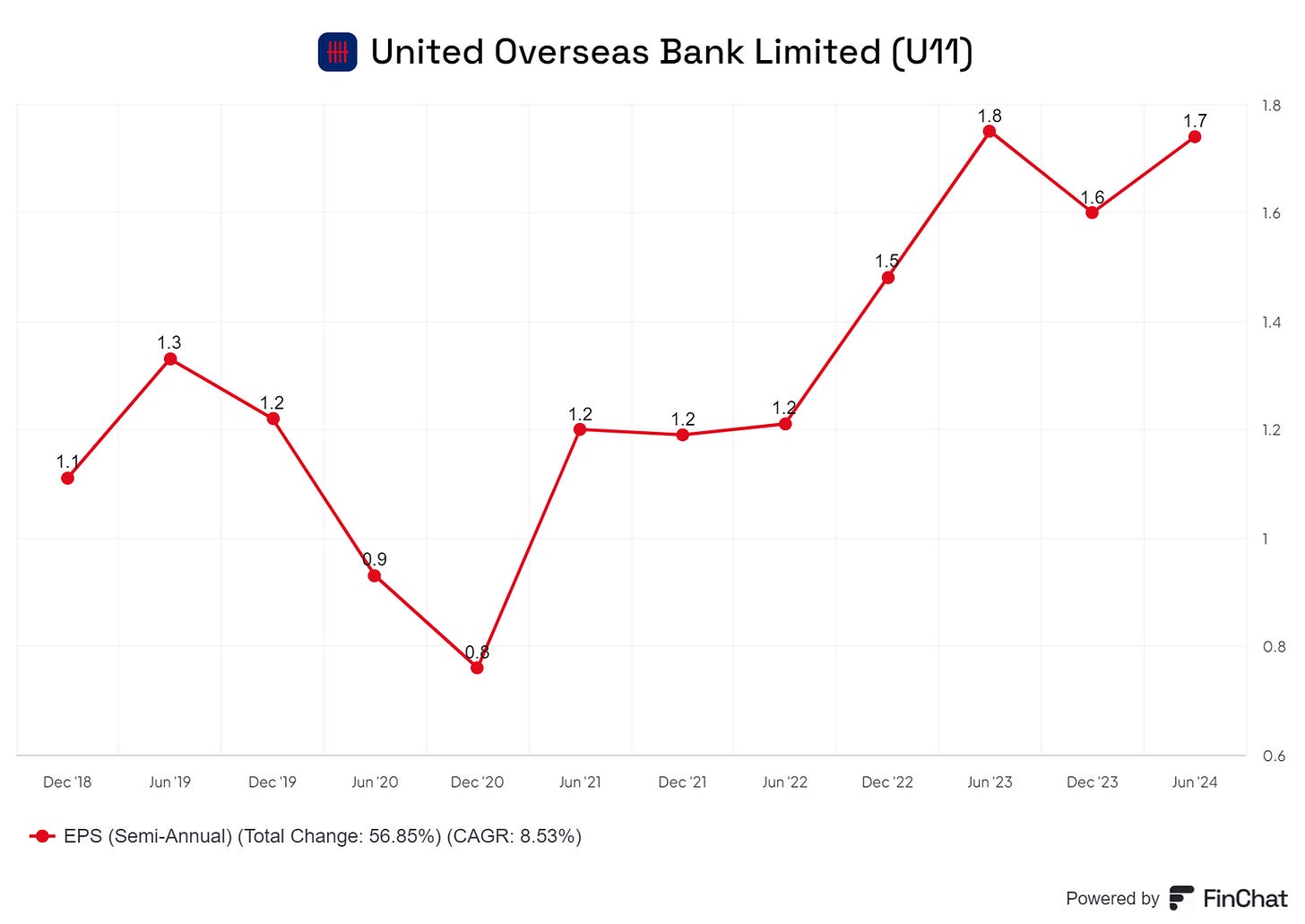

Earnings per share (EPS) has been growing, mainly due to the high interest income in the past 3 years.

What's driving this growth spurt?

It seems that UOB's clients are becoming more adventurous, rotating their liquid assets out of traditional fixed deposits and embracing more diverse investment options. This shift in risk profile is a testament to the bank's ability to cater to the evolving needs of its customer base.

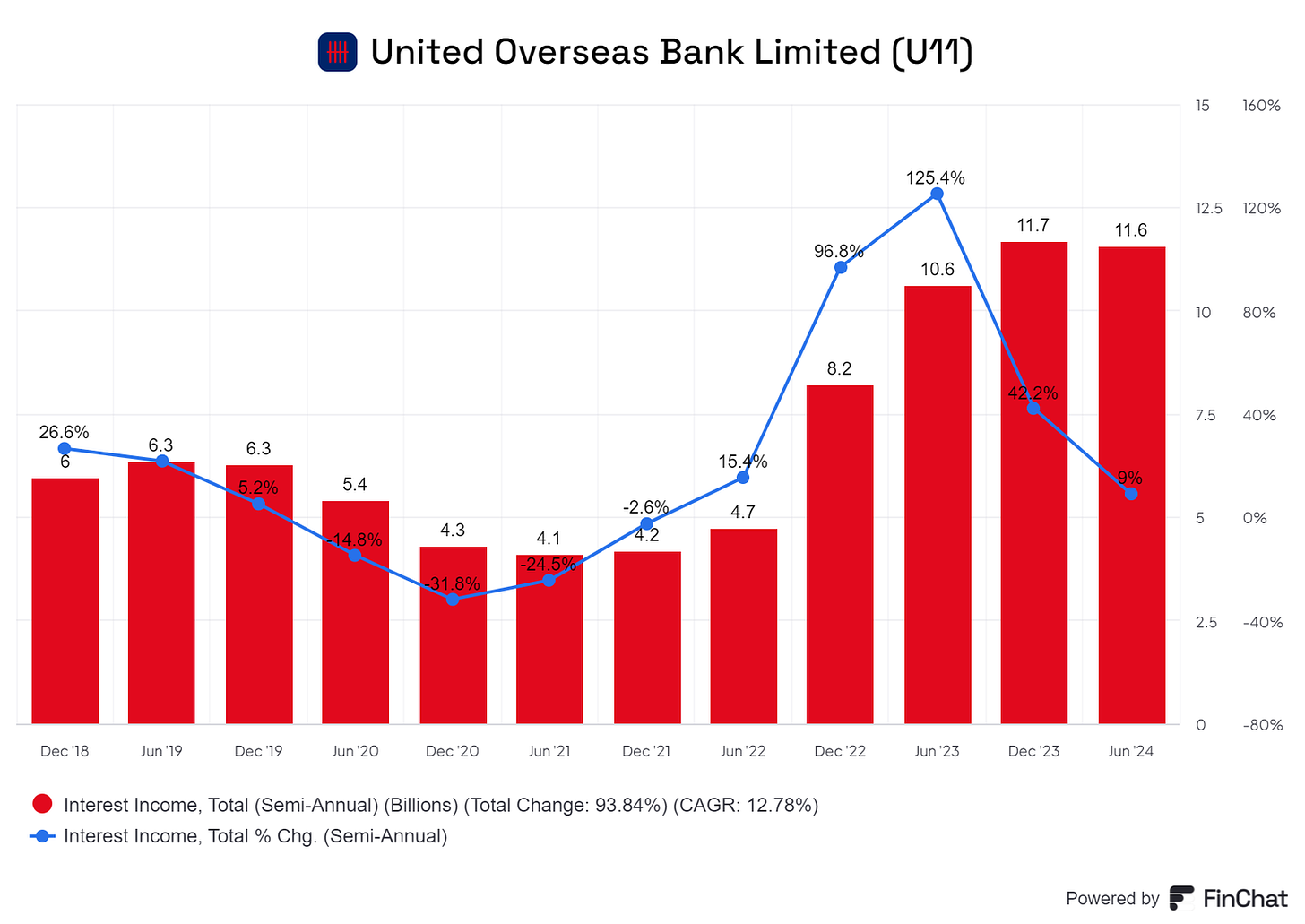

When it comes to net interest income (NII), UOB has managed to find a delicate balance.

Loan growth may have reached a plateau, but the bank has been adept at navigating the shifting tides of interest rates. Improved funding costs and loan yields have helped expand net interest margins, even as the prospect of Fed rate cuts looms on the horizon. Interestingly, the bank's regional diversification is also bearing fruit, with robust loan growth in developed markets like data centers and student accommodation.

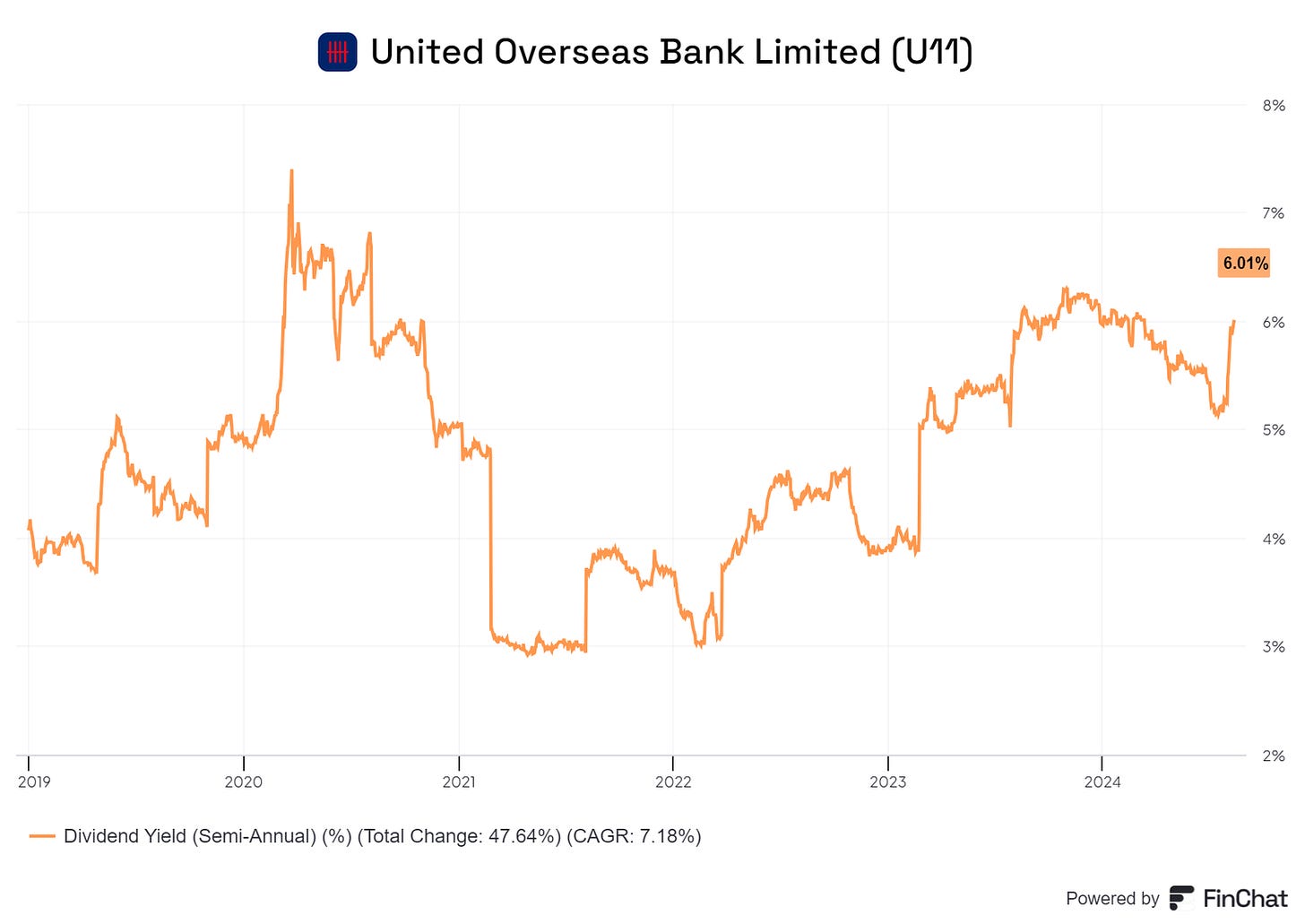

Dividend Yield

Yield wise, UOB is offering 6% yield, which is quite lucrative. And if we look at the yield trend, 6% is at the high side since 2021.

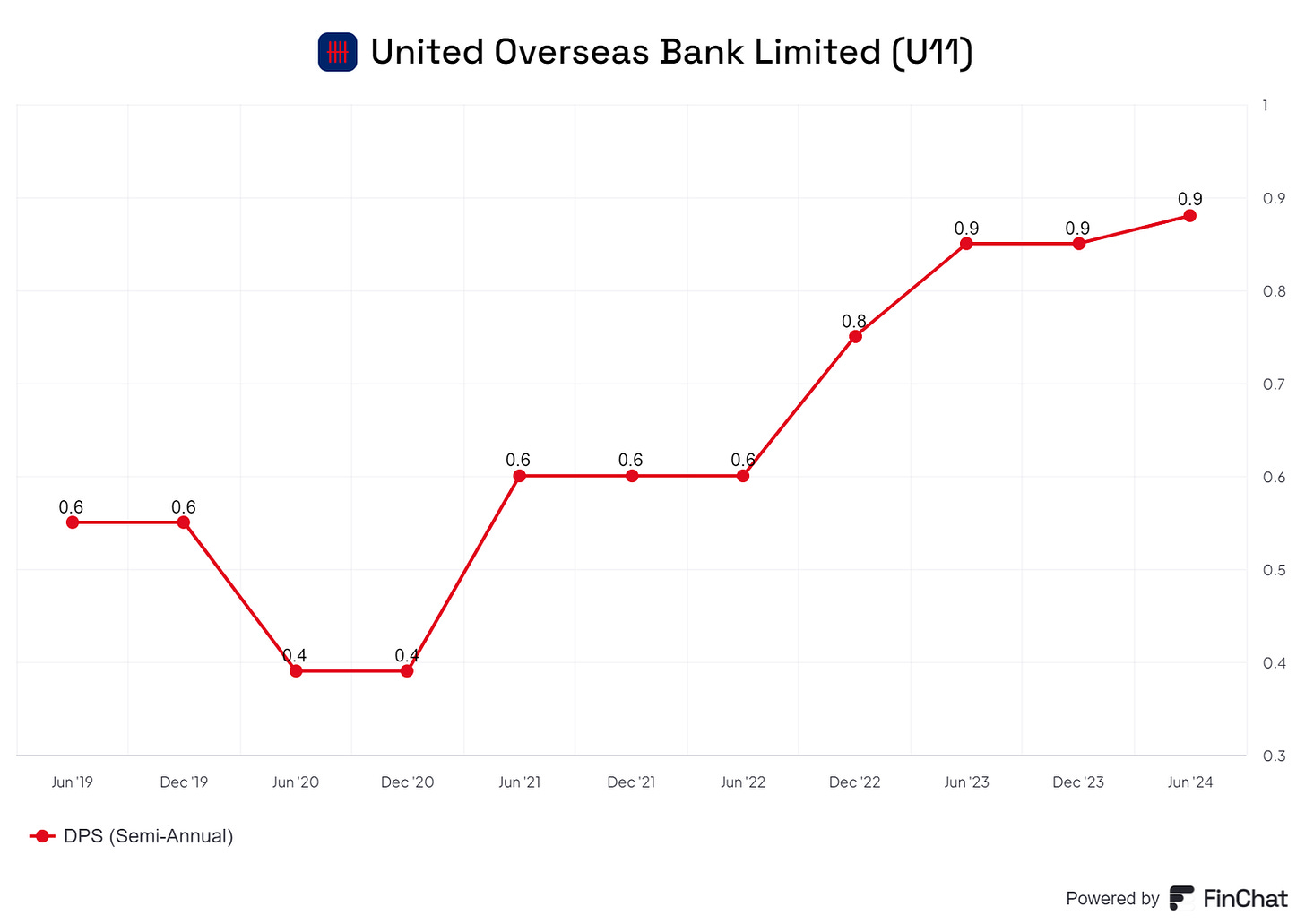

Dividend per share (DPU) has been growing consistently, and more than doubled since the 2020 Covid period.

Value Proposition

UOB's value proposition lies in its strong, legacy relationships as the largest SME lender in the region, resulting in higher lending yields than peers. The bank is conservative, focused on traditional commercial banking, and headed by a founding family that has not made aggressive overseas or trading bets.

UOB's wide Southeast Asian footprint through fully-owned operations in Malaysia, Thailand, Indonesia, and Hong Kong provides diversified earnings growth. The bank's well-integrated regional operations enable cross-border services to an increasingly regional client base. Importantly, UOB is committed to maintaining a 50% dividend payout ratio, which is a good news for dividend investors.

Competitor Analysis

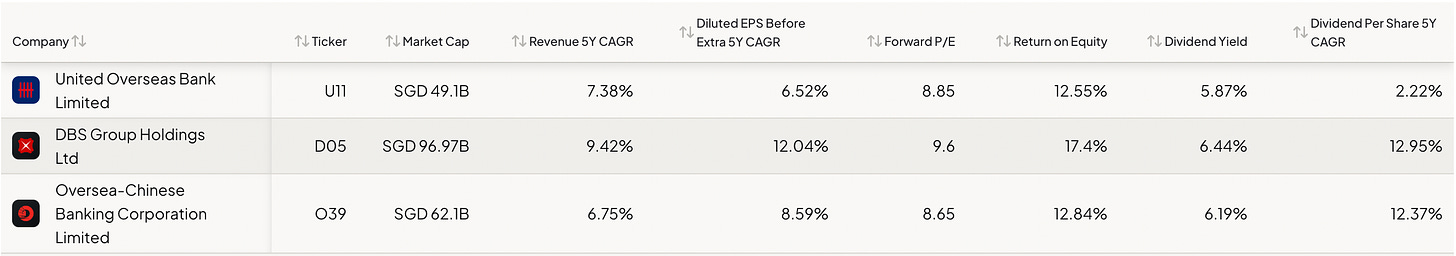

When compared to its peers, DBS and OCBC, UOB stands out for its focus on traditional commercial banking and risk-averse approach. While DBS and OCBC have made more aggressive overseas expansions and trading bets, UOB's conservative strategy has proven to be a source of stability during volatile market conditions.

Furthermore, UOB's regional diversification and strong SME relationships allow it to maintain higher lending yields than its competitors. This, combined with its commitment to dividends, makes UOB an attractive proposition for investors seeking reliable returns.

In terms of key financial metrics, UOB is slightly more expensive compared to its peers.

Swing Factors

Upside potential for UOB includes an improved growth trajectory for China and ASEAN driving higher loans and fees, a turnaround in wealth management and other fee income as market conditions improve, and potentially higher dividends or special dividends.

Downside risks include asset quality downside surprises, especially from China and North American commercial property, digital platform outages and cyber attacks, and FX translation downside surprises, particularly from ASEAN currencies.

In an era of market volatility, UOB's focus on stability, regional diversification, and commitment to reliable dividends make it a compelling investment proposition for those seeking steady returns.

Conclusion

We have been holding UOB under our dividend portfolio. Should we increase our positions? We will wait for more clarity in the market and a better price point to increase our holdings again.

Note: we will launching a dividend portfolio soon, click below to subscribe to our newsletter to get the latest update.

Sign up now and get our free dividend stock list for free.

Disclaimer: This article constitutes the author’s personal views and is for entertainment and educational purposes only. It is not to be construed as financial advice in any form. Please do your own research and seek advice from a qualified financial advisor. From time to time, I have positions in all or some of the mentioned stocks when publishing this article. This is a disclosure - not a recommendation to buy or sell stocks.