Capitaland Integrated Commercial Trust's DPU Up 2.5%

Capitaland Integrated Commercial Trust (CICT) has recently published its 1H 2024 financial report. In this article, we will deep dive into its performances.

In case you missed it:

Capitaland Integrated Commercial Trust (CICT) has recently published its 1H 2024 financial report. In this article, we will deep dive into its performances.

🏢 Market cap: $14.1B

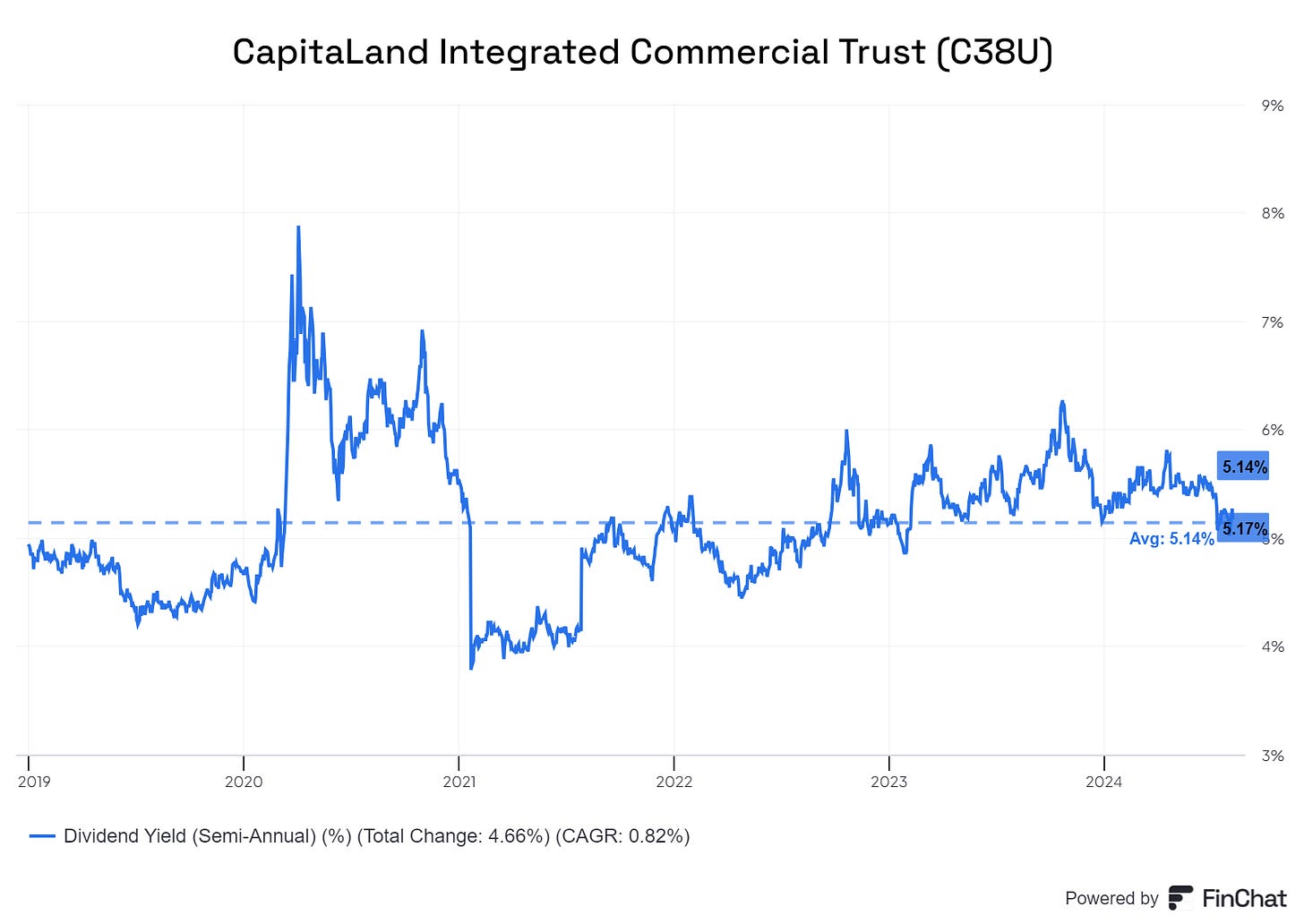

🔥 Dividend yield: 5.17%

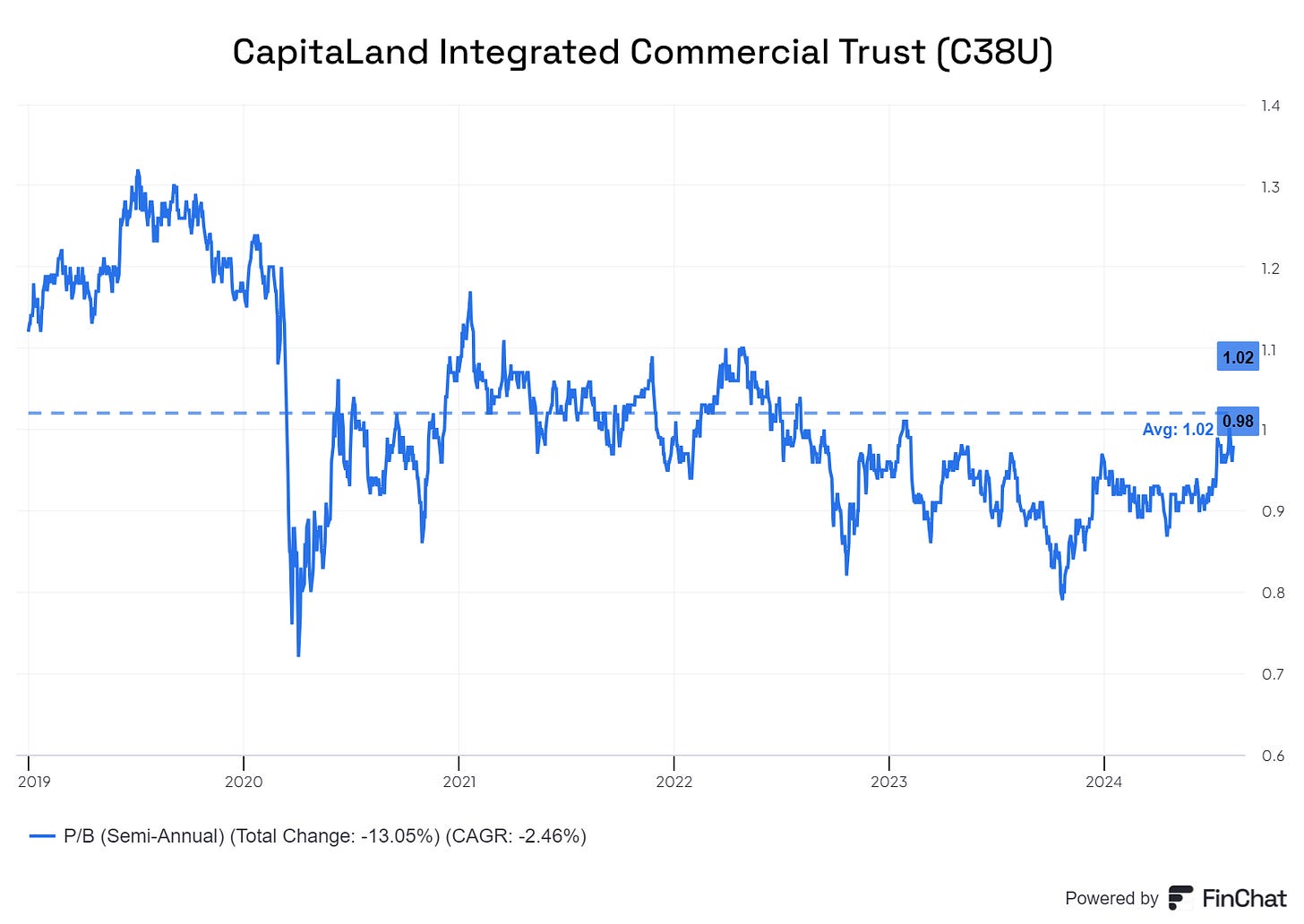

📒 Price to book: 0.98

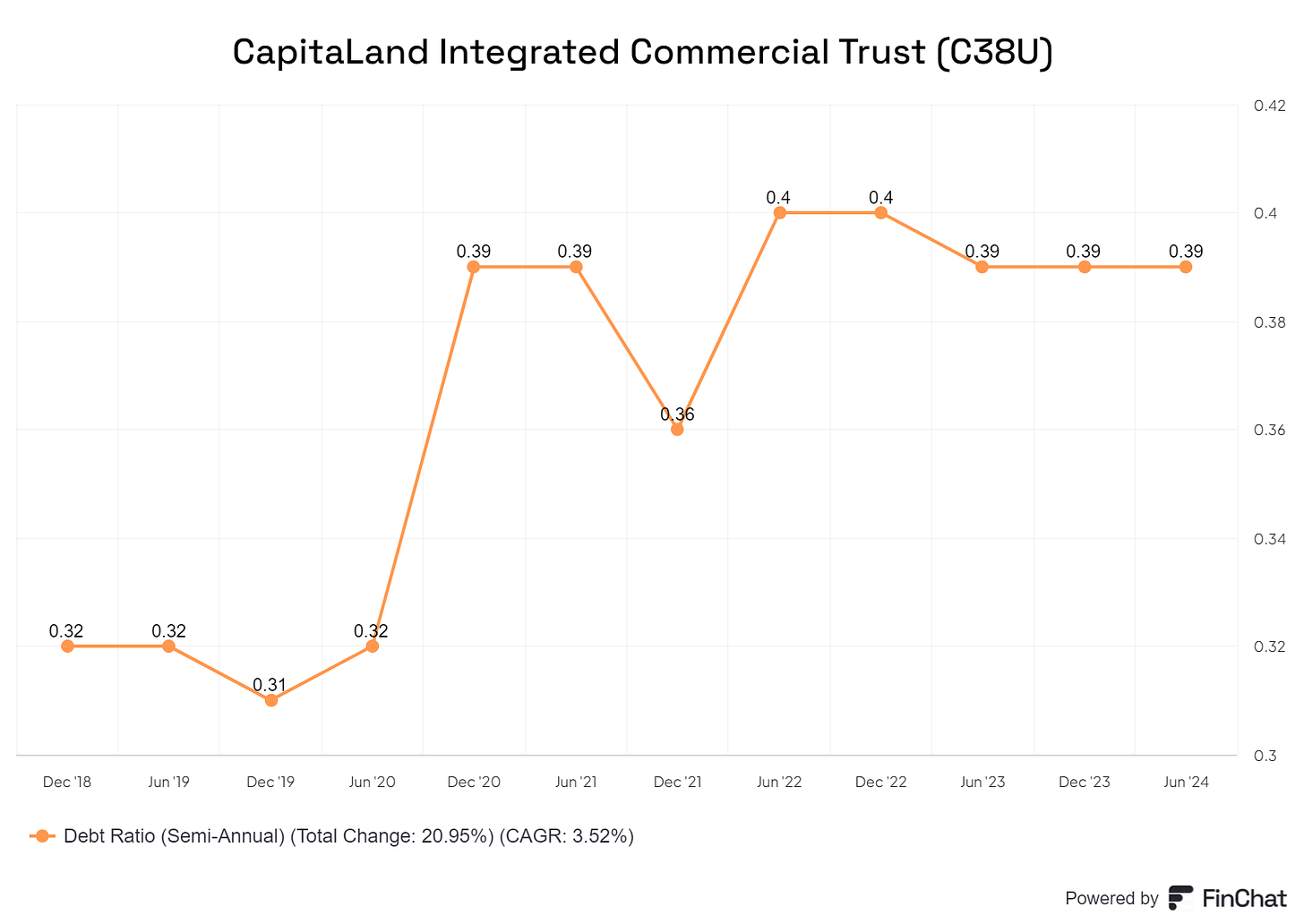

📢 Gearing: 39%

🔎 DPU 5Y Growth: -1.7%

Financial Highlights

Looking at the portfolio, occupancy rates remained relatively steady at 96.8%, with strength in the retail segment offsetting some slippage in the office properties. On the rent reversion front, the team is tracking their full-year guidance of high single-digit growth, though they expect some normalization in the office segment in the second half.

Financially, CICT remains on firm footing, with gearing holding steady at around 39% and the cost of debt staying low, at just under 3.5%. The management team is guiding for a full-year cost of debt in the mid-3% range, showcasing their prudent financial management.

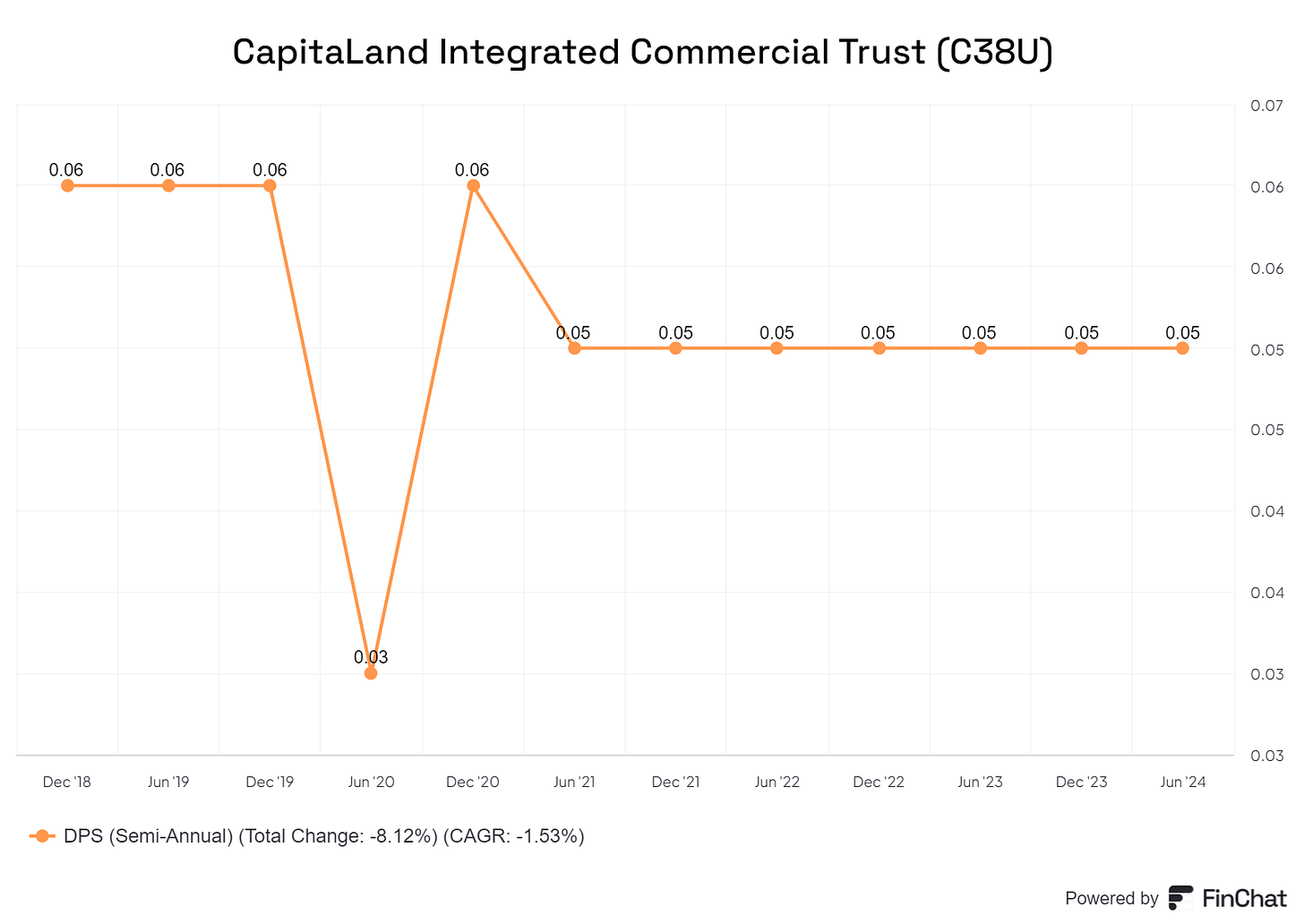

Dividend per share (DPU)

DPU remains quite stagnant since 2021. CICT reported a solid set of first-half results, with the distribution per unit (DPU) coming in at SGD5.43 cents - a modest 0.4% dip from the previous half, but a healthy 2.5% increase year-over-year. This performance was underpinned by top-line growth and effective cost management, which helped mitigate the impact of higher interest expenses.

Yield

AAREIT is offering an attractive 5.17% yield. This is just slightly above the average yield of 5.14%.

Price to book

In terms of net asset value valuation, AAREIT is slightly undervalued at 0.98. The current valuation is also below its 5-years average of 1.02.

Gearing

Gearing remains steady at 39%. This gives the REIT some headroom for future acquisitions

Value Proposition

Formed in 2020 through the merger of CCT and CMT, CICT is now the largest proxy to Singapore's commercial real estate market, with a diverse portfolio of 23 retail, office, and integrated development assets across Singapore and Germany, valued at SGD24.2 billion.

The REIT benefits from the strong sponsorship of CapitaLand Investment, one of Asia's largest real estate investment managers with SGD121 billion in assets under management. This provides CICT with a valuable pipeline of potential acquisition opportunities, with a book value equivalent to 15-20% of the sponsor's AUM.

Moreover, CICT's enlarged AUM and sizable SGD5.8 billion development headroom offer ample room for growth and portfolio remodeling over the medium term. This, combined with the team's proven execution capabilities, positions the REIT well to drive sustainable distribution growth for investors.

Risk and Competitor Analysis: Navigating Challenges

While CICT's performance has been resilient, the management team remains vigilant to potential downside risks. A prolonged slowdown in economic activity could dampen demand for both retail and office spaces, leading to lower occupancies and rental rates.

There is also the risk of long-term lease terminations, which could negatively impact the portfolio's tenant retention rate.

In terms of competition, CICT faces challenges from other major commercial REITs in Singapore, such as Ascendas REIT and Mapletree Commercial Trust. These players operate similar diversified portfolios and compete for prime assets and quality tenants. CICT's ability to maintain its competitive edge through active asset management and strategic capital allocation will be crucial.

Conclusion:

Looking ahead, the management team remains cautiously optimistic about CICT's growth prospects. They are projecting DPU growth of 7% in FY2024, driven by higher occupancies, positive rent reversions, and contributions from new assets.

The full impact of the recent retail rent growth is also expected to materialize in FY2024, further boosting the REIT's earnings. Additionally, the successful completion of the AEI works at IMM Mall and Gallileo, with their high committed occupancies, highlights the team's ability to unlock value through proactive asset management.

Overall, CICT's resilient income stream, diversified portfolio, and promising growth avenues make it a compelling choice for long-term investors seeking exposure to Singapore's commercial real estate market. While navigating the road ahead will require vigilance and agility, this REIT's proven track record and strong sponsorship instill confidence in its ability to deliver sustainable returns for unitholders.

Sign up now and get our free dividend stock list for free.

Disclaimer: This article constitutes the author’s personal views and is for entertainment and educational purposes only. It is not to be construed as financial advice in any form. Please do your own research and seek advice from a qualified financial advisor. From time to time, I have positions in all or some of the mentioned stocks when publishing this article. This is a disclosure - not a recommendation to buy or sell stocks.