Portfolio Performance - Sep 2024

In case you missed it:

As the leaves begin to turn and the air gets a bit crisper, September has proven to be a month of solid growth for global equity markets. With the MSCI World Index climbing 1.7%, it’s clear that investor confidence is on the upswing, even amidst the swirling uncertainties of the global economy. But what does this mean for you, the savvy investor? Let’s break it down in a way that’s as engaging as it is informative.

United States: S&P 500 Performance

The S&P 500 rose by 2.0% in September, extending gains from earlier months. Investor sentiment remains strong, reflecting resilience amid ongoing Federal Reserve rate decisions. Corporate earnings have remained robust, supporting this upward trend.

Europe: Struggles Amidst Challenges

European equities fell by 0.5% in September. The energy crisis and inflationary pressures have caused caution among investors. Economic outlooks are mixed, highlighting the need for strategic adjustments in this region.

Asia: A Strong Performer

Asia emerged as a significant contributor to global market performance, with a 4.6% increase. Strong corporate earnings and favorable government policies in Japan and China have boosted investor confidence. This region's growth signals a shift in market dynamics.

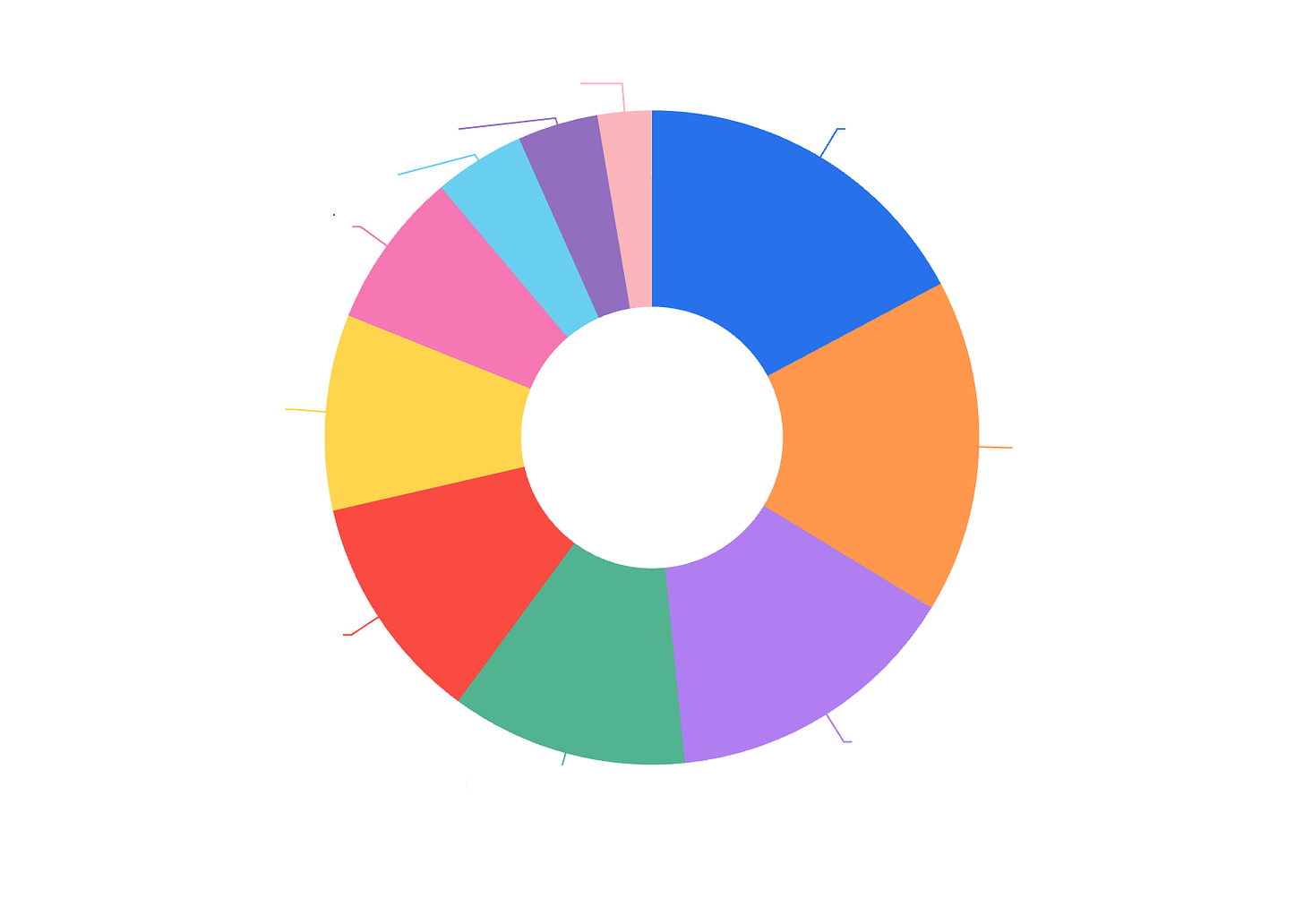

Let’s take a closer look on our portfolio so far.

Our Portfolio's Performance

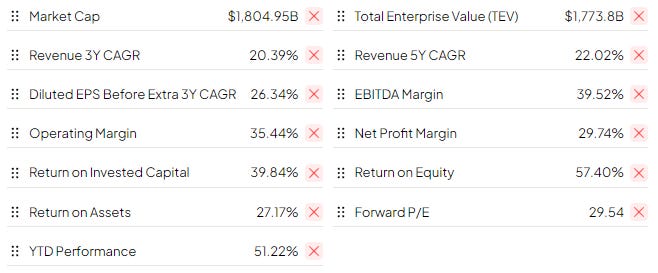

Amid this dynamic market landscape, our portfolio experienced impressive returns with a CAGR of 26.4% since inception. The portfolio metrics remain very healthy as below.

Check out our full portfolio below:

Keep reading with a 7-day free trial

Subscribe to Wealth Insights to keep reading this post and get 7 days of free access to the full post archives.