DBS vs OCBC vs UOB: Which Is Best Bank To Buy

The "Big 3" banks has released their Q1 results recently, this article will discuss which bank actually stands out among the 3 of them.

In case you missed it:

Hey there, money-savvy folks! Let's talk about the stellar performance of Singapore's "Big 3" banks in Q1 2024 - DBS, OCBC, and UOB. These local titans have been making waves and raking in some serious profits, leaving many of us wondering if their stocks are worth adding to our investment portfolios.

Full Year 2023 Financial Results

First off, let's have a quick recap on 2023, and we should give a round of applause to DBS Group, our nation's largest bank. Its net profit soared past the S$10 billion mark for the first time ever! And it is on track to exceed its 2023 results this year! Talk about a major milestone.

But they weren't the only ones shining bright – OCBC and UOB also reported record-breaking net profits, proving that our local banking scene is on fire! It's all thanks to those rising global interest rates. As the rates climbed, our banks saw their top and bottom lines surge in tandem. It's like they were riding a wave of financial success!

But let's dive a little deeper into the numbers.

DBS Group took the top spot with a whopping 22.3% year-on-year jump in total income, leaving the other two in the dust. However, OCBC wasn't about to be left behind – they recorded the highest year-on-year jump in net profit at an impressive 27.1%. And if that wasn't enough, they also saw a 28.5% year-on-year growth in operating profit before allowances.

One of the key factors contributing to these banks' profitability is their strong net interest margins (NIMs). For those unfamiliar with the term, NIMs reflect the difference between the interest earned on loans and the interest paid out on deposits. And let me tell you, our "Big 3" banks have been killing it in this department, with all three maintaining NIMs above 2% in the latest first-quarter earnings.

Q1 2024 Financial Results

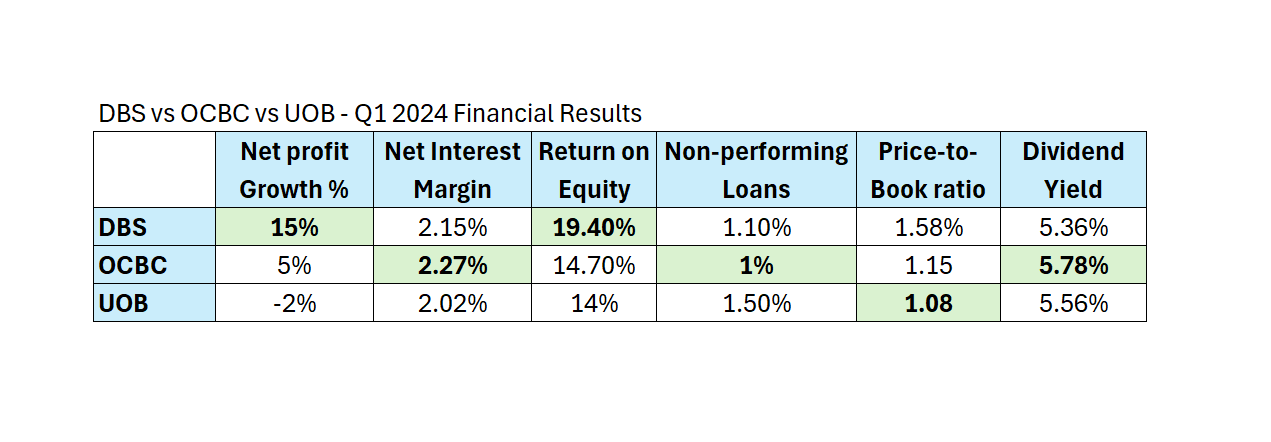

OCBC led the pack with the highest NIM at 2.27% for the 1st quarter, followed closely by DBS at 2.15% and UOB at 2.02%. It's like they've got a secret formula for squeezing every last drop of profit out of those interest rates!

But profitability isn't just about interest margins – it's also about operational efficiency and making the most of those shareholder dollars. That's where the return on equity (ROE) metric comes into play. In Q1, DBS' ROE hit a new high of 19.4%, leaving OCBC and UOB trailing behind at 14.7% and 14.0%, respectively. Talk about maximizing those returns!

But wait, there's more! Asset quality is another crucial factor, and our "Big 3" banks didn't disappoint. Non-performing loan (NPL) ratios improved across the board, with OCBC boasting the lowest NPL ratio and the biggest improvement over the year. It's like they've got a magic touch when it comes to managing those pesky bad loans.

Now, let's talk about something that really gets income investors excited – dividends!

All three banks raised their year-on-year dividends in line with their robust financial results. Based on their 12-months trailing dividends, OCBC takes the lead with the highest dividend yield of 5.78%, but DBS and UOB aren’t far behind with an attractive 5.56% and 5.36% respectively. Who doesn't love a little extra cash in their pockets?

When it comes to valuations, UOB is the most affordable with the lowest price-to-book ratio at 1.08 times, followed closely by OCBC at 1.15 times. DBS, on the other hand, sports a higher valuation at 1.58 times price-to-book.

So, what's the bottom line? Even with the US Federal Reserve expected to cut interest rates in the latter half of 2024, our Singaporean banking giants seem well-positioned to sustain their earnings growth. With their solid balance sheets and strong capital positions, DBS, OCBC, and UOB are like financial superheroes, ready to deliver sustainable long-term growth for their investors.

Summary

Whether you're a seasoned investor or just dipping your toes into the world of finance, these "Big 3" bank stocks are definitely worth considering for your portfolio. From the overall financial performance perspective, OCBC is a clear winner. However, we slightly prefer DBS, due to its better growth prospect and higher return on equity. Just remember to do your due diligence and invest wisely, my friends. After all, we're in this for the long haul!

Disclaimer: This article constitutes the author’s personal views and is for entertainment and educational purposes only. It is not to be construed as financial advice in any form. Please do your own research and seek advice from a qualified financial advisor. From time to time, I have positions in all or some of the mentioned stocks when publishing this article. This is a disclosure - not a recommendation to buy or sell stocks.