DBS Shares Jump With Record Profits And Share Buyback Plan

DBS’s recent earnings report for the first nine months of 2024 has surpassed expectations, showcasing buoyant trading and impressive fee income.

In case you missed it:

Today, we turn our attention to DBS Bank (SGX: D05), a leader in Southeast Asia's banking sector. Recent financial highlights reveal a strong base for growth and capital returns, making a compelling case for continued investment. Let's dive deeper into what makes DBS an attractive option, examining its financial highlights, value proposition, potential risks, and competitor landscape.

🏢 Market cap: $118.6B

🔥 Dividend yield: 5.18%

📒 Price to book: 1.77

💰 Price to earnings: 11.2

💸 Return on Equity: 13.98%

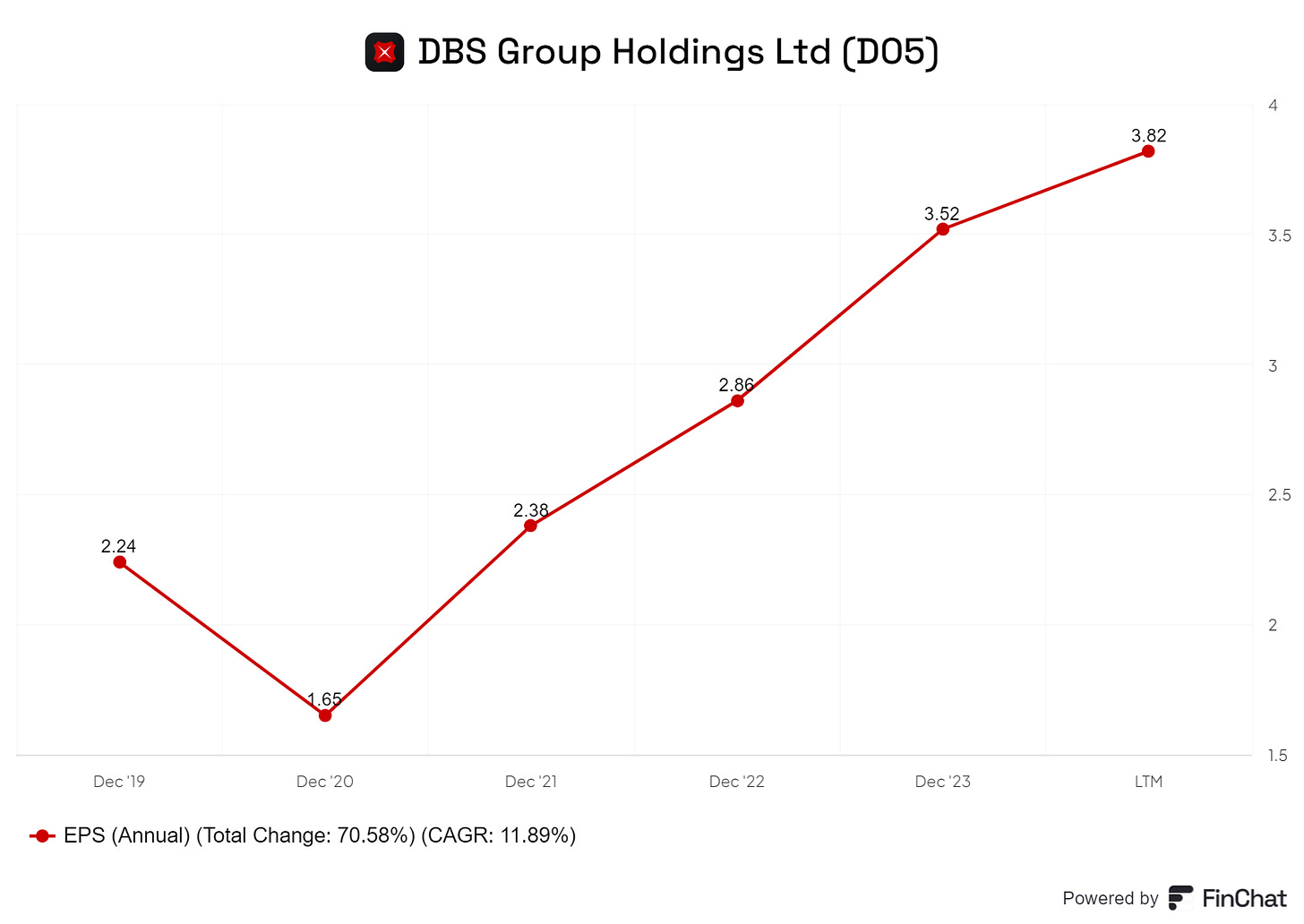

📢 EPS 5Y Growth: 11.9%

🔎 DPU 5Y Growth: 9.11%

Financial Highlights

DBS’s recent earnings report for the first nine months of 2024 has surpassed expectations, showcasing buoyant trading and impressive fee income. This performance is not just a flash in the pan; the trends suggest a sustained upward trajectory. For instance, the bank's net interest income (NII) is bolstered by a recovery in loan growth, with management projecting a low single-digit recovery in 2025. Additionally, non-interest income (NoII) has seen a remarkable uptick, driven by a staggering 53% year-over-year increase in market trading income, particularly in foreign exchange and equity derivatives.

The bank's asset quality remains strong, with non-performing loans (NPLs) dropping to just 1%. This is akin to maintaining a clean kitchen—essential for operational efficiency and customer satisfaction.

Moreover, DBS has announced a SGD 3 billion share buyback program, a positive move that not only reflects confidence in its financial stability but also hints at future capital returns for shareholders. With a target price raised to SGD 46.91, the outlook remains bullish. The bank’s commitment to progressive dividends further solidifies its position as a steadfast investment choice.

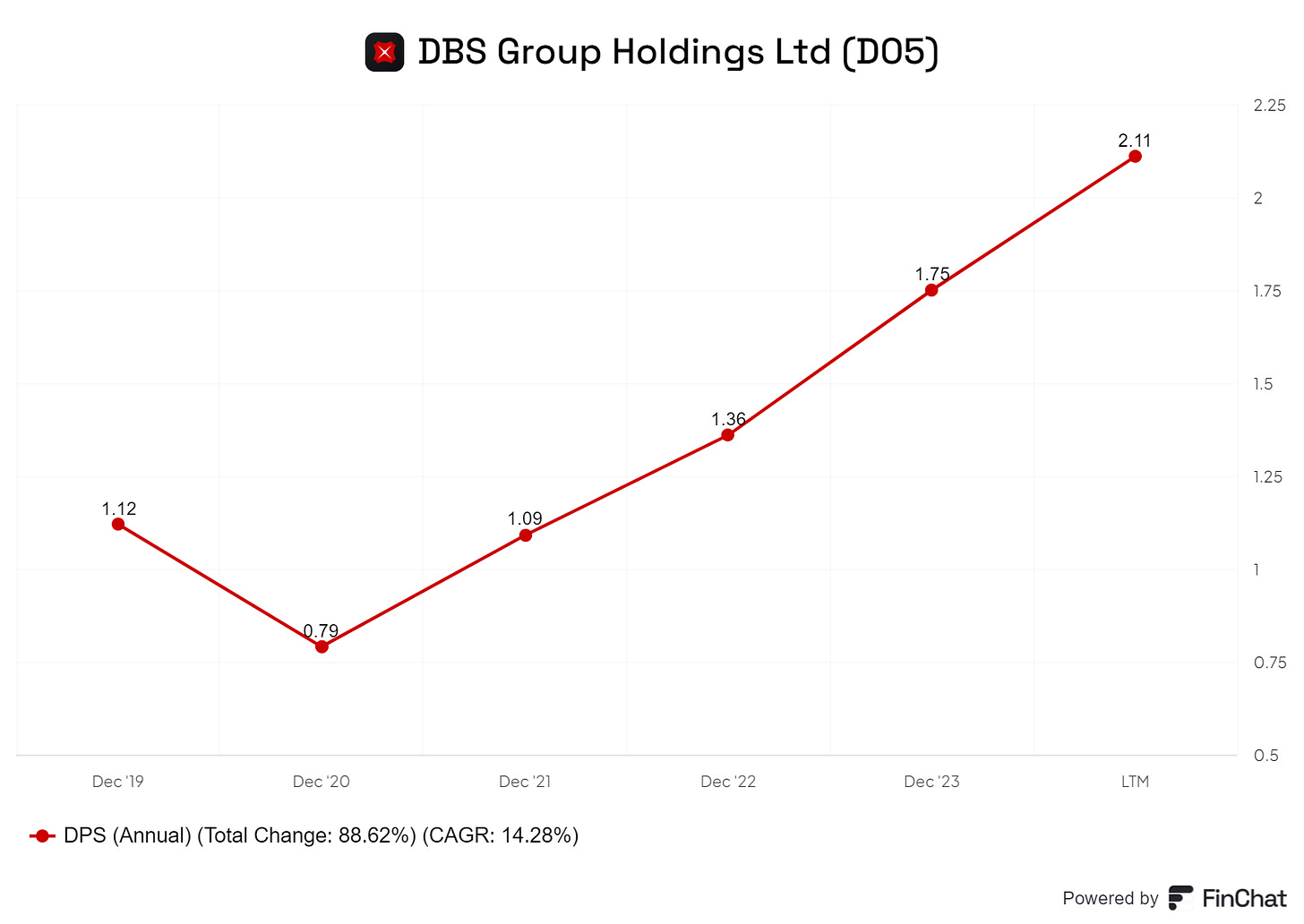

Dividend per share (DPU)

The DPU chart below is self-explanatory. DBS has been increasing its DPU over the years. If we compare to 2020 Covid period, DBS’ DPU has gone up by almost 3X!

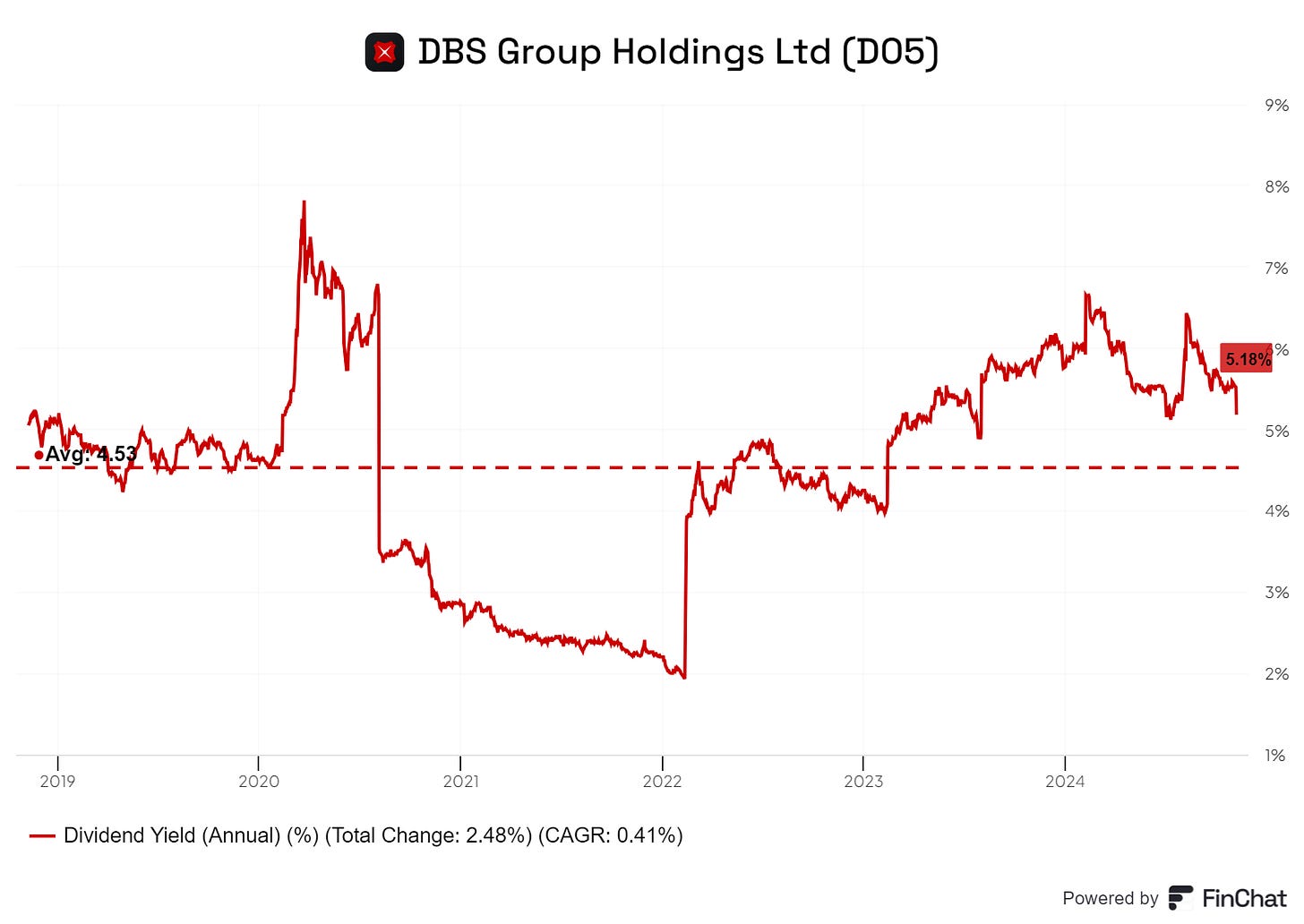

Yield

DBS is offering an attractive 5.18% yield. And this way above its average yield of 4.5%!

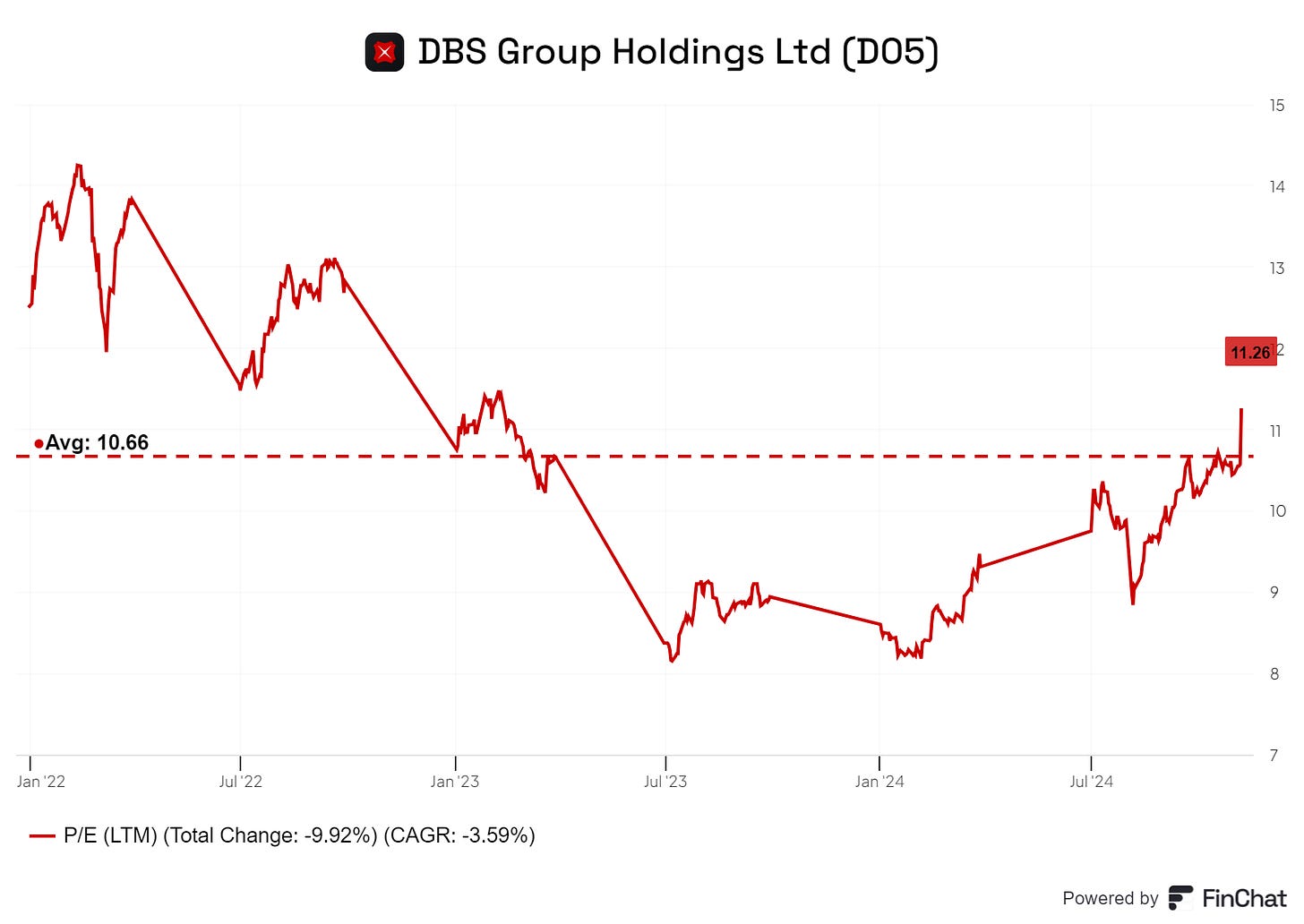

Price to earnings

In terms of price to earnings valuation, DBS is valued at 9.6. The current valuation is also below its 5-years average of 11.2.

Earnings per Share

EPS is strong as well. DBS has been delivering strong growth over the years, partly driven by the high interest income.

Value Proposition

What sets DBS apart in the competitive banking landscape? It’s not just their impressive numbers; it’s their strategic focus and innovative approach. As Southeast Asia’s largest bank by assets, DBS commands a significant market share, particularly in corporate loans and cash management. Their heartland banking franchise captures over 50% of SGD CASA deposits, showcasing a solid foundation in retail banking.

Consider DBS’s strategy as a roadmap in a city filled with traffic. While navigating through challenges, they have successfully refocused on commercial banking after earlier attempts to become a universal bank. This pivot has allowed them to streamline operations and enhance service delivery, much like a driver opting for less congested routes to reach their destination more efficiently.

Furthermore, DBS is increasing its footprint in South and South Asia, particularly in India and Indonesia. Their early adoption of technology and automation not only drives efficiency but also creates new revenue opportunities. In a world where convenience is king, DBS is positioning itself as a forward-thinking institution ready to meet evolving customer needs.

Risk and Competitor Analysis: Navigating Challenges

However, no investment comes without its risks. While the economic outlook in Southeast Asia appears promising, challenges lie ahead. The high-interest rate environment may pressure asset quality, with potential NPLs projected to rise to 1.3% by 2026. Additionally, the transition to a new CEO could introduce uncertainties in strategy, akin to a ship changing captains mid-voyage.

Competitively, DBS faces challenges from other established banks and fintech disruptors. As digital banking gains traction, the risk of disruptions and outages in digital infrastructure is a valid concern. Moreover, as the global economy grapples with recovery, pressures on small and medium-sized enterprises (SMEs) from higher interest rates could pose a significant challenge for DBS’s loan portfolio.

Yet, it’s essential to view these risks in context. The bank’s solid capital position, with a CET1 ratio projected at 15.2%, provides a buffer against economic fluctuations. DBS’s proactive approach to managing risks and leveraging technology suggests they are well-equipped to navigate potential headwinds.

Conclusion:

In summary, DBS Bank stands out as a beacon of resilience and strategic foresight in the financial sector. With a strong foundation for growth, a clear value proposition, and an understanding of potential risks, investors can feel optimistic about the bank's future. As they continue to adapt and innovate, DBS is not just a bank; it’s a partner in financial growth—ready to take you on a journey toward financial success. So, whether you’re a seasoned investor or just beginning to explore the world of finance, keeping an eye on DBS could be a wise move.

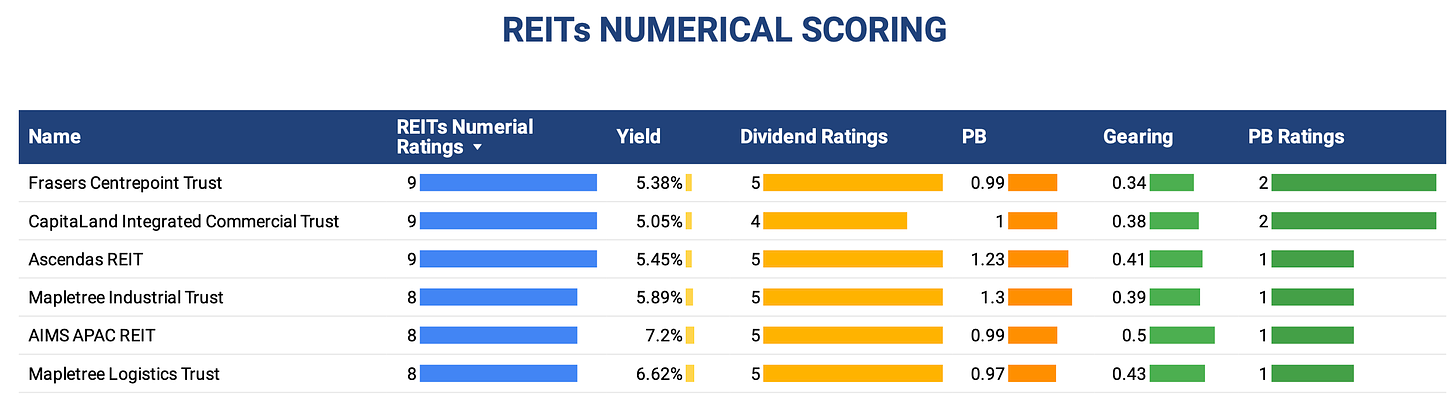

Interested in Singapore REITs but lazy to analyze all the numbers by yourself?

Subscribe our free newsletter below to get the latest REITs Numerical Scoring for free.

Disclaimer: This article constitutes the author’s personal views and is for entertainment and educational purposes only. It is not to be construed as financial advice in any form. Please do your own research and seek advice from a qualified financial advisor. From time to time, I have positions in all or some of the mentioned stocks when publishing this article. This is a disclosure - not a recommendation to buy or sell stocks.