Frasers Hospitality Trust - Balancing Opportunities and Challenges

FHT reported a Distribution Per Unit (DPU) of SGD 2.2592 cents for FY24. While this may sound promising, it’s important to note that the DPU saw a decline of 7.5% year-on-year.

Frasers Hospitality Trust (FHT) has recently published its full year 2024 financial report. In this article, we will deep dive into its performances.

🏢 Market cap: $837M

🔥 Dividend yield: 5.6%

📒 Price to book: 0.66

📢 Gearing: 35%

🔎 DPU 5Y Growth: -13.1%

Financial Highlights

On the revenue front, FHT generated SGD 132.5 million, marking a 7.6% increase compared to the previous year. However, this growth was somewhat offset by higher property taxes and increased operational expenses. Looking ahead, its revenue might grow 8 to 9% based on the anticipated growth in markets such as Europe, Malaysia, and Japan, along with expected contributions from the retail sector of the ANA Crowne Plaza Kobe.

Dividend per share (DPU)

FHT reported a Distribution Per Unit (DPU) of SGD 2.2592 cents for FY24. While this may sound promising, it’s important to note that the DPU saw a decline of 7.5% year-on-year. This dip can be attributed primarily to increased withholding taxes from its Australian subsidiary and rising financing costs.

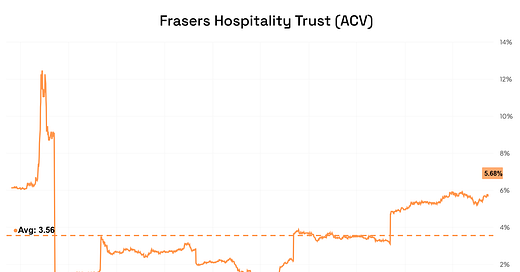

Yield

FHT is offering a 5.68% yield after the recent correction. which is above its historical average yield of 3.56%.

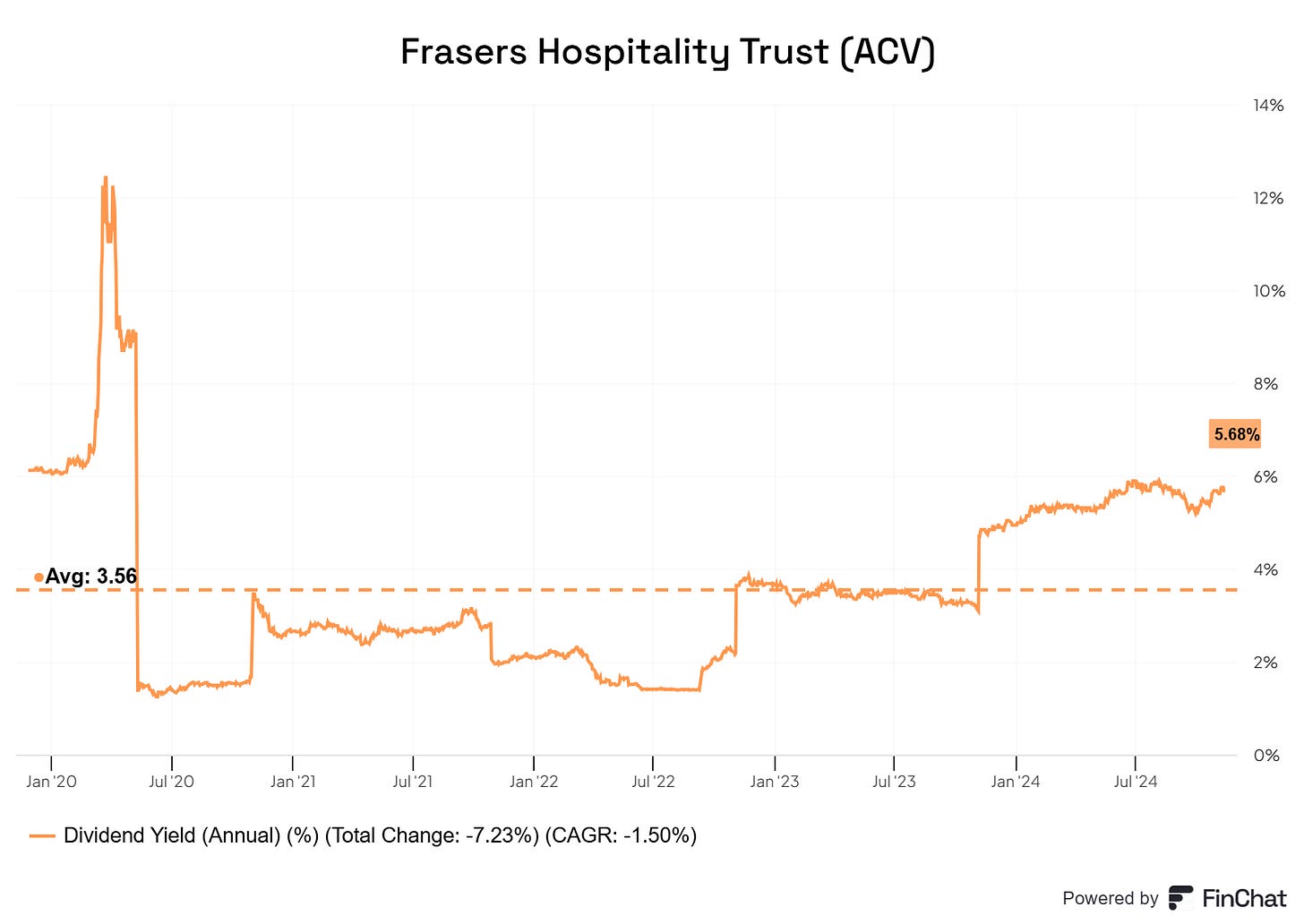

Price to book

In terms of net asset value valuation, FHT is undervalued at 0.66 price to book ratio, which is also below its historical average of 0.76.

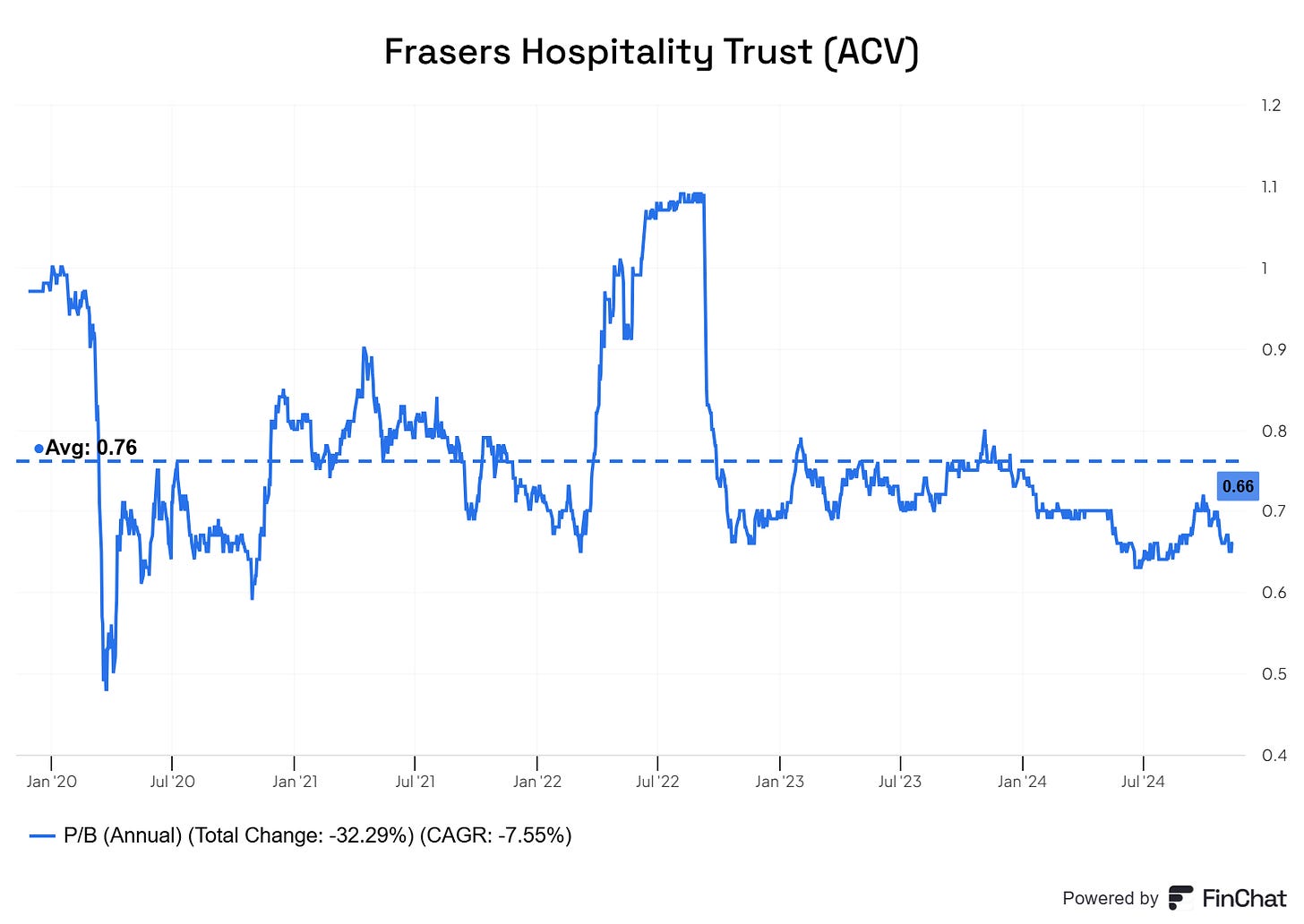

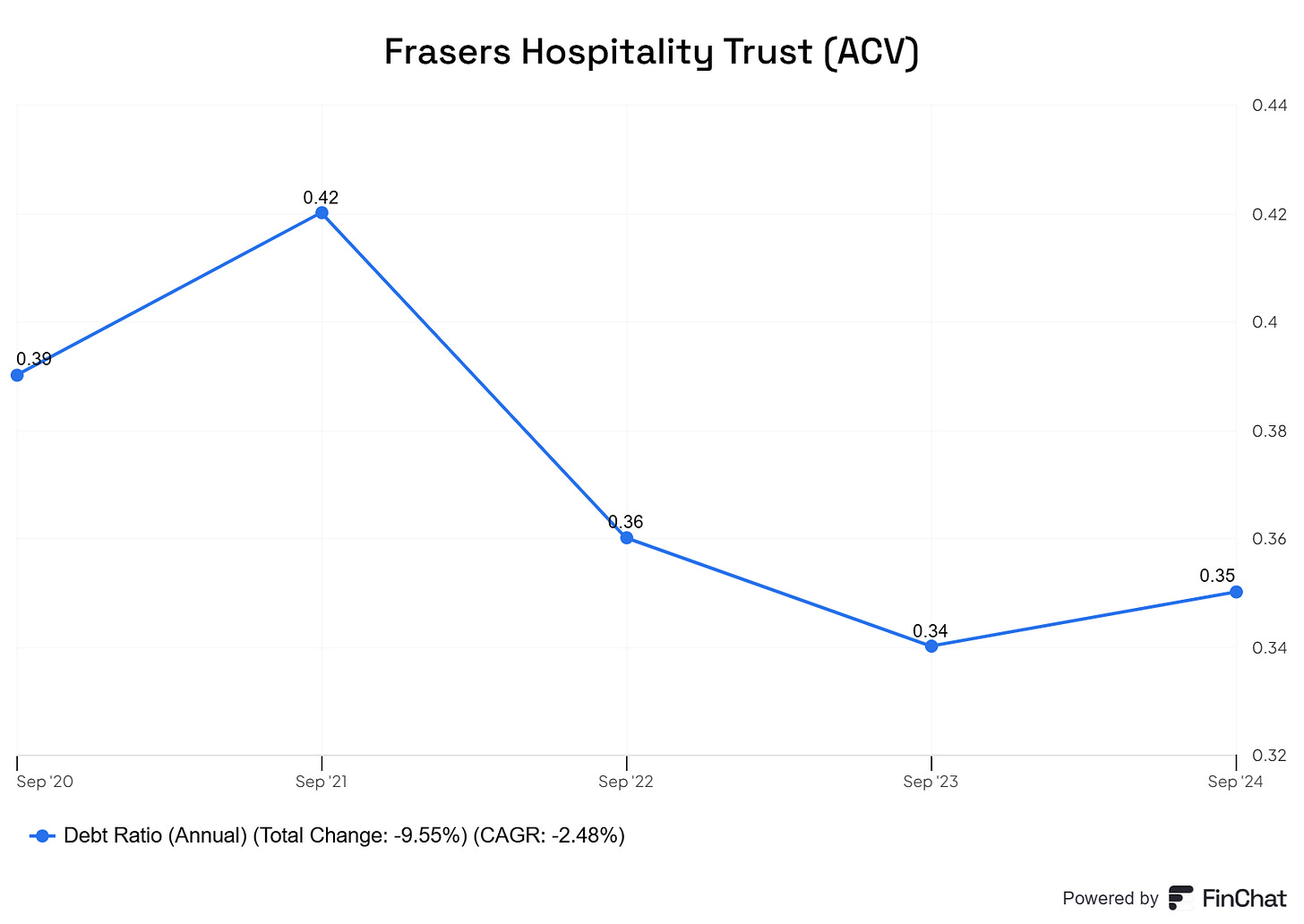

Gearing

Gearing is healthy at 35%. This gives the REIT ample headroom for future acquisitions.

Value Proposition

FHT’s portfolio remains robust, with the Singapore, Australia, and UK markets contributing 77% of its total gross revenue. However, the Singapore market experienced a slight setback, indicated by a 3.4 percentage point drop in occupancy and a 2% decline in Average Daily Rate (ADR). This situation is a reminder of the competitive nature of the hospitality industry, especially with new residential projects entering the market, which increases competition for long-stay accommodations.

Conversely, Australia showed a positive trend with a 5 percentage point increase in occupancy, although ADR experienced a minor decline. This dynamic reflects the market’s absorption of pent-up supply in cities like Melbourne. The UK market remained stable, but management expressed caution regarding potential oversupply, which could affect future performance.

In contrast, FHT’s operations in Japan, Malaysia, and Germany showcased a different narrative. The Kobe hotel reported a 4% growth in ADR and a 6.4 percentage point increase in occupancy, fueled by a recovering demand landscape. The Westin Kuala Lumpur also performed admirably, with a remarkable 18.6% growth in Revenue Per Available Room (RevPAR), supported by a surge in transient and corporate bookings. These successes highlight the potential for recovery and growth in select markets, offering a silver lining for investors.

Risk and Competitor Analysis: Navigating Challenges

As with any investment, risks are inherent, and FHT faces several that warrant attention. The company’s gearing ratio dipped to 34.9%, while the cost of debt remains stable at 3.5%. However, management is navigating an upcoming refinancing cycle, which includes SGD 150 million in borrowings due for refinancing in FY25. This could lead to a higher cost of debt, impacting future earnings and potentially valuations.

FHT's loss of Managed Investment Trust status for FY24 and FY25 has resulted in an effective tax rate of 37.5% for its Australian operations, adding another layer of financial pressure. In response, management is exploring options for portfolio rebalancing to mitigate these challenges.

Moreover, the competitive landscape presents its own set of hurdles. The potential for significant increases in hotel and serviced residence supply without a corresponding rise in demand could lead to downward pressure on RevPAR. Additionally, economic factors such as a slowdown in consumer spending or significant foreign exchange headwinds could further impact performance.

Conclusion:

In summary, FHT's FY24 results paint a picture of resilience amidst challenges. While the decline in DPU and rising costs are concerning, the growth in revenue and strategic adjustments for future projections highlight the trust’s potential for recovery. With strategic management in place and a focus on enhancing occupancy and ADR, FHT is well-positioned to navigate the complexities of the hospitality market.

Investors should remain optimistic about the opportunities ahead, particularly in recovering markets like Japan and Malaysia. By keeping a close eye on market dynamics and strategic initiatives, stakeholders can better understand FHT’s journey and make informed decisions moving forward. As the hospitality landscape evolves, so too will FHT, adapting and thriving in the face of change.

Sign up now and get our free REITs’ Numerical Ratings.

Disclaimer: This article constitutes the author’s personal views and is for entertainment and educational purposes only. It is not to be construed as financial advice in any form. Please do your own research and seek advice from a qualified financial advisor. From time to time, I have positions in all or some of the mentioned stocks when publishing this article. This is a disclosure - not a recommendation to buy or sell stocks.