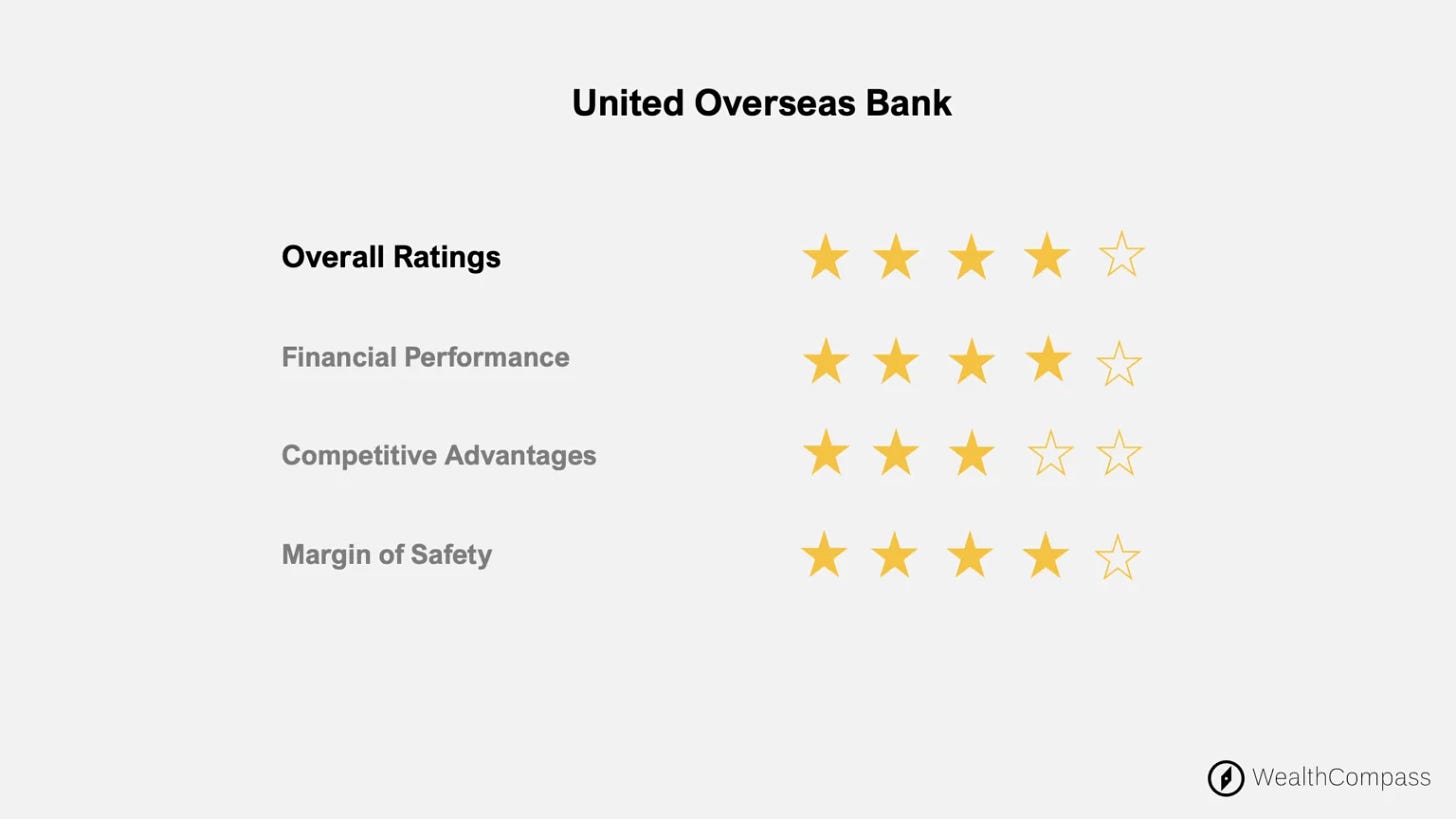

In the ever-evolving landscape of the banking industry, UOB has emerged as a formidable player, making waves with its robust performance and strategic initiatives. Despite challenges such as narrowing net interest margins and potential downsides, the bank's solid earnings for FY23, driven by non-interest income and strong asset quality, position it for further growth. This narrative takes you on a journey through UOB's recent achievements, its regional expansion, and the factors shaping its future.

A Blossoming Performance:

UOB's FY23 earnings surpassed expectations, propelled by impressive net interest income and reduced provisions for bad loans. The bank's proactive measures to streamline fixed deposit rates have contributed to its non-interest income growth, with fees rising by 17% YoY in 4Q23. The integration of the Citi franchise has paved the way for synergies, promising additional growth opportunities for UOB.

Navigating Challenging Margins:

While UOB faces mounting pressure on net interest margins due to lower loan yields and higher funding costs, the bank remains resilient. In the fourth quarter of 2023, UOB's net interest margins experienced a year-on-year decline of 20 basis points. However, the bank's management has been proactive in taming these challenges, and the integration of Citi's operations is expected to bolster its return on equity.

ASEAN Integration and Firm Asset Quality:

UOB's focus on ASEAN markets has proven fruitful, as evidenced by its 21% QoQ increase in ASEAN operating profits. The bank's cross-border client servicing and integration strategy have propelled its success in the region. In FY23, ASEAN accounted for 22% of UOB's operating profits, a figure poised to expand further with the Citi integration. UOB's asset quality remains strong, with non-performing loans decreasing to 1.5% in 4Q23.

Unleashing Growth Potential:

UOB's market position as the largest SME lender, coupled with its conservative approach to banking, sets it apart from its peers. The bank's commitment to traditional commercial banking and its avoidance of aggressive overseas or trading ventures have garnered investor confidence. With fully-owned operations in key Southeast Asian markets, including Malaysia, Thailand, Indonesia, and Hong Kong, UOB enjoys diversified earnings growth. The integration of its regional operations strengthens its ability to offer cross-border services to an expanding client base.

Upside Factors and Potential Downsides:

UOB's growth trajectory is intertwined with the economic conditions of China and ASEAN. A positive turn in these markets would fuel higher loans and fees for the bank. Additionally, as market conditions improve, a revival in wealth management and other fee income is expected. However, potential downsides include asset quality surprises, particularly from the Greater China region, and the risk of economic downturns or sharp interest rate hikes impacting UOB's performance. Regulatory changes and increased competition in the banking sector are also factors to monitor.

Conclusion:

UOB's FY23 earnings exceeded expectations, bolstered by strong net interest income and improved asset quality. The bank's regional expansion, especially with the integration of Citi, positions it favorably in ASEAN's growth story. While challenges such as narrowing net interest margins and potential downsides exist, UOB's solid foundation and strategic approach make it a compelling player in the banking sector.