Microsoft And Alphabet's Price Dropped Despite Delivering Strong Results

Microsoft and Alphabet all reported impressive quarterly results. Microsoft's cloud business demonstrated rapid growth and Alphabet's advertising revenue remained strong. However, both stocks suffered a drop of 2.7% and 7.5% respectively.

Microsoft - the world most valuable company

Microsoft achieved a strong quarterly performance. Its revenue increased by 18% year-on-year, with earnings per share (EPS) reaching $2.97, a 28% increase compared to the previous year. Microsoft's global distribution and its strong presence in the corporate sector have given the company an advantage in executing generative AI applications.

The company's cloud revenue amounted to $33.7 billion, surpassing the estimated $32.2 billion. Microsoft highlighted that its revenue growth was boosted by 6% due to AI. From a broader perspective, Microsoft indicated that it expects a significant increase in capital expenditures in the current quarter, driven by the demand for AI-related services and investments in data centers.

Although investors expressed some disappointment regarding Microsoft's growth, it is generally concluded that growth remains robust and the outlook is positive, which should positively impact equity sentiment in the future.

Technical wise, the next support level will be at 384 if the price continues to move down. The price is trading in a strong uptrend.

Alphabet Reported 13.5% increase in revenue

Alphabet's strong quarterly results are a promising sign for the overall economic outlook. The company achieved its fourth consecutive quarter of increasing revenue growth, with a 13.5% year-on-year increase in Q4. Furthermore, the EBIT margin expanded for the third straight quarter. The combination of rising revenue growth and an expanding EBIT margin is encouraging for equity sentiment. Alphabet's increased focus on improving profitability is proving successful, consistently delivering an EBIT margin of around 27%, up from approximately 20% before the pandemic.

Although Alphabet's advertising revenue fell slightly short of estimates, the absolute numbers remain strong, suggesting a positive outlook for global demand from a macro perspective. Advertising revenue serves as a pro-cyclical indicator. One positive surprise was the revenue generated by Alphabet's cloud business, which amounted to $9.1 billion, surpassing the estimated $9 billion. The increasing demand for Google's cloud services, driven by the companies' push in generative AI, contributed to this result.

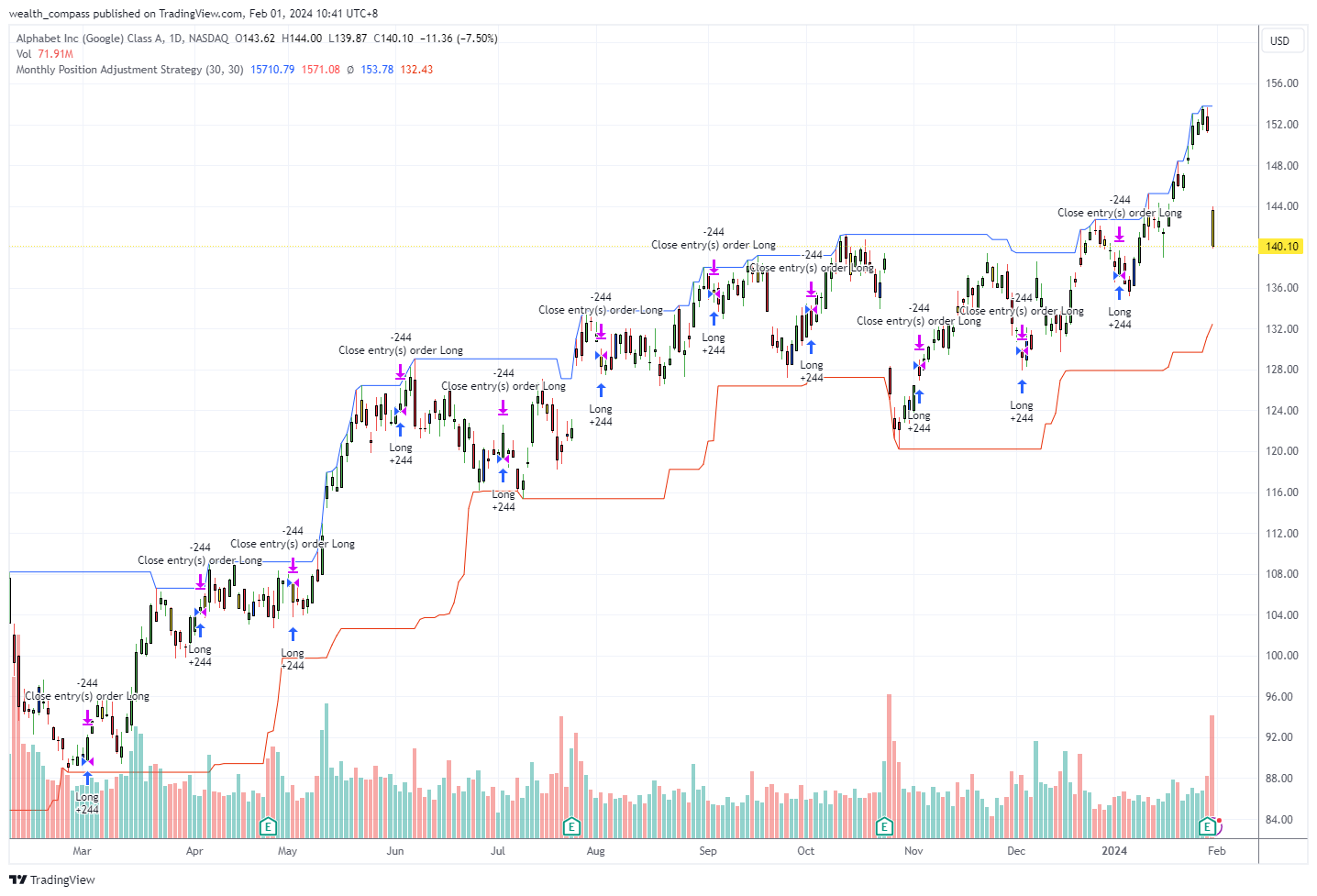

Technical wise, the next support level will be at 135 if the price continues to move down. The price is trading in a strong uptrend. Potentially, we might see the price to move back up to close the yesterday gap.