Market uncertainty presents both risks and opportunities. Investors are currently navigating a complex landscape marked by slowing growth, policy risks, and geopolitical tensions, all contributing to market volatility. Despite these challenges, history has shown that strong companies tend to recover, offering long-term investors a chance to purchase quality stocks at a discount.

Amid this uncertainty, selectivity and diversification are crucial. The optimistic outlook hinges on potential tax cuts, deregulation, and possible Federal Reserve rate cuts, which could bolster earnings growth. However, policy risks, high valuations, and global economic uncertainty necessitate a selective and diversified investment approach.

History shows that great companies tend to recover and often emerge stronger. For long-term investors, times like these present opportunities to buy quality stocks at a discount.

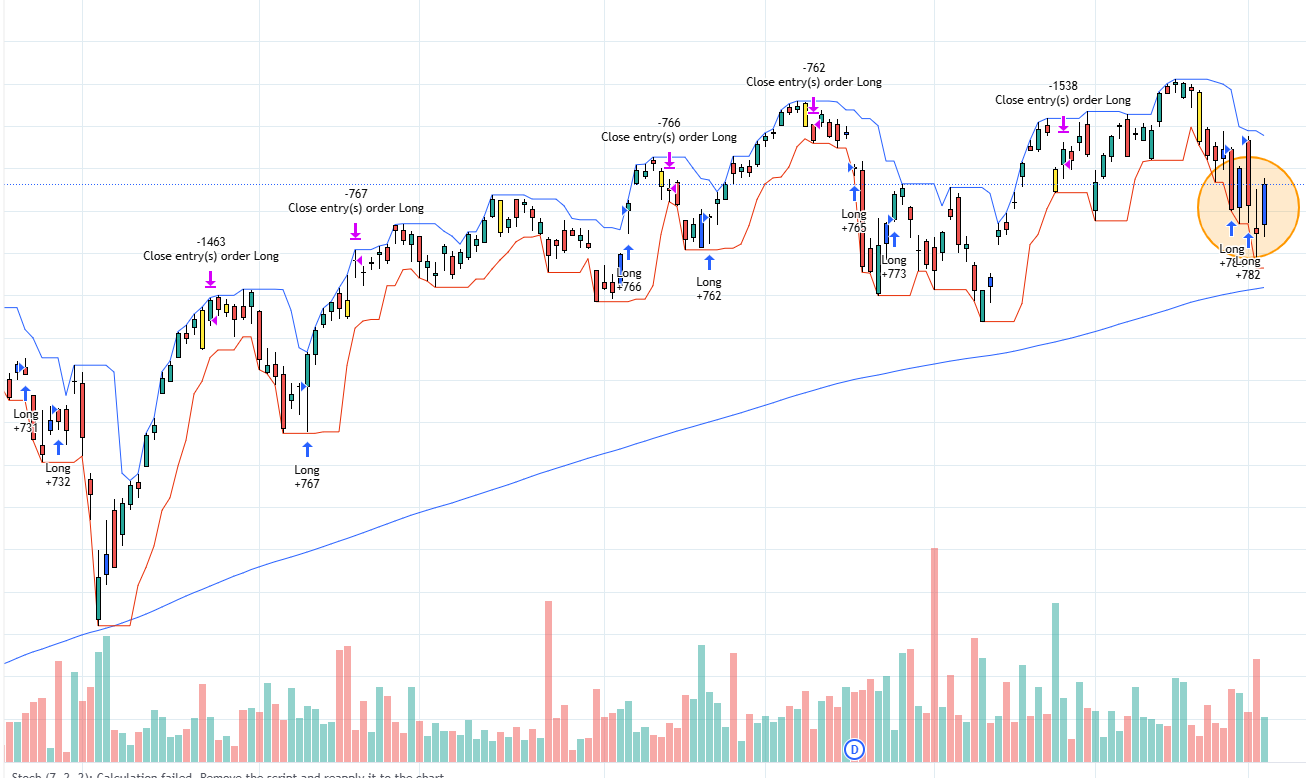

Our main portfolio strategy is to pick growth stocks that potentially outperform the market in the long run, and we use momentum trading to find a better price level to enter or rebalance our portfolio.

The stock below in our portfolio currently offers a good investment opportunity.

Keep reading with a 7-day free trial

Subscribe to Wealth Insights to keep reading this post and get 7 days of free access to the full post archives.