Portfolio Performance - Oct 2024

In case you missed it:

As the dust settles on the latest election, one thing is clear: Donald Trump has once again shown a remarkable resilience that has left pollsters scratching their heads. Just when it seemed the electoral landscape would be a tight battle, Trump emerged with an unexpectedly strong performance, even poised to secure a clear majority of the popular vote—a feat he hasn't accomplished before.

A Shift in Power: Senate and House Dynamics

The political ramifications of this election are profound. With the potential for Republicans to expand their Senate majority to 54 or even 55 seats, the landscape for governance has shifted dramatically. This significant gain reduces the likelihood of a moderate senator blocking Trump's agenda, paving the way for a more unified Republican front.

However, the situation in the House of Representatives remains murky. With Republicans previously holding a slim majority of just 11 seats, the stakes are incredibly high. If Democrats can flip five seats, they could effectively obstruct Trump’s policies, particularly regarding deregulation, taxation, and spending. This scenario puts us at a crossroads: will we witness a Trump gridlock or a robust Trump 2.0 administration?

Market Reactions: The Trump Trade

As the election results unfolded, markets responded in ways many anticipated. Investors had already begun pricing in a Trump victory, leading to what’s now being dubbed the “Trump trade.” The expectation is that Trump's administration will usher in tariffs, particularly on countries like China, alongside tax cuts and deregulation—an appealing cocktail for many investors.

Stock Market Surge

The equity markets reacted positively overnight, with the small-cap Russell 2000 index soaring nearly 6%. This uptick was more than double that of larger indices like the S&P 500. Small-cap stocks typically thrive in a Trump 2.0 scenario, where corporate tax cuts become a reality.

Sector-Specific Impacts

Positive Movers: Companies like Tesla saw their shares jump over 14%. Elon Musk's substantial contributions to Trump's campaign might give him a say in shaping future regulations for autonomous vehicles—a silver lining for Tesla investors. Similarly, defense companies, particularly European ones like Rheinmetall, reacted positively, possibly anticipating less commitment to NATO under Trump.

Negative Reactions: On the flip side, US retailers could face challenges. With the potential for increased tariffs on imported goods, consumers might see prices rise, creating a ripple effect on purchasing behavior. European car manufacturers also opened lower, bracing for the impact of Trump’s tariff policies.

Our Portfolio's Performance

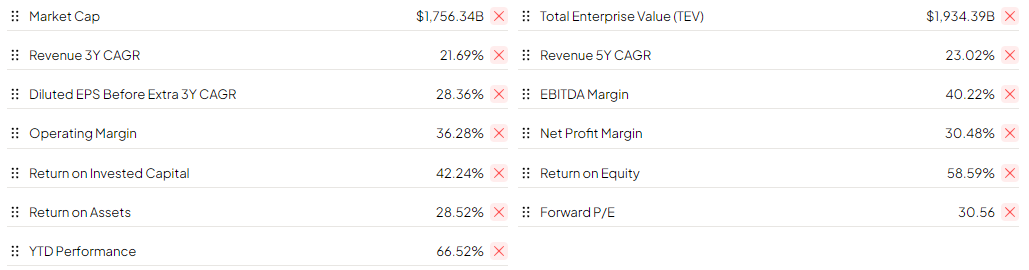

Amid this dynamic market landscape, our portfolio experienced impressive returns with a CAGR of 27.7% since inception. The portfolio metrics remain very healthy as below.

Check out our full portfolio below:

Keep reading with a 7-day free trial

Subscribe to Wealth Insights to keep reading this post and get 7 days of free access to the full post archives.