Subscribe our free newsletter below to get the latest REITs Numerical Scoring for free.

In the bustling city-state of Singapore, investors have long been drawn to the allure of real estate investments. However, the thought of managing properties, dealing with tenants, and navigating the complexities of the property market can be daunting for many. Fortunately, there's a solution that allows investors to reap the rewards of real estate without the hands-on responsibilities – Singapore REITs (S-REITs).

S-REIT has not been performing well in the last 3 years during the high interest rate environment. As the Fed is almost ready to reduce interest rates, it might be a good time to collect S-REITs again. We also pick 5 REITs that are currently top in our watchlist.

Yield comparison:

S-REIT: 6.17%

DBS Bank: 5.8%

UOB Bank: 5.51%

OCBC Bank: 5.8%

CPF Special Account Rate: 4.01%

As you can see, S-REITs are offering attractive yields as compared to the local banks and the risk-free rate (CPF Special Account Rate).

What are Singapore REITs

S-REITs are publicly traded companies that own, operate, or finance income-generating real estate across various sectors, from commercial and industrial to retail and hospitality. These investment vehicles offer a unique opportunity for Singaporeans to participate in the lucrative real estate market while enjoying the benefits of regular income distributions and potential capital appreciation.

Imagine you're a busy professional living in the heart of Singapore's bustling business district. Instead of scouring the property market for your next investment, you can simply allocate a portion of your portfolio to a diversified basket of S-REITs. It's like owning a piece of iconic landmarks like Marina Bay Sands or Raffles City Singapore, without the hassle of being a landlord.

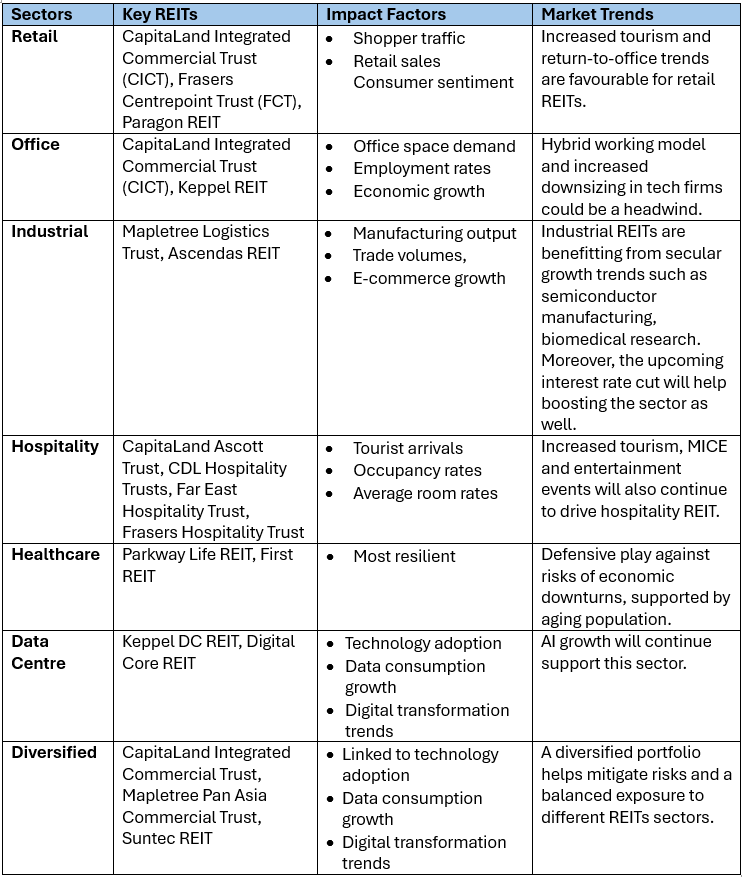

Summary of the different types of REITs and Characteristics

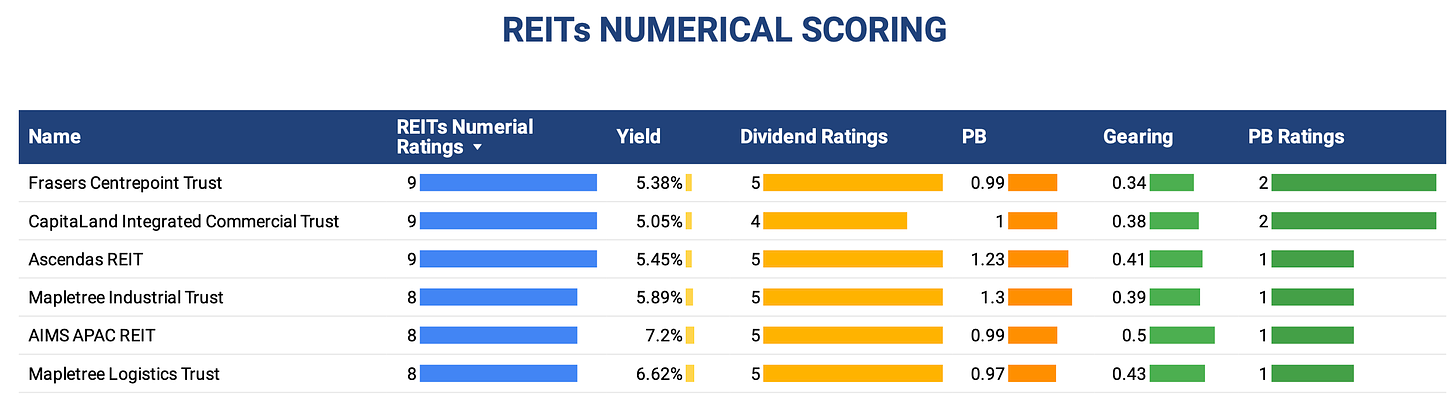

Evaluate REITs In Minutes

Of course, as with any investment, it's crucial to understand the key terms and metrics associated with S-REITs. Concepts like Yield, Gearing Ratio, Net Asset Value (NAV), and Occupancy Rate provide valuable insights into the financial health and performance of these investment vehicles. By familiarizing themselves with these concepts, investors can make more informed decisions and navigate the S-REIT landscape with confidence. Alternatively, you can just download our REITs ratings for free below.

Get a copy of our REITs Numerical Scoring for Free

Why Invest In REITs

Steady Income Stream

S-REITs are renowned for their regular and attractive dividend payouts. Mandated to distribute at least 90% of their taxable income to unitholders, these REITs can serve as a reliable source of passive income - especially appealing for retirees or those seeking a steady cash flow.

Imagine your portfolio as a well-stocked pantry. S-REITs act as the non-perishable items that provide a consistent food supply, complementing the more volatile "fresh produce" of stocks and bonds. This balanced approach can help you weather any market storms.

Diversification and Risk Reduction

By adding S-REITs to your investment mix, you're introducing an asset class that often has a low correlation to stocks and bonds. This means that when traditional asset classes are experiencing volatility, your S-REIT holdings can provide stability and act as a cushion, reducing the overall risk of your portfolio.

It's like having a diverse investment "menu" - you wouldn't want to eat the same dish for every meal, right? Similarly, diversifying your portfolio with S-REITs can help you achieve a healthier, more resilient financial "diet."

Liquidity and Accessibility

Unlike direct real estate investments, which can be illiquid and require substantial capital, S-REITs offer investors the convenience of buying and selling units on the Singapore Exchange (SGX). This accessibility and liquidity make S-REITs an attractive option, especially for those who don't have the resources or expertise to manage physical properties.

Imagine you need to quickly access funds for an unexpected expense. With S-REITs, you can easily liquidate a portion of your holdings, unlike waiting months to sell a physical property. This flexibility can provide peace of mind and financial agility.

Potential for Capital Appreciation

S-REITs not only offer regular income but also the potential for capital appreciation. As property values increase over time, the underlying assets of the REIT also gain in value, potentially leading to a rise in the price of the REIT units themselves.

It's a bit like owning a piece of Singapore's thriving real estate market, without the hassle of managing the property yourself. As the city-state continues to evolve and property prices rise, your S-REIT investments can potentially grow in value, providing you with capital gains.

Inflation Hedge

Real estate, the backbone of S-REITs, is a tangible asset that typically appreciates in value over time. This makes S-REITs an effective hedge against inflation, as rental income - a significant part of REIT earnings - often increases with rising prices.

Imagine your favorite hawker stall. As the cost of ingredients and operating expenses rise, the stall owner can gradually increase the prices of their dishes. Similarly, S-REITs can pass on higher costs to their tenants, helping to maintain the real value of your investment.

Professional Management

S-REITs are managed by experienced teams who handle all the complex tasks of property acquisition, leasing, and maintenance. This allows you to benefit from real estate investments without the hands-on responsibilities of direct property management.

It's like having a trusted personal chef who takes care of all the grocery shopping, meal preparation, and cleanup, so you can simply enjoy the delicious results. With S-REITs, you can leave the real estate expertise to the professionals while reaping the rewards.

Stringent Regulation

Singapore's REIT sector is governed by a robust regulatory framework, ensuring stability and protecting investor interests. These regulations include mandatory distribution of over 90% of taxable income, maintaining a gearing ratio below 50%, and limiting property development investments.

Imagine your favorite local hawker stall - it's not just the delicious food that keeps you coming back, but also the trust that the authorities have ensured high standards of cleanliness and safety. Similarly, the rigorous regulations surrounding S-REITs can provide you with the confidence to invest in this asset class.

Top 5 REITs

1. Ascendas REIT

First on our list is Ascendas REIT, the largest REIT in Singapore by market capitalization. Specializing in industrial properties, it’s a key player in the logistics and business parks sector. Think of it as the sturdy oak in our dividend garden—reliable and robust.

Ascendas REIT has a diversified portfolio that includes logistics, business parks, and data centers, which helps mitigate risks and provides consistent rental income. With a history of steady dividend growth, it’s like watching a tree grow over the years, bearing fruit as it expands its roots. Investors can expect solid returns, especially as e-commerce continues to thrive.

In the last few years, Ascendas REIT has consistently increased its distribution per unit (DPU). This growth reflects its effective management and adaptability in an ever-changing market.

2. AIMS APAC REIT

Next, let’s stroll over to AIMS APAC REIT. This REIT focuses on industrial and logistics properties across the Asia-Pacific region. With a strategy centered on optimizing yield and enhancing asset quality, AIMS APAC is like a diligent gardener, always looking for ways to improve its crop.

The REIT’s commitment to sustainability and smart building technologies positions it well for future growth. As more companies prioritize eco-friendly practices, AIMS APAC’s properties are likely to attract tenants willing to pay a premium for sustainable spaces.

Consider AIMS APAC REIT as a tech-savvy gardener who not only grows plants but also employs innovative methods to ensure they thrive. This forward-thinking approach can lead to greater yields—both in terms of returns and impact.

3. Capital Integrated Commercial Trust

Now, let’s take a look at Capital Integrated Commercial Trust (CICT), which specializes in retail and commercial properties. This REIT is like the vibrant flower bed in our garden, drawing attention with its colorful blooms.

CICT’s properties include some of Singapore’s most iconic shopping malls and office buildings. With tourism and consumer spending rebounding, the potential for growth in rental income is promising. The REIT has a solid track record of dividend payments, making it a reliable choice for income-focused investors.

After the pandemic, CICT has shown resilience by adapting its strategies to cater to changing consumer behaviors. This adaptability is vital in ensuring sustained growth and attractive dividends.

4. Mapletree Industrial Trust

Moving on, we have Mapletree Industrial Trust. This REIT invests primarily in industrial properties, including data centers and high-tech buildings. Picture it as a well-organized greenhouse, where each plant has its designated space and care, ensuring optimal growth.

Mapletree Industrial Trust has been expanding its portfolio to include data centers, which are in high demand in today’s digital economy. As more companies shift to cloud computing and data storage, this REIT is poised to benefit significantly.

5. Frasers Centrepoint Trust

Last but not least is Frasers Centrepoint Trust (FCT), another strong contender in the retail space. FCT focuses on suburban retail properties, making it a crucial player in the community’s ecosystem—much like a fruit-bearing tree that provides nourishment to those around it.

FCT has been proactive in enhancing its assets and expanding its portfolio through strategic acquisitions. As suburban shopping habits evolve, FCT is well-positioned to capture the changing dynamics of consumer behavior.

FCT’s focus on community-centric properties has allowed it to maintain stable occupancy rates and consistent dividends, even during challenging economic times.

Summary

In conclusion, S-REITs offer Singaporean investors a compelling blend of stable income, diversification, liquidity, and growth potential. Whether you're a retiree seeking a reliable income stream or a growth-oriented investor looking to enhance your portfolio, S-REITs deserve a closer look.

As you navigate the investment landscape, remember that the key is to find the right balance that aligns with your financial goals and risk tolerance. By incorporating S-REITs into your investment strategy, you can build a resilient, future-proof portfolio that can weather any market conditions, just like a well-stocked Singaporean pantry.

Sign up now and get our free dividend stock list for free.

Disclaimer: This article constitutes the author’s personal views and is for entertainment and educational purposes only. It is not to be construed as financial advice in any form. Please do your own research and seek advice from a qualified financial advisor. From time to time, I have positions in all or some of the mentioned stocks when publishing this article. This is a disclosure - not a recommendation to buy or sell stocks.