Capitaland Ascendas REIT - Steady Performance In 1H 2024

Capitaland Ascendas REIT has recently published its 1H 2024 financial report. In this article, we will deep dive into its performances.

In case you missed it:

Capitaland Ascendas REIT (CLAR) has recently published its 1H 2024 financial report. In this article, we will deep dive into its performances.

🏢 Market cap: $12.14B

🔥 Dividend yield: 5.45%

📒 Price to book: 1.23

📢 Gearing: 39%

🔎 DPU 5Y Growth: 0%

Financial Highlights

CLAR, the second-largest listed S-REIT and the largest in the industrial sub-sector, has reported a steady performance in the first half of the year.

CLAR's portfolio occupancy remained stable at 93.1%, though the US business parks saw a modest dip of a couple of percentage points due to lease expirations. The trust's rent reversion, a key metric indicating the strength of its leasing activities, was an impressive 13.4% for the first half, led by the strong performance in the logistics segment.

Recognizing this positive momentum, CLAR's management has raised its full-year rent reversion guidance from mid-single digit to high single-digit. This reflects the trust's ability to capitalize on the robust demand for industrial spaces, particularly in the logistics, business parks, and data center sectors.

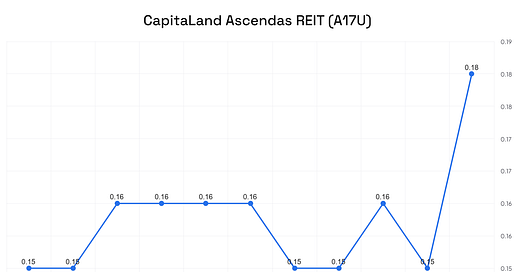

Dividend per share (DPU)

2024 DPU is on track to beat last year. The trust's distribution per unit (DPU) stood at SGD7.52 cents, a 1.1% increase from the previous half-year but a 2.5% dip year-on-year. This can be attributed to higher interest expenses and an enlarged number of units, which offset the solid top-line growth.

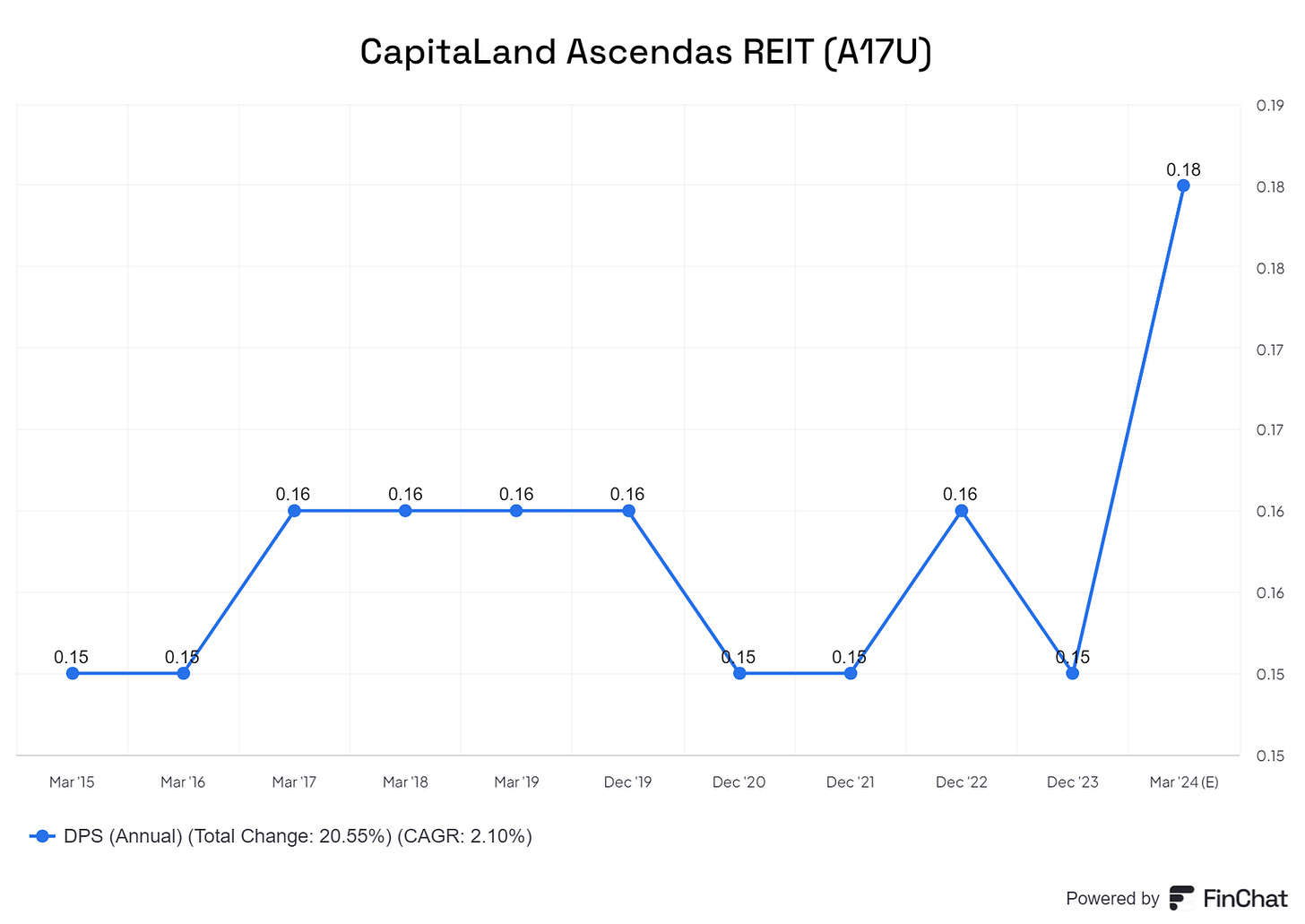

Yield

Yield is attractive at 5.55%. This is just slightly above its average yield of 5.45%.

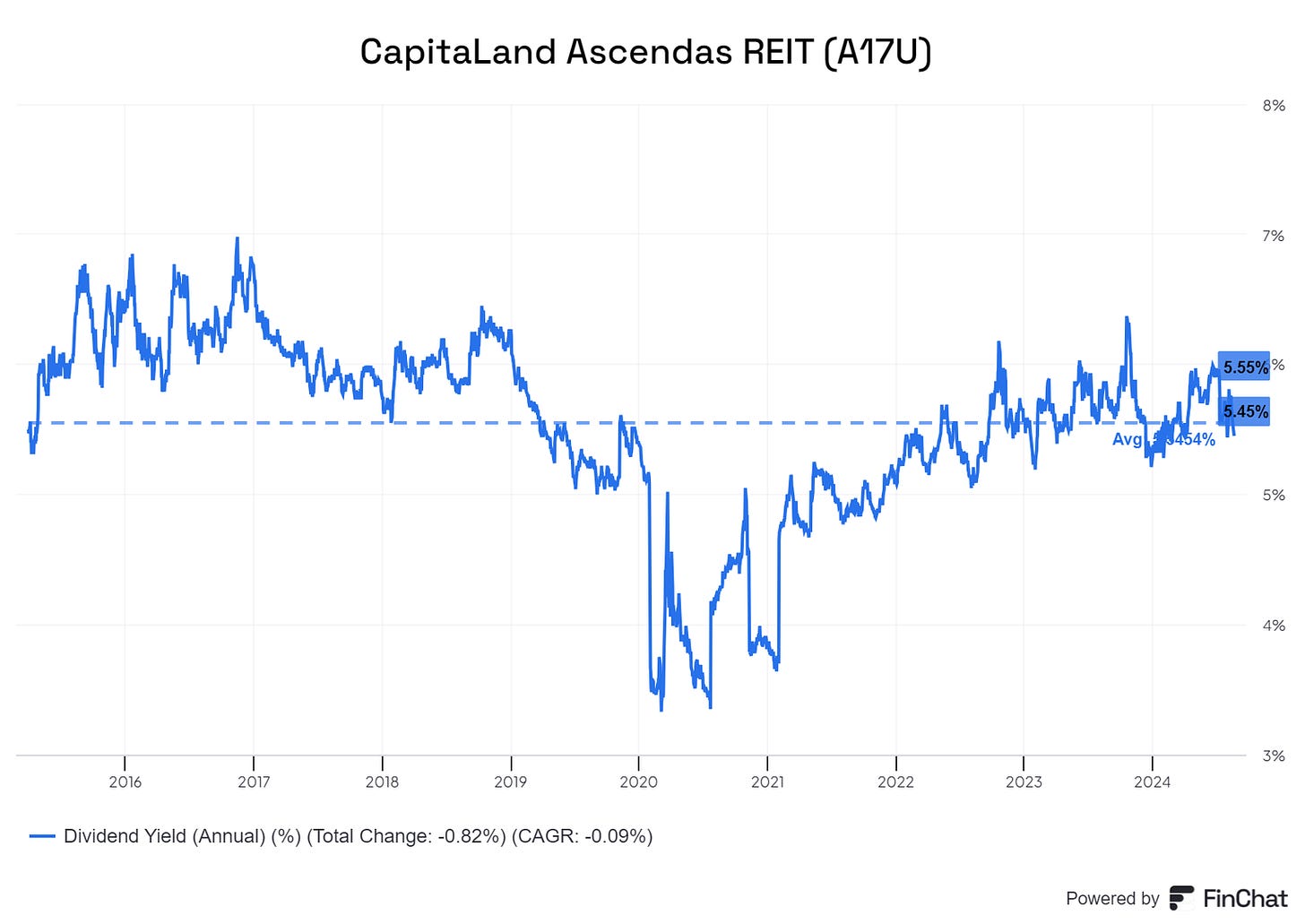

Price to book

In terms of net asset value valuation, CLAR is overvalued at 1.26. The current valuation is also above its 5-years average of 1.23. Its valuation based on both historical yield and price to book ratio is not very attractive at current price.

.

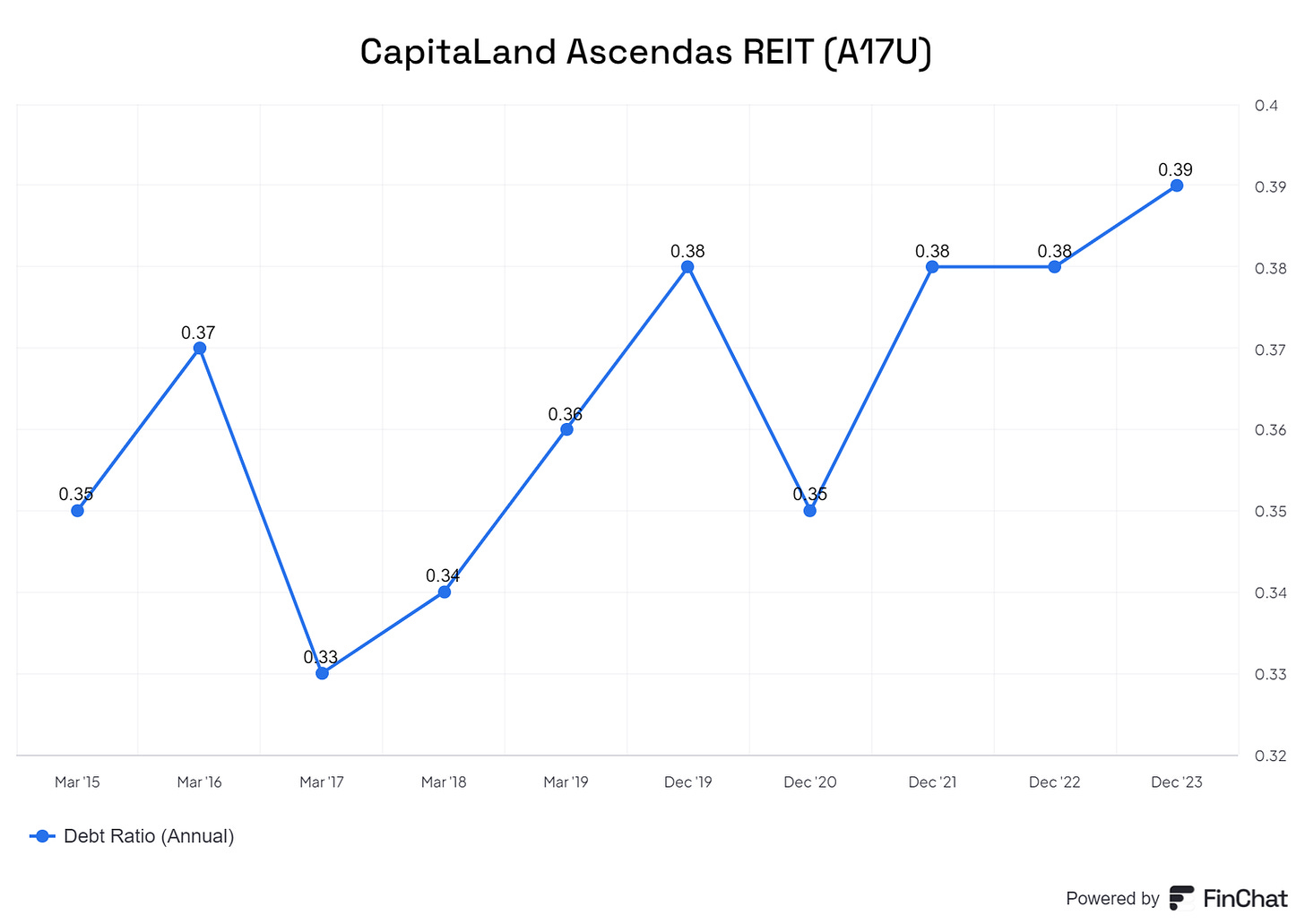

Gearing

Gearing remains steady at 39%. This gives the REIT some of headroom for future acquisitions.

Value Proposition

CLAR's diversified portfolio, which comprises business spaces, life sciences, logistics, and data centers, positions it well to navigate the evolving needs of the modern economy. The trust's strong sponsor, AscendasSingbridge (now part of CapitaLand Investment), and its extensive asset management expertise further enhance its competitive edge.

One of CLAR's key strengths lies in its proactive portfolio reconstitution efforts, which have strengthened its balance sheet and positioned it for growth. The trust's focus on expanding its overseas footprint, particularly in Australia, the UK, and the US, is expected to drive earnings visibility and diversify its geographical risk.

Importantly, CLAR's new economy assets, which account for 81% of its SGD16.4 billion portfolio, provide investors with exposure to the resilient and high-growth sectors of the market. This strategic positioning is likely to underpin the trust's DPU resilience in the years ahead.

Risk and Competitor Analysis: Navigating Challenges

While CLAR's performance has been largely steady, there are a few potential headwinds to consider. The rapid expansion into overseas markets, especially in the US business park and European data center sectors, could pose integration risks and weigh on the trust's profitability. Additionally, some of CLAR's older Singapore business parks may require capital expenditure and face temporary downtime, which could impact their performance.

In terms of competition, CLAR stands out as the largest listed industrial REIT in Singapore, with a diverse and high-quality portfolio. Its closest peers, such as Mapletree Logistics Trust and Ascendas REIT, offer investors exposure to different industrial sub-sectors, allowing them to diversify their real estate investments.

However, CLAR's strong financial metrics, including its A3 credit rating from Moody's, and its proactive capital recycling strategy differentiate it from its competitors. Investors seeking exposure to the resilient industrial real estate sector may find CLAR's well-positioned portfolio and growth potential particularly appealing.

Conclusion:

CLAR's steady first-half performance, marked by robust rent reversion, stable occupancy, and a strengthened financial profile, underscores the trust's ability to navigate the evolving industrial real estate landscape. With its diversified portfolio, experienced management team, and strategic expansion into high-growth overseas markets, CLAR appears well-positioned to deliver sustainable returns to its unitholders.

We will continue to monitor its price movement for better valuations.

Sign up now and get our free dividend stock list for free.

Disclaimer: This article constitutes the author’s personal views and is for entertainment and educational purposes only. It is not to be construed as financial advice in any form. Please do your own research and seek advice from a qualified financial advisor. From time to time, I have positions in all or some of the mentioned stocks when publishing this article. This is a disclosure - not a recommendation to buy or sell stocks.