Portfolio Performance - June 2024

In case you missed it:

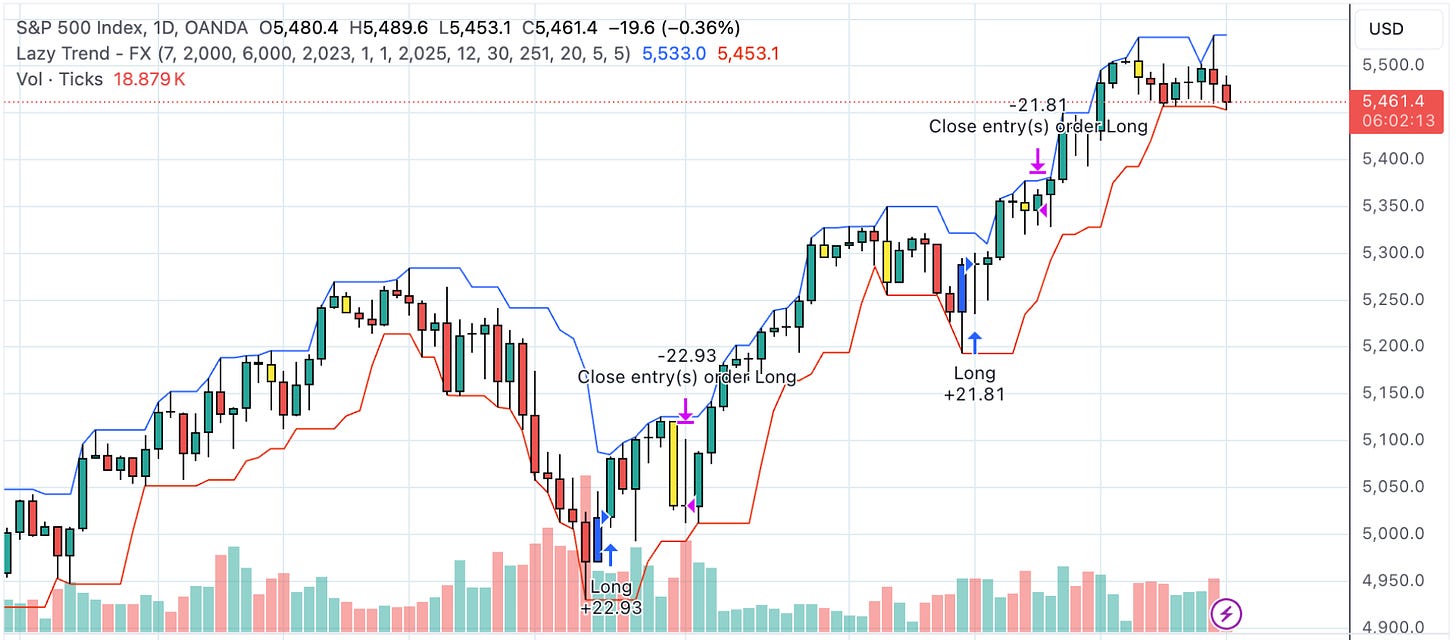

As we turn the page on the first half of 2024, the stock market seems to be firing on all cylinders. The S&P 500 index has already notched an impressive 15% gain year-to-date, setting a blistering pace that harkens back to the banner year of 2023.

In fact, the index has already reached a staggering 31 record closing highs so far this year - the most such milestones in the first half of a calendar year since 2021. This remarkable run has echoes of the past, with history showing that when the S&P 500 gains 15% or more in the first six months, the full-year outcome is usually a continued march higher.

Let's take a closer look at this trend through a Singaporean lens. Imagine you're running a successful hawker stall in Chinatown - your business is booming, with customers lining up eagerly to enjoy your signature dishes. Just like the S&P 500, you've gotten off to an incredible start in 2024, with revenue soaring in the first half of the year.

Now, you might be tempted to coast and enjoy the summer lull, but history tells us that the smart play is to keep your foot on the gas. In 13 previous instances where the S&P 500 gained 15% or more in the first half, the index went on to finish the year strongly, with a median full-year gain of 26.7%.

Only twice in those 13 years did the index struggle to maintain its momentum - in 1986 and the infamous 1987, the year of the Black Monday crash. But even then, the full-year returns were still positive, demonstrating the resilience of the market.

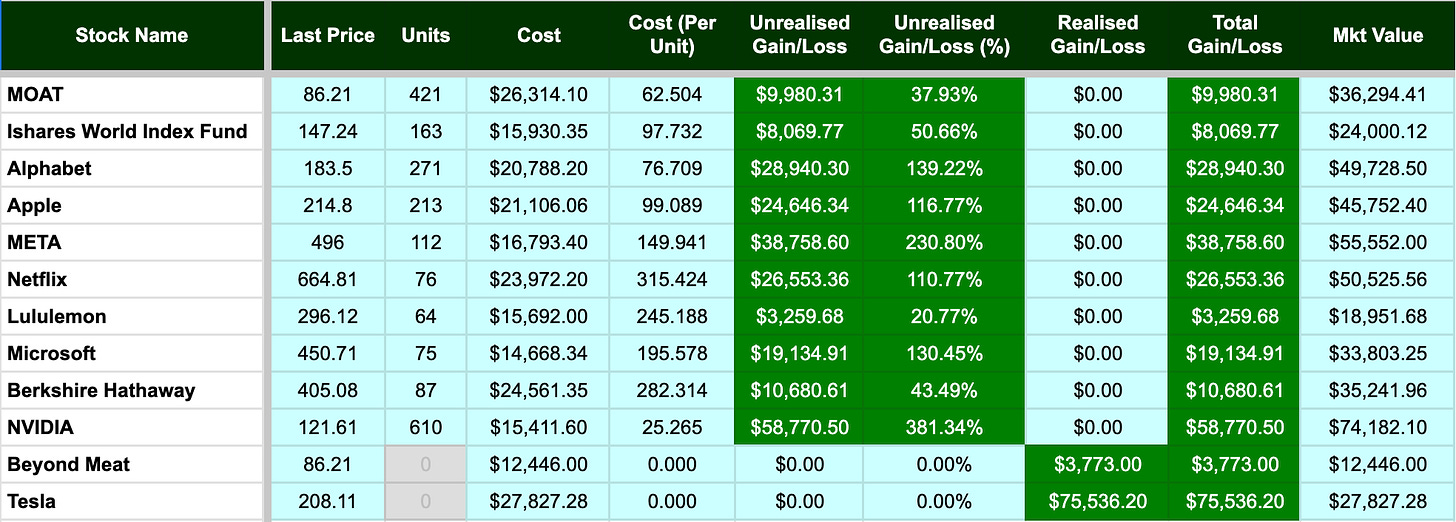

Our Portfolio's Performance

Amid this dynamic market landscape, our portfolio experienced sizzling returns in June, surging by 6%. This brings our total returns since inception in 2020 to an impressive 78%. We are excited to announce that we have recently added position on one of the stocks in our portfolio.

Portfolio summary

Keep reading with a 7-day free trial

Subscribe to Wealth Insights to keep reading this post and get 7 days of free access to the full post archives.