Is AIMs APAC REIT A Good Buy Now?

AIMS APAC REIT reported net property income increase by 6.6% to S$34.4 million.

Aims Apac REIT (AAREIT) has recently published its Q1 2025 financial report. In this article, we will deep dive into its performances.

🏢 Market cap: $1.01B

🔥 Dividend yield: 7.55%

📒 Price to book: 0.95

📢 Gearing: 34%

🔎 DPU 5Y Growth: -1.8%

Financial Highlights

AAREIT, the industrial real estate investment trust, has reported a slightly softer 1Q25 distribution per unit (DPU) of SGD2.27 cents, a 3% quarter-on-quarter (QoQ) and 1.7% year-on-year (YoY) decline. However, this performance still managed to meet 24% and 23% of the consensus and our own full-year estimates, respectively.

Despite the sector headwinds, AAREIT has demonstrated stable operations. Occupancy dipped slightly by 50 basis points in the Singapore portfolio, but double-digit rental reversions were sustained. Management remains confident, not seeing any longer lead times for tenants to reach leasing decisions, and maintains its full-year guidance for high single-digit to low teens rental reversions.

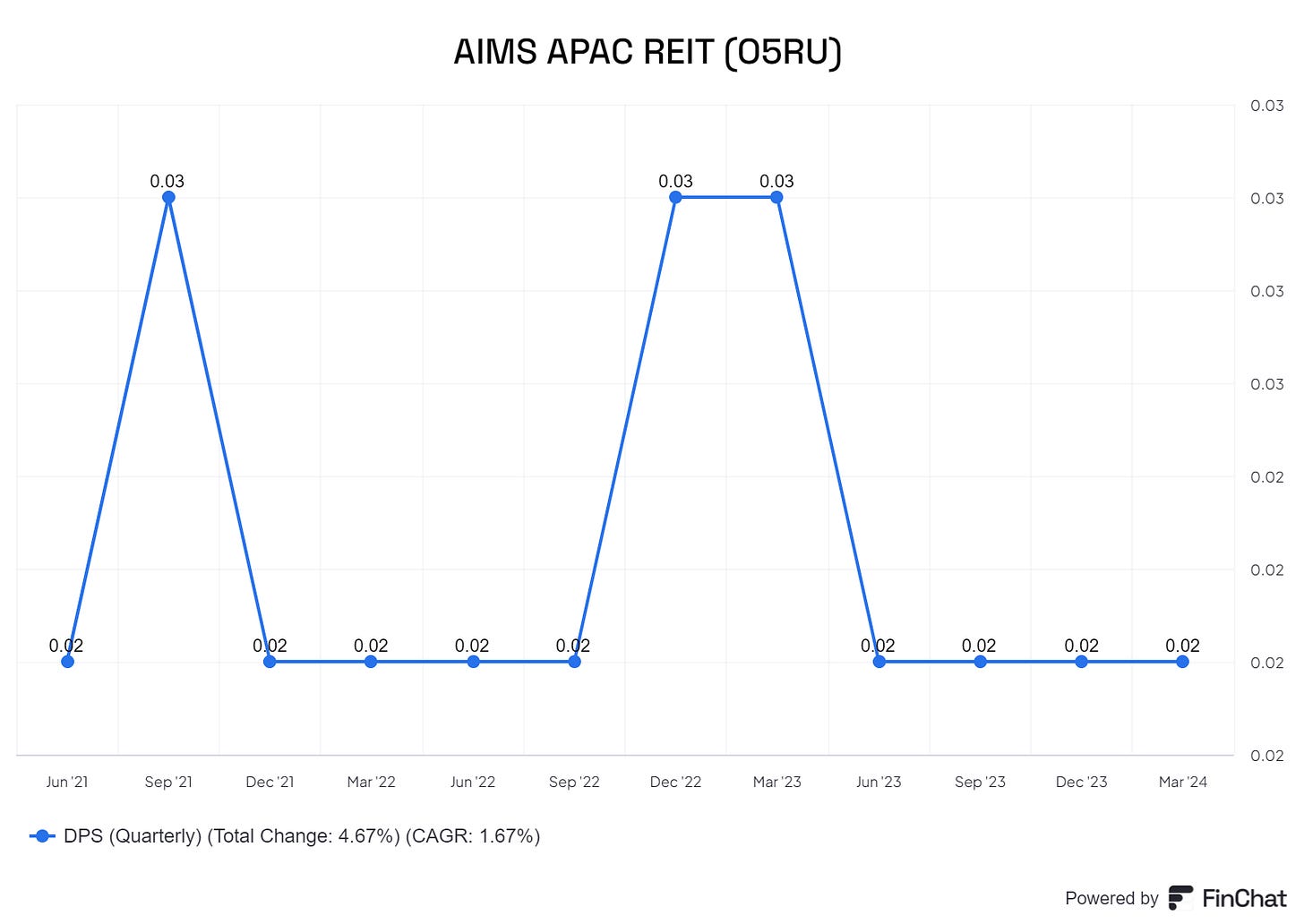

Dividend per share (DPU)

DPU remains quite stagnant for the past few quarters. Revenue and net property income (NPI) grew by 5.6% and 2.8% QoQ, respectively, though higher property expenses partially offset the topline gains.

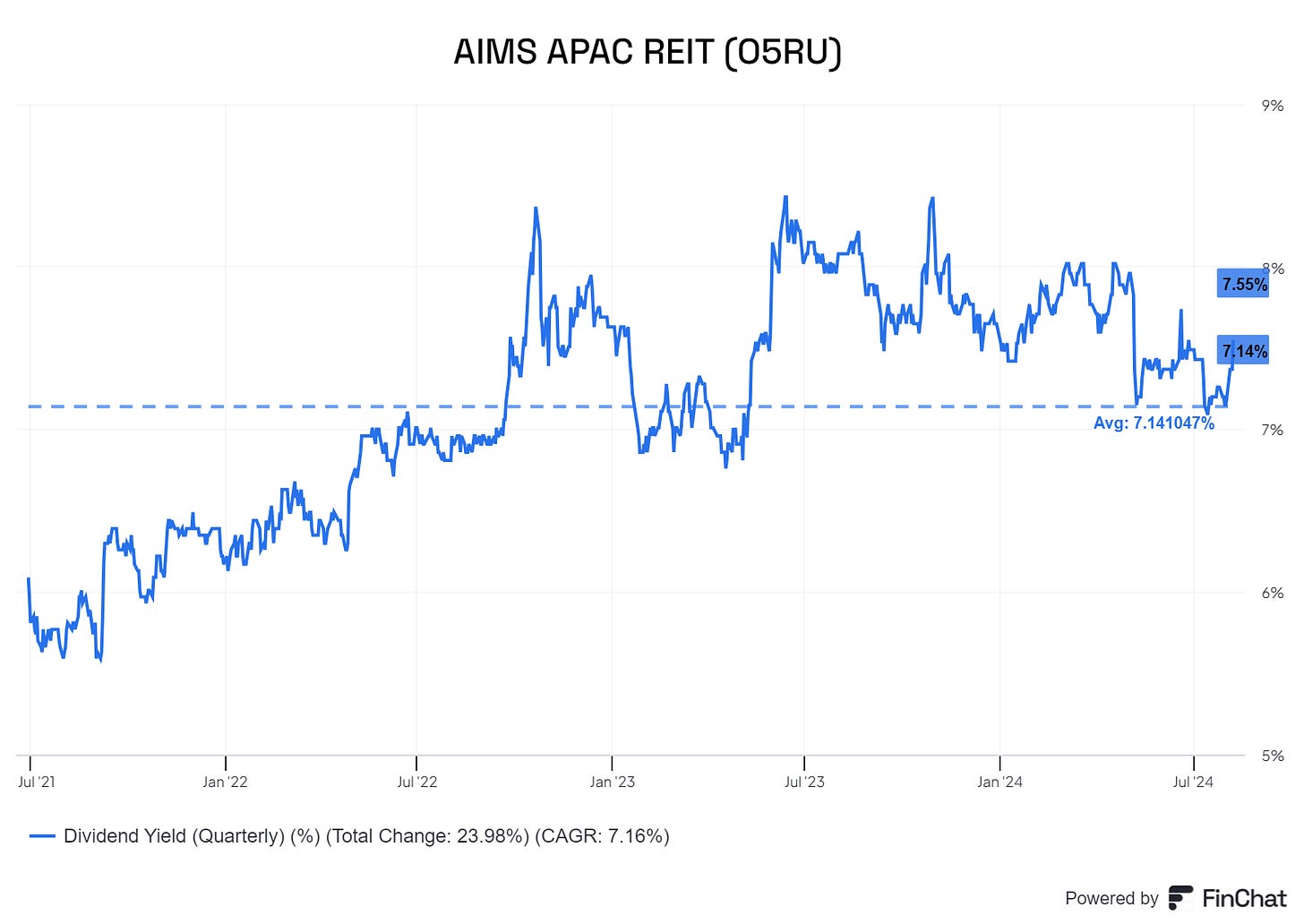

Yield

AAREIT is offering an attractive 7.5% yield after the recent correction. This is above the average yield of 7.14%.

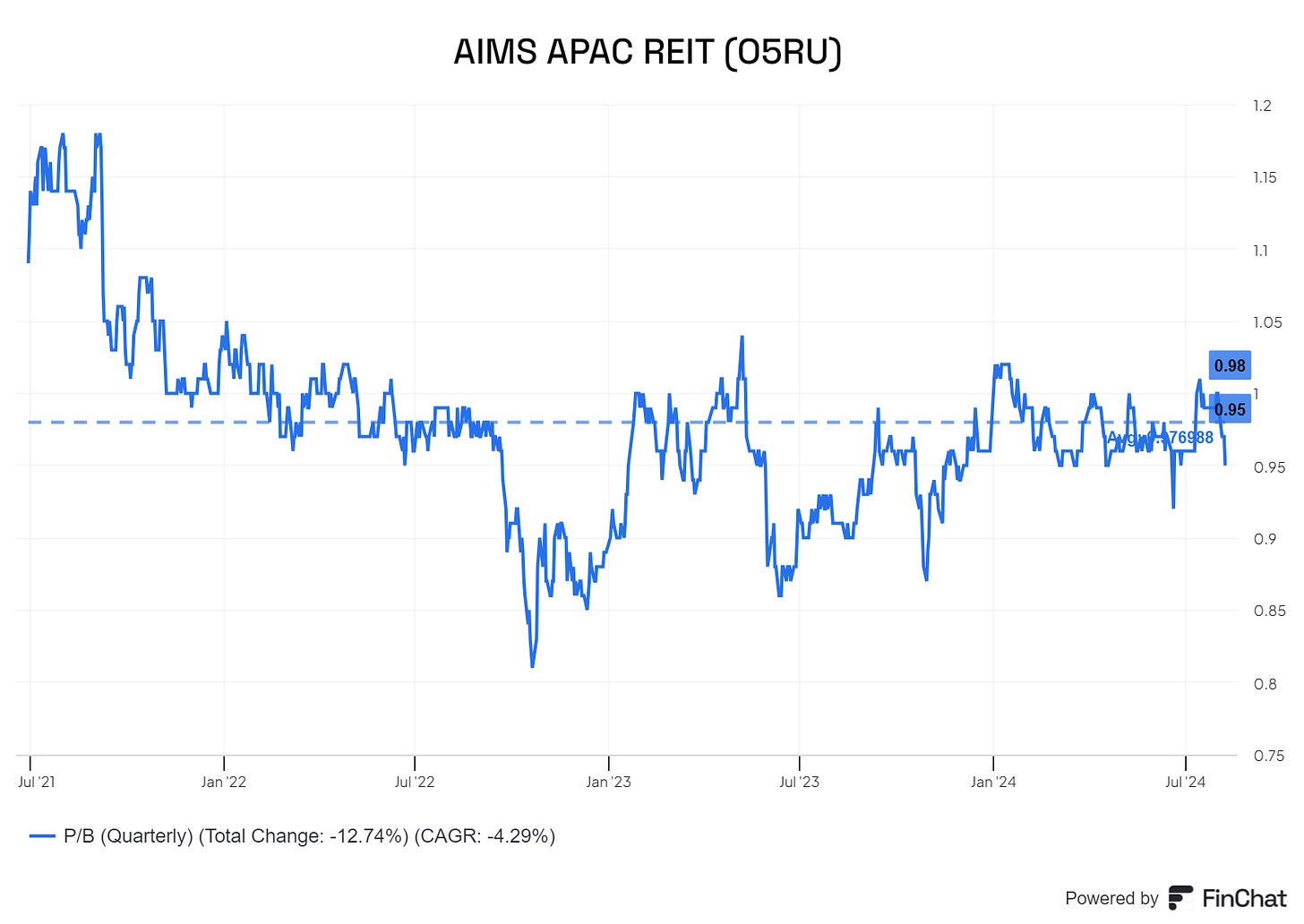

Price to book

In terms of net asset value valuation, AAREIT is slightly undervalued, and this has been the case since 2022 after the high interest rate environment that suppressed the REITs’ price in general.

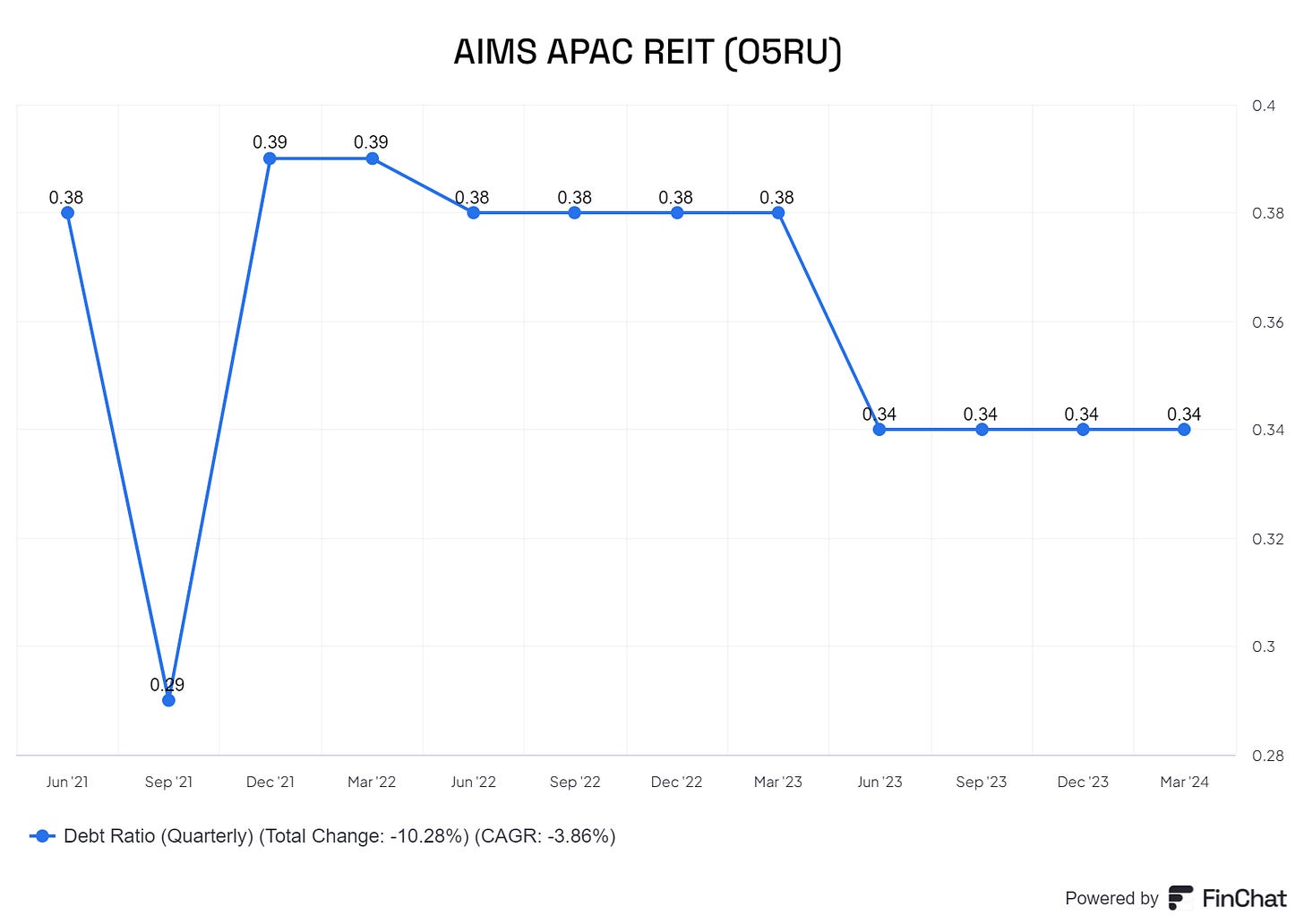

Gearing

Gearing is healthy at 34%. This gives the REIT ample headroom for future acquisitions.

Value Proposition

AAREIT boasts a diversified industrial property portfolio, comprising warehouses (52% of 4Q21 rental income), light industrial buildings (10), and business parks (16). This diversification provides resilience and growth opportunities.

The sponsor, AIMS Financial Group, brings a wealth of real estate fund and asset management expertise, which has driven a robust 10-year net asset value (NAV) compound annual growth rate (CAGR) of around 8% to FY21. Acquisitions and proactive redevelopment initiatives have been key value-accretive drivers for the portfolio.

Looking ahead, AAREIT's growth optionality is supported by the redevelopment potential of its under-utilized portfolio, which accounts for about 7% of the existing net lettable area (NLA). The upcoming asset enhancement initiatives (AEIs) at 7 Clementi Loop and 15 Tai Seng Drive, with pre-commitments from master/anchor tenants, are expected to deliver attractive net property income (NPI) yields of above 7%.

Risk and Competitor Analysis: Navigating Challenges

While AAREIT faces potential headwinds, such as a prolonged slowdown in economic activity and reduced demand for industrial space, the management team remains vigilant. The upcoming refinancing of the SGD100 million medium-term note (MTN) due in November 2024 is being closely monitored, the current 3.6% pricing might not increase as Fed seems to be on track to cut rates.

In terms of competition, AAREIT's diversified portfolio, disciplined capital management, and proactive asset management strategies position it well within the industrial REIT landscape. The strong demand for logistics assets and the potential for accretive acquisitions or redevelopment projects offer further upside.

Conclusion:

AAREIT's steady performance, diversified portfolio, and strategic initiatives demonstrate its resilience and growth potential. The upcoming AEIs, coupled with the sponsor's expertise and the trust's redevelopment opportunities, suggest a compelling investment case. While navigating the current challenges, AAREIT remains poised to unlock value for its unitholders through a combination of stable operations, strategic initiatives, and prudent capital management.

There is no surprise in its Q1 financial report. We will continue monitoring the REIT closely in the upcoming months.

Sign up now and get our free dividend stock list for free.

Disclaimer: This article constitutes the author’s personal views and is for entertainment and educational purposes only. It is not to be construed as financial advice in any form. Please do your own research and seek advice from a qualified financial advisor. From time to time, I have positions in all or some of the mentioned stocks when publishing this article. This is a disclosure - not a recommendation to buy or sell stocks.