Mapletree Industrial Trust - Strong Growth Ahead

Mapletree Industrial Trust (MINT) has recently made headlines with its strategic moves in the Japanese market.

In case you missed it:

Mapletree Industrial Trust (MINT) has recently made headlines with its strategic moves in the Japanese market. Let’s dive into the financial highlights, value proposition, risk factors, and competitor analysis to understand why MINT is a compelling investment opportunity.

🏢 Market cap: $7.1B

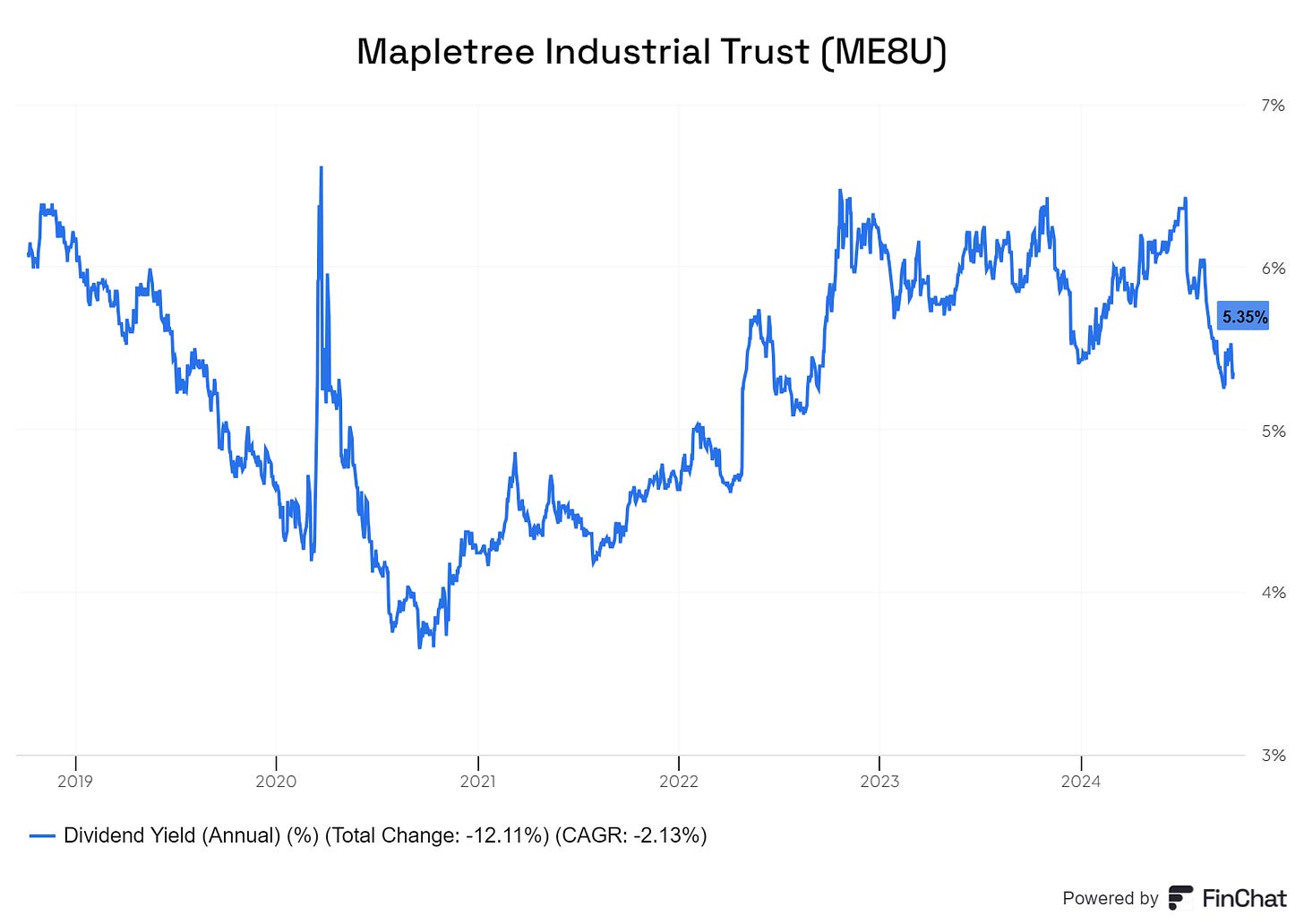

🔥 Dividend yield: 5.4%

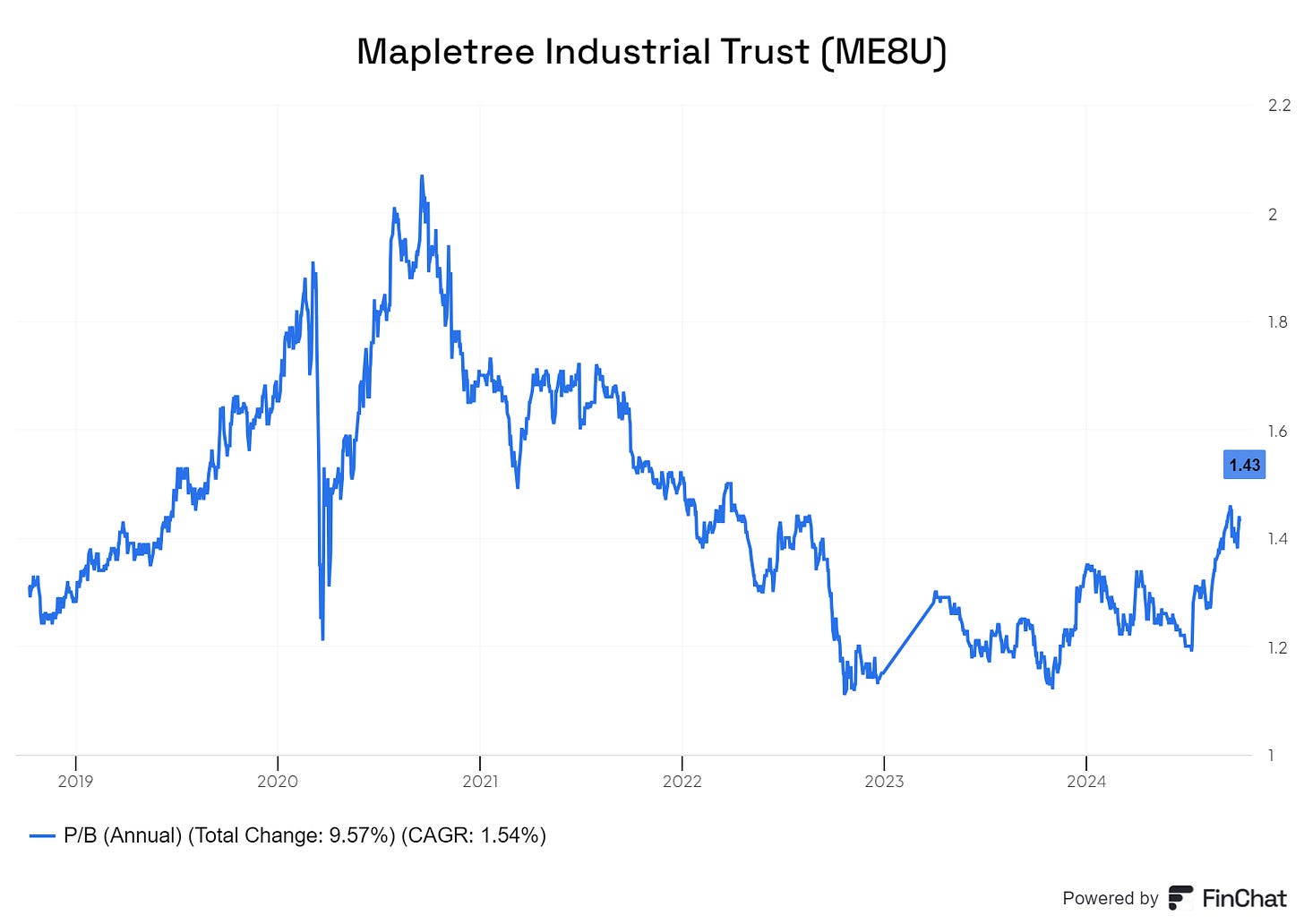

📒 Price to book: 1.4

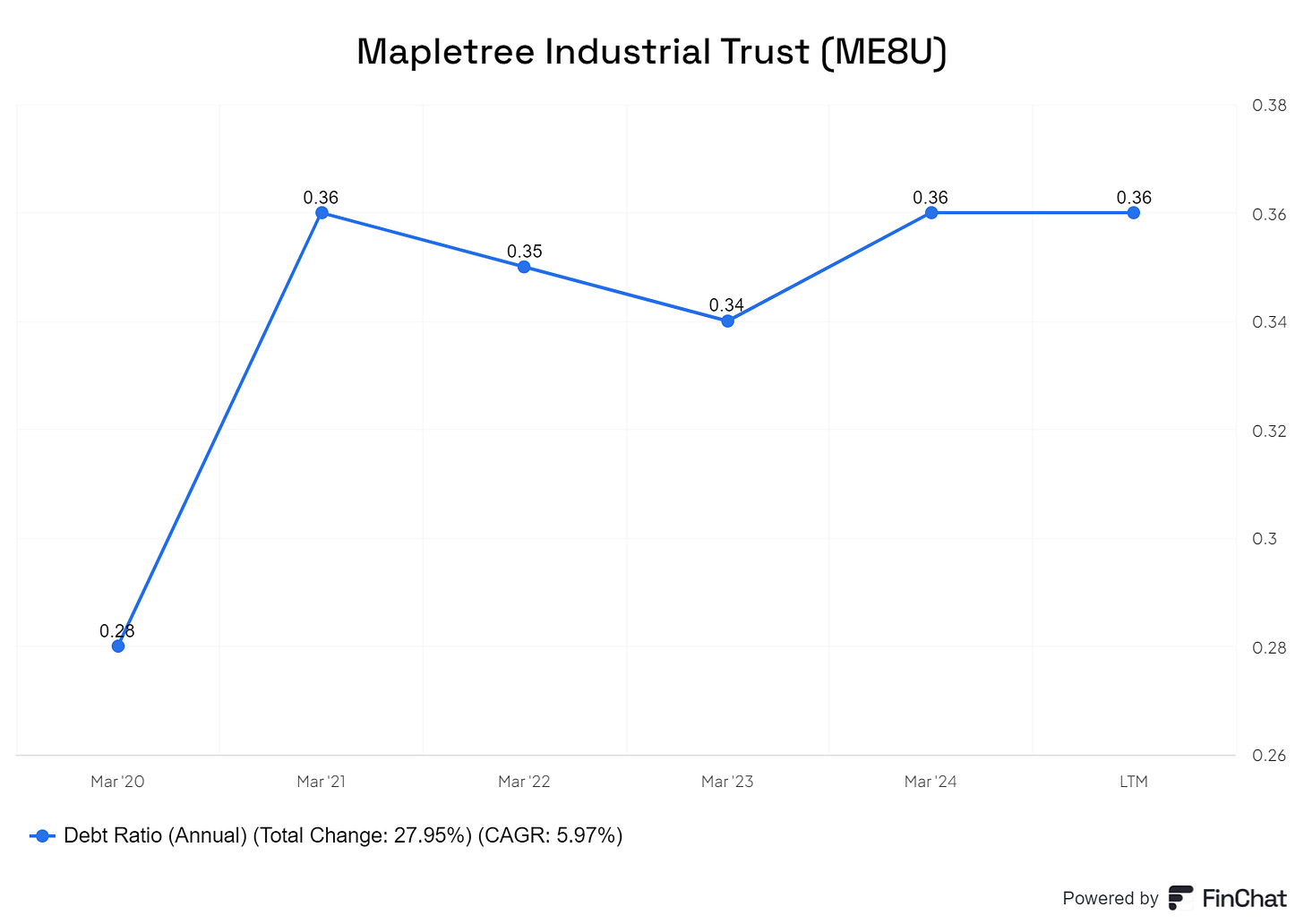

📢 Gearing: 36%

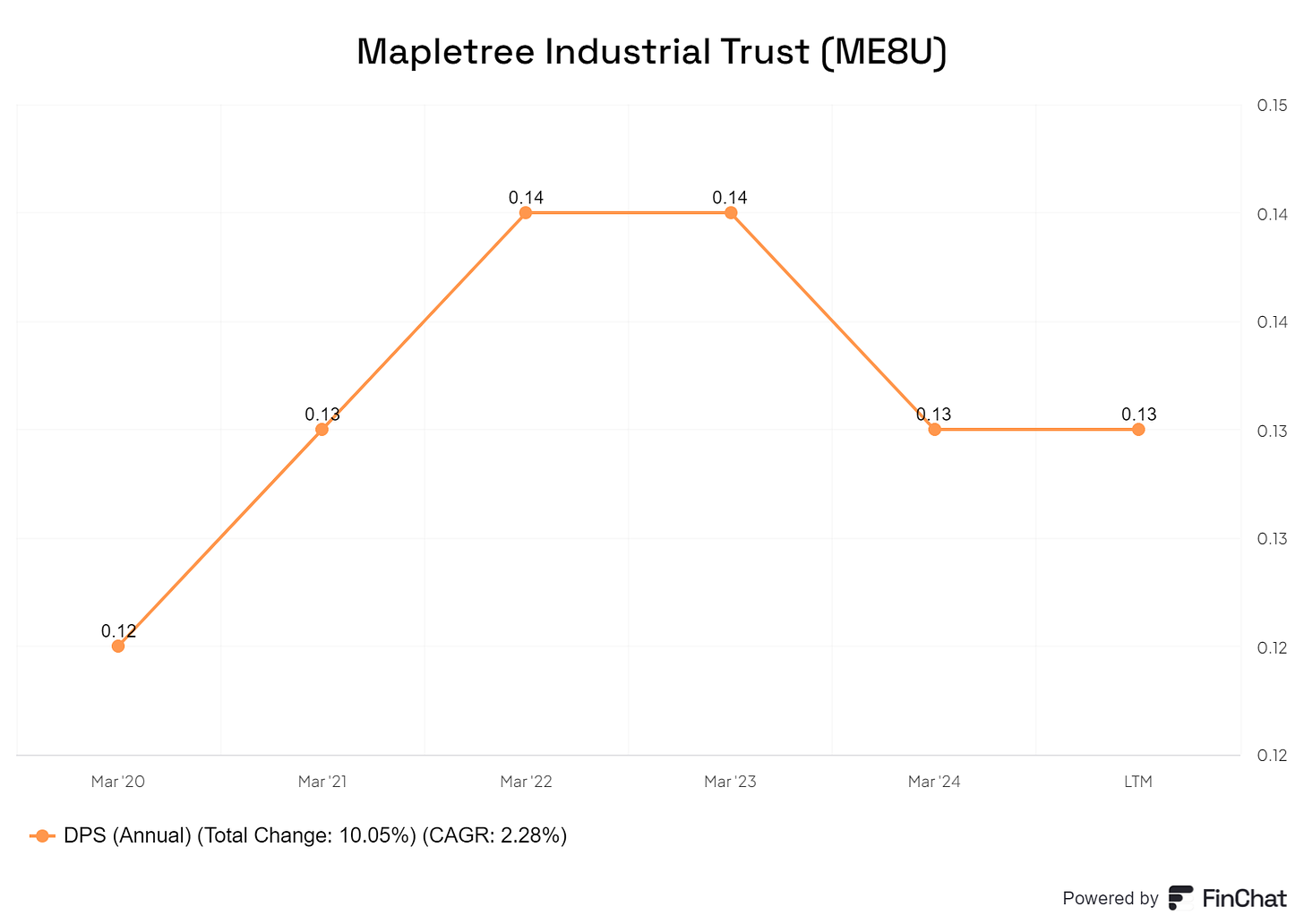

🔎 DPU 5Y Growth: 1.9%

Financial Highlights

MINT is making waves in the investment community by acquiring a mixed-use industrial facility in Tokyo for JPY 14.5 billion (approximately SGD 127.8 million). This acquisition is not just a number on a balance sheet, it represents a freehold asset with significant redevelopment potential once the existing lease expires. With a net property income (NPI) yield of 4%, MINT offers a cushion against market fluctuations, providing investors a sense of security.

The management team has updated its forecasts, showing a 0.2% to 0.5% increase for FY25-26E due to this acquisition. This slight bump may seem modest, but it reflects a proactive approach to capitalizing on market conditions, especially with the current trend of falling interest rates. MINT’s ability to adapt and optimize its portfolio is indicative of its commitment to long-term growth.

Dividend per share (DPU)

2024 DPU is on track to meet the performance last year. The trust's distribution per unit (DPU) stood at SGD0.135 cents.

Yield

Yield is attractive at 5.4%. This is just slightly above its average yield of 5.25%.

Price to book

In terms of net asset value valuation, MINT is overvalued at 1.43. The current valuation is slightly below its 5-years average of 1.46.

Gearing

Gearing remains steady at 36%. This gives the REIT some of headroom for future acquisitions.

Value Proposition

What truly sets MINT apart is its strategic focus on acquiring assets that blend stable income streams with growth potential. The Tokyo facility is not just any property; it’s part of a thriving data center cluster in west Tokyo, which accounts for nearly 40% of the IT supply in Greater Tokyo. The current tenant, a prominent Japanese conglomerate, primarily uses the facility as a training site with a significant portion dedicated to data center operations.

Imagine a bustling tech hub where innovation meets education. This facility has the potential to evolve into a cutting-edge data center by 2033/34, with management projecting a 30-40MW IT load and a yield-on-cost of 5.5-6%. This forward-thinking approach allows MINT to ride the wave of increasing demand for data centers, a trend that is only expected to grow.

Moreover, MINT's portfolio consists of 141 properties valued at SGD 8.8 billion, backed by the reputable Mapletree Investments. This strong foundation provides a robust platform to execute further acquisitions, especially with a divestment pipeline valued between SGD 200-400 million anticipated in the next year. The combination of a strong balance sheet and favorable market conditions makes MINT a well-positioned player in the industrial sector.

Risk and Competitor Analysis: Navigating Challenges

While MINT presents an attractive investment opportunity, it’s essential to consider potential risks. A prolonged economic slowdown could dampen demand for industrial spaces, potentially leading to lower occupancy and rental rates. Additionally, the termination of long-term leases could impact tenant retention, which is crucial for maintaining a stable income stream.

The investment landscape is also competitive. MINT is the third-largest industrial sector S-REIT, contending with other established players. Competitors may also pursue aggressive acquisition strategies, which could pressure MINT’s growth prospects.

However, MINT’s diversified tenant base and a greater proportion of multitenant assets provide a buffer against these risks. The firm’s commitment to redeveloping properties and enhancing asset quality through active management further solidifies its competitive edge.

Conclusion:

With its recent acquisition in Tokyo, a solid financial foundation, and a focus on growth, MINT is poised for a promising future. As always, potential investors should weigh the risks against the rewards, but for those seeking a resilient and growth-oriented investment, MINT stands out as a compelling choice. The journey ahead looks bright, and the best may be yet to come!

Sign up now and get our free dividend stock list for free.

Disclaimer: This article constitutes the author’s personal views and is for entertainment and educational purposes only. It is not to be construed as financial advice in any form. Please do your own research and seek advice from a qualified financial advisor. From time to time, I have positions in all or some of the mentioned stocks when publishing this article. This is a disclosure - not a recommendation to buy or sell stocks.