Keppel REIT - Stable Yield of 6.7%

Keppel REIT has recently published its 1H 2024 financial report. In this article, we will deep dive into its performances.

In case you missed it:

Keppel REIT(KREIT) has recently published its 1H 2024 financial report. In this article, we will deep dive into its performances.

🏢 Market cap: $3.2B

🔥 Dividend yield: 6.7%

📒 Price to book: 0.65

📢 Gearing: 32%

🔎 DPU 5Y Growth: 0.72%

Financial Highlights

KREIT, a leading real estate investment trust (REIT), has recently reported its financial results for the first half of the year. While the top-line growth was impressive, with revenue and net property income (NPI) rising by 8.9% and 7.7% respectively on a year-over-year basis, the story doesn't end there. The trust's distribution per unit (DPU) saw a slight decline of 3.4% compared to the previous year, primarily due to higher finance expenses. However, this was offset by positive rent reversion, which reached a healthy high single-digit level.

The trust's occupancy rates grew across various geographies, showcasing the resilience of its portfolio. The acquisition of the 255 George Street property in Sydney, coupled with the completion of the 2 Blue Street development, contributed to the overall growth. However, the trust's gearing ratio and borrowing costs did rise, following the Sydney acquisition.

Dividend per share (DPU)

DPU remains quite stagnant since 2018.

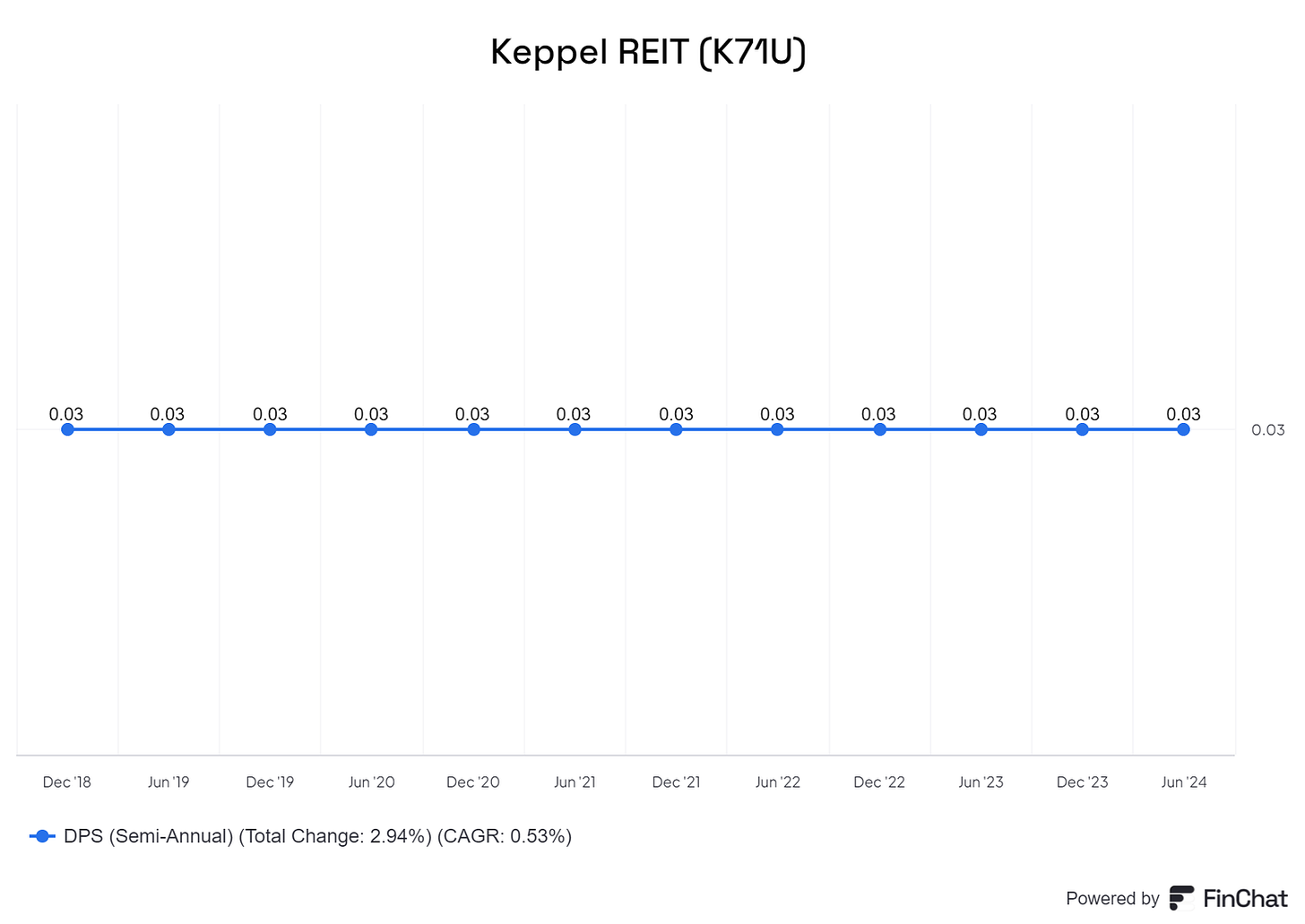

Yield

Yield is attractive at 6.7%. This is also above its average yield of 5.5%. The DPU has been stagnant but the stock price has been corrected for quite a while since the high interest rate environment.

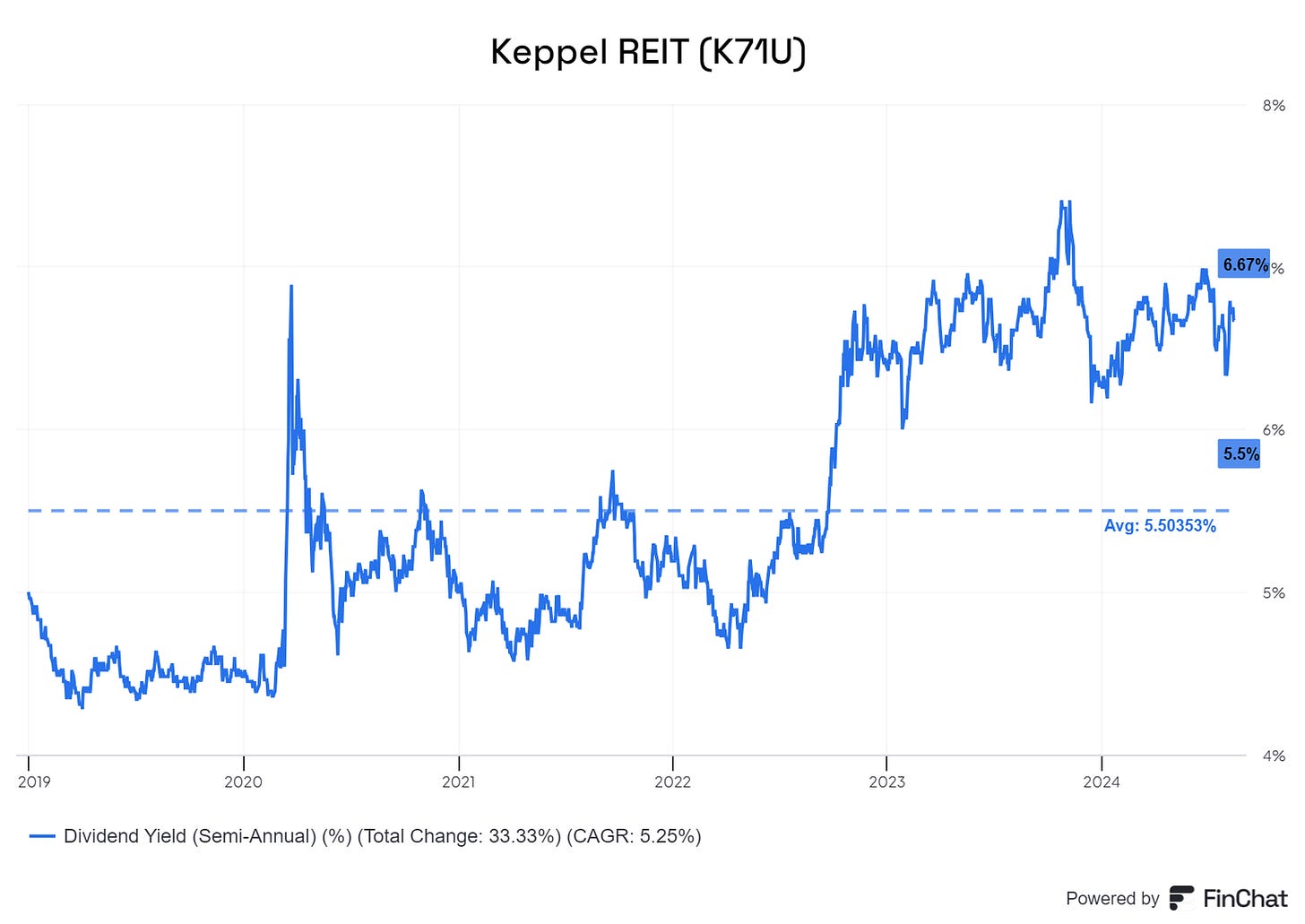

Price to book

In terms of net asset value valuation, Keppel REIT is slightly undervalued at 0.65. The current valuation is also below its 5-years average of 0.79.

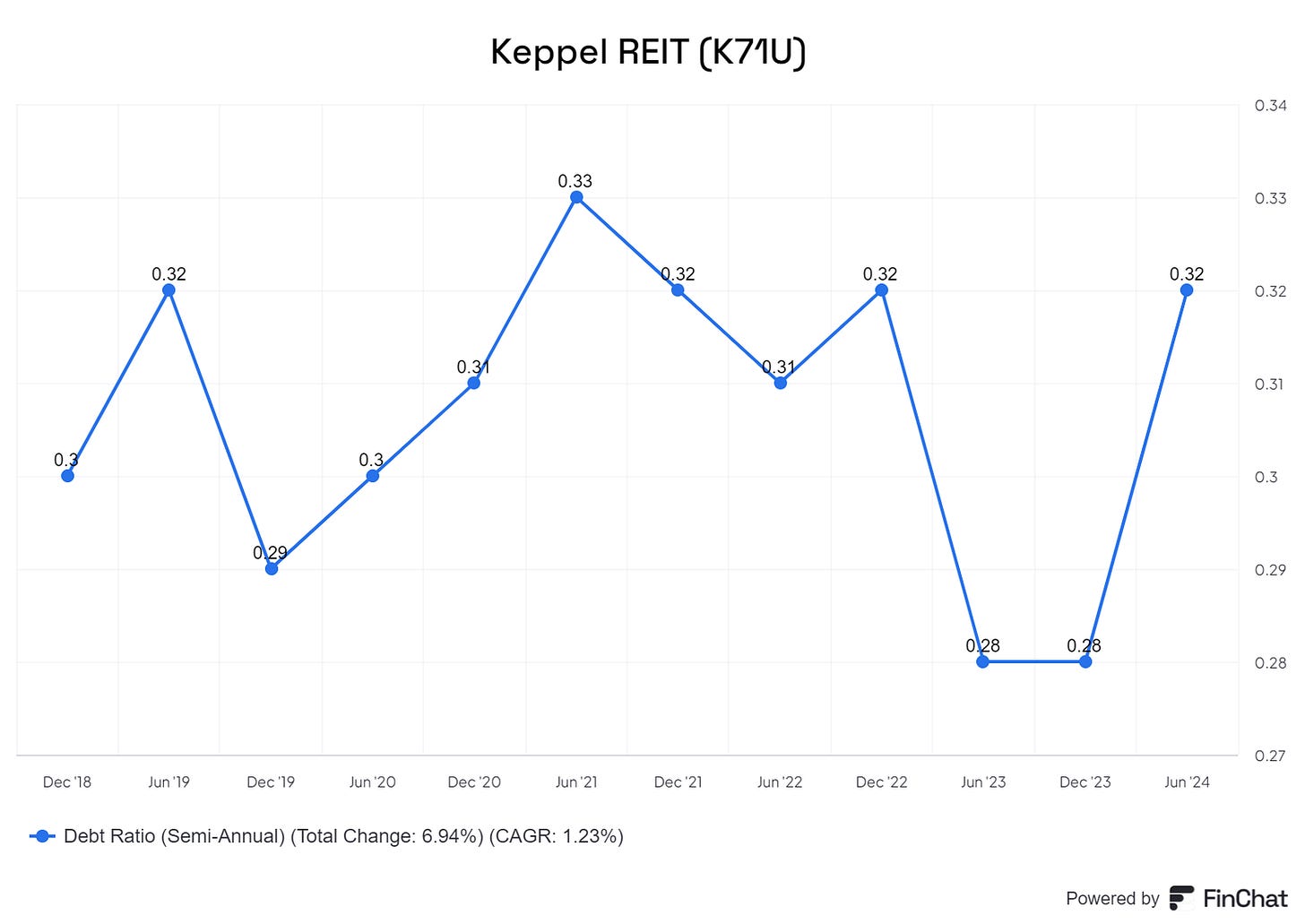

Gearing

Gearing remains steady at 33%. This gives the REIT plenty of headroom for future acquisitions.

Value Proposition

KREIT is one of the largest S-REITs, boasting an impressive asset under management (AUM) of SGD9.0 billion. With a significant exposure to Singapore's Grade-A office market, which accounts for around 80% of its NPI, and a strong presence among financial institution tenants (making up approximately 28% of its net lettable area), the trust is well-positioned to weather the current market conditions.

The trust's Grade-A assets in gateway cities are expected to retain their value, even as the impact of hybrid working models becomes more pronounced in the medium term. KREIT's management team is focused on optimizing the portfolio to maintain a sound capital structure, ensuring the trust's stability and resilience.

Risk and Competitor Analysis: Navigating Challenges

While KREIT's portfolio has demonstrated resilience, there are still potential risks to consider. A prolonged slowdown in economic activity could reduce the demand for office space, leading to lower occupancy rates and rental prices. Additionally, the termination of long-term leases could contribute to a weaker portfolio tenant retention rate.

When compared to its peers, KREIT stands out as one of the largest S-REITs, with a diverse and high-quality portfolio. Its focus on optimizing the portfolio and maintaining a sound capital structure sets it apart, as it navigates the challenges posed by the evolving office market. While some competitors may be more exposed to the headwinds, KREIT's strategic approach and diversified assets position it as a compelling investment option for discerning investors.

Conclusion:

Despite the short-term headwinds, KREIT's portfolio remains resilient, with the trust poised to navigate the evolving market landscape. The trust's diversified asset base, with a strong presence in Singapore's Grade-A office market and a significant share of financial institution tenants, positions it well to capitalize on the ongoing trends in the real estate sector.

As KREIT continues to optimize its portfolio and focus on prudent capital management, investors can expect a stable DPU profile, supported by divestment gains and an attractive valuation with a yield of 6.7% and a price-to-book ratio of 0.65x.

Sign up now and get our free dividend stock list for free.

Disclaimer: This article constitutes the author’s personal views and is for entertainment and educational purposes only. It is not to be construed as financial advice in any form. Please do your own research and seek advice from a qualified financial advisor. From time to time, I have positions in all or some of the mentioned stocks when publishing this article. This is a disclosure - not a recommendation to buy or sell stocks.