Best Fixed Deposit Rates Singapore (Sep 2024)

Subscribe our free newsletter below to get the latest REITs Numerical Scoring for free.

When it comes to securing your hard-earned money, Singaporeans have a variety of options. Among these, fixed deposits (FDs) stand out as a popular choice for those looking to grow their savings with minimal risk. Imagine fixed deposits as a cozy little nest for your money—safe, warm, and slowly growing over time. In this article, we’ll explore what fixed deposits are, their pros and cons, and how to choose the right one for your financial needs.

What is a Fixed Deposit Account?

At its core, a fixed deposit account is a savings vehicle that allows you to deposit a lump sum of money for a predetermined period at a guaranteed interest rate. Think of it as locking your money in a time capsule where it can’t be touched until it’s time to open it again. This setup not only helps you resist the temptation to spend but also guarantees a return on your investment.

Advantages of Fixed Deposits

1. Virtually Risk-Free

One of the main attractions of fixed deposits is their low-risk profile. In Singapore, deposits up to $100,000 are insured by the Singapore Deposit Insurance Corporation (SDIC). This means that your money is safe, even if the bank faces financial difficulties. It's like having a safety net under your financial tightrope!

2. Guaranteed Returns

Fixed deposits provide a clear path to savings. By locking in your money, you can avoid impulsive spending and stick to your savings goals. For instance, if you have a target of buying a new car, setting up a fixed deposit can help you reach that goal without the distractions of day-to-day expenses.

3. Tax-Free Interest

In Singapore, the interest earned on fixed deposits is tax-exempt. This means that every dollar you earn is yours to keep, making it an even more attractive option for savers. It’s akin to finding a hidden treasure chest where all the gold coins are yours, without the pesky taxman taking a cut!

4. High Liquidity

While it’s true that your money is locked in for a period, you can still withdraw it—albeit with some penalties. This flexibility can be a relief for many, especially in emergencies. Just remember, accessing your funds early may result in lower interest earnings, but having that option is still comforting.

Disadvantages of Fixed Deposits

1. Less Flexibility

The trade-off for guaranteed returns is reduced access to your funds. Unlike a regular savings account where you can dip in and out as you please, fixed deposits require you to be disciplined. Think of it like committing to a workout plan: you might not feel like going to the gym every day, but the long-term benefits are worth it.

2. Early Withdrawal Fees

If life throws you a curveball and you need to access your funds before maturity, be prepared for early withdrawal fees. This could mean receiving less interest than you would have if you had waited. It’s a bit like canceling a gym membership early—you lose a portion of what you put in!

3. Minimum Deposit Amount Required

Most banks require a minimum deposit, typically ranging from $1,000 to $5,000. This can be a barrier for some, especially those just starting their savings journey. However, setting aside emergency funds before committing to a fixed deposit is always a wise move.

How to Choose the Right Fixed Deposit

1. Minimum Amount

Before diving into fixed deposits, ensure you have sufficient emergency savings. Think of it as having a backup parachute when skydiving—you want to be prepared for any unexpected falls.

2. Promotional Interests

Banks often run promotions that offer higher interest rates or additional perks. Keep an eye out for these deals! It's akin to spotting a seasonal sale; timing your deposit can pay off significantly.

3. Tenures

Choosing the right tenure is crucial. Fixed deposits can range from a few months to several years. While longer tenures might seem appealing, they don’t always yield better returns. Assess your financial goals and liquidity needs before making a decision. It’s like picking the right time to plant a tree—you want to ensure it gets enough sunlight and nourishment to thrive.

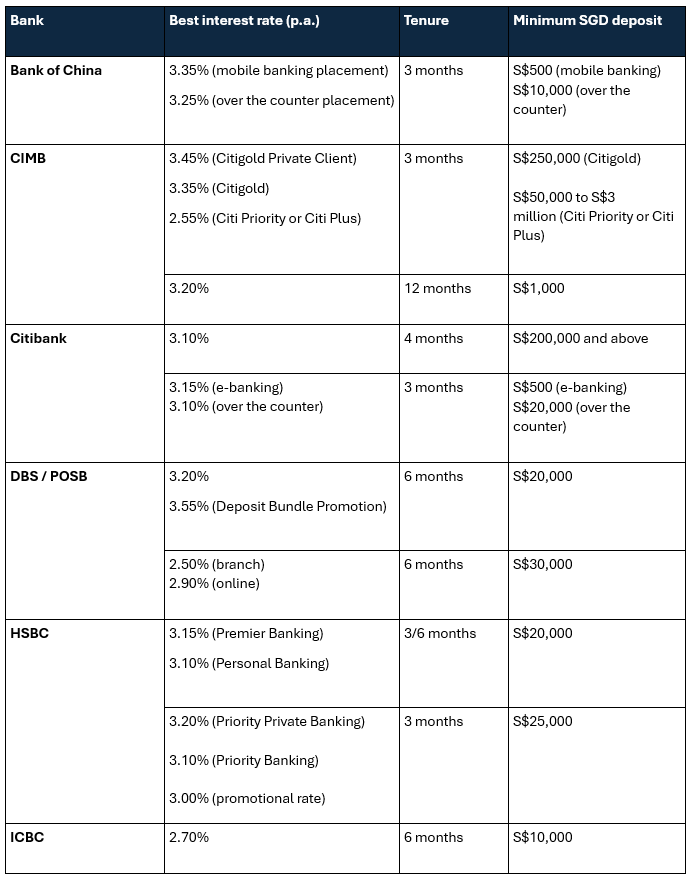

Summary on Fixed Deposit Rates - Sep 2024

Bank of China (BOC) Fixed Deposit Rates

Interest Rate: Up to 3.35% p.a.

Tenure: 3 months

Minimum Deposit: S$500 (via mobile placement)

Alternative Rate: 3.25% p.a. for over-the-counter transactions with a minimum deposit of S$10,000.

Bank of China has rolled out an appealing promotional rate for mobile account openings. If you’re looking for short-term options, this could be a great fit. Just remember, the rates are updated quarterly, so keep an eye on any changes!

CIMB Fixed Deposit Rates

Personal Banking Rate: Up to 2.95% p.a.

Tenure: 6 months

Minimum Deposit: S$10,000

Preferred Banking Rate: Up to 3.00% p.a.

Tenure: 6 months

Minimum Deposit: S$10,000

CIMB is offering solid rates for both personal and preferred banking clients. The rates began on September 1, 2024, making it a timely option for those looking to lock in their savings for six months.

Citibank Fixed Deposit Rates

Citi Private Client Rate: Up to 3.45% p.a.

Tenure: 3 months

Minimum Deposit: S$250,000 (through a Relationship Manager)

Citigold Rate: Up to 3.35% p.a.

Tenure: 3 months

Minimum Deposit: S$250,000

Citi Priority/Citibanking Rate: Up to 2.55% p.a.

Tenure: 3/6 months

Minimum Deposit: S$50,000

Citibank offers some of the highest rates in the market, especially for its Private Client and Citigold customers. However, these rates come with higher minimum deposit requirements, so they’re best suited for those with substantial funds to invest.

DBS / POSB Fixed Deposit Rates

Highest Rate: 3.20% p.a.

Tenure: 12 months

Minimum Deposit: S$1,000 to S$19,999

DBS/POSB is currently accepting placements for tenures of 12 months or less, making it a great choice for those looking for a longer-term commitment. Plus, there’s an enticing offer for credit card applicants, which could add extra value to your banking experience.

ICBC Fixed Deposit Details

Minimum Deposit Requirements:

E-Banking: S$500

Over-the-Counter: S$20,000

Interest Rates

3-Month Tenure:

E-Banking Rate: 3.15% p.a.

Over-the-Counter Rate: 3.10% p.a.

ICBC’s promotional rates make it an attractive option for savers looking for short-term placements. The flexibility of being able to open an account with a minimum deposit of just S$500 via e-banking is particularly appealing for those who want to start saving without a significant upfront investment.

Tenure Options

ICBC offers fixed deposits with a maximum tenure of 12 months. This is ideal for individuals who want to ensure their funds are secure for an extended period but still want the option to access their money relatively soon.

Renewal Process

Upon reaching the end of your fixed deposit tenure, ICBC will automatically apply the prevailing e-banking promotional rate for renewals. This means you don’t have to worry about missing out on updated rates—your funds will continue to earn competitive interest without any hassle.

Maybank Fixed Deposit Details

Interest Rates

6-Month Tenure:

Online Placement: Up to 3.20% p.a.

Branch Placement: Up to 3.20% p.a.

If you prefer a more hands-on approach and visit a branch, you might want to explore Maybank’s Deposit Bundle Promotion for even higher rates.

Deposit Bundle Promotion

Interest Rate: Up to 3.55% p.a.

Minimum Deposit: S$20,000

This promotion is designed to reward customers who maintain a balance in selected Maybank Current or Savings accounts while also investing in fixed deposits. Here’s how it works:

Deposit Requirement: For every S$1,000 deposited into one of the selected accounts (with a minimum total of S$2,000), you can qualify for the Deposit Bundle Promotion.

Fixed Deposit Requirement: A minimum deposit of S$20,000 is required for the fixed deposit placement.

Eligible Accounts for the Bundle

To benefit from the Deposit Bundle Promotion, you need to deposit fresh funds into one of the following Maybank accounts:

Passbook Savings Account

Privilege Plus Savings Account

SaveUp Account

PremierOne Account

Current Account

FlexiBiz Account

PremierBiz Account

This bundle is available to individual, SME, and commercial banking customers, making it accessible for a wide range of savers.

OCBC Fixed Deposit Details

Interest Rates

6-Month Tenure:

Online Application: Up to 2.90% p.a.

Branch Application: Up to 2.50% p.a.

If you decide to apply for a fixed deposit through OCBC’s Internet Banking platform, you’ll receive a higher interest rate of 2.90% p.a., making it a great choice for tech-savvy savers. However, if you prefer to visit a branch, you can still earn a respectable 2.50% p.a., but with a minimum deposit requirement of S$30,000.

Minimum Deposit Requirement

The minimum deposit for both online and branch placements is S$30,000. This amount may be on the higher side for some, but it’s designed to offer attractive rates for those with substantial savings.

OCBC 360 Account

If you’re exploring additional savings options, consider the OCBC 360 Account. This account offers an impressive interest rate of up to 7.65% p.a. (Effective Interest Rate: 4.65% p.a.). The OCBC 360 Account is tailored for those who want to maximize their savings potential through a combination of regular deposits and meeting certain criteria.

RHB Fixed Deposit Rates

Interest Rates

Premier Banking Online Placement:

Interest Rate: 3.15% p.a.

Personal Banking:

3-Month Placement: 3.10% p.a.

6-Month Placement: 3.10% p.a.

12-Month Placement: 2.80% p.a.

Minimum Deposit Requirement

To qualify for these promotional rates, you need to place a minimum deposit of S$20,000. Additionally, applications must be made through the RHB Mobile SG app, making it convenient for tech-savvy customers looking to manage their finances on the go.

Important Note

Keep in mind that the promotional rates are subject to change without prior notice, so it’s wise to confirm current rates before making your decision.

UOB Fixed Deposit Rates

Interest Rates

Promotional Rate:

Interest Rate: 2.70% p.a.

Tenure: 6 months

Minimum Deposit: S$10,000

This promotional rate is in effect from August 30 to September 30, 2024, making it a limited-time offer. UOB's minimum deposit requirement is lower compared to RHB, which could appeal to those looking to start saving without a large initial investment.

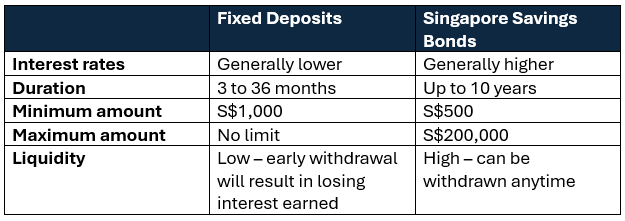

Comparing SSBs and Fixed Deposits

Both SSBs and fixed deposits require a fixed cash investment for a predefined period, but they differ in several key ways:

What Are Singapore Savings Bonds (SSB)?

SSBs are a type of Singapore Government Securities (SGS) issued and fully backed by the Singapore government. This means your investment is secure, making SSBs an attractive option for conservative investors. Each month, new bonds are issued with interest rates that are fixed based on the average SGS yields from the previous month.

Key Features of SSBs

Step-Up Interest Rates:

SSBs feature a unique structure where the interest rate starts low but increases over time. This step-up mechanism encourages investors to hold onto their bonds for the full 10-year duration, as the longer you keep your SSB, the more interest you earn.

Interest Payments:

Interest is paid every six months and is automatically credited to the bank account linked to your Central Depository (CDP) Securities account. This regular income can be particularly beneficial for those looking to supplement their cash flow.

Fixed Terms:

Although SSBs have a maximum tenure of 10 years, they allow for flexibility. You can redeem your bonds before maturity, but the interest will only be paid up to the date of redemption, which may result in lower overall returns.

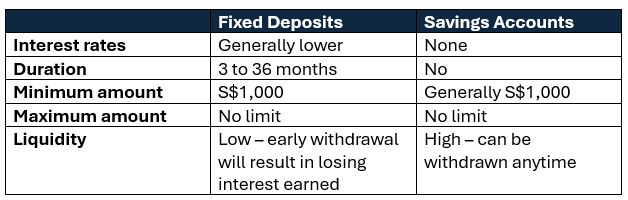

Fixed deposits vs savings accounts: Which to choose?

Besides fixed deposits and SSBs, you can also consider savings accounts to keep your cash liquid.

What Are High-Yield Savings Accounts?

High-yield savings accounts allow you to earn interest on the money in your account while maintaining easy access to your funds. The interest rates can vary significantly depending on the account type and the conditions you must fulfill to earn those rates.

Potential Interest Rates

Up to 7.88% p.a.: This enticing rate is often advertised by several banks, but achieving it typically requires meeting specific criteria.

Types of Savings Accounts

CIMB FastSaver Account:

Interest Rate: Competitive rates without complicated conditions.

Requirements: Simply keep your funds in the account; no additional actions required.

DBS Multiplier Account:

Interest Rate: Higher rates available for meeting certain criteria.

Requirements: To qualify for the best rates, you might need to:

Credit your salary to the account.

Spend a minimum amount on DBS credit cards.

Purchase insurance or investment products.

Take up a personal loan.

OCBC 360 Account:

Interest Rate: Attractive rates, but with conditions.

Requirements: Earn higher interest by:

Crediting your salary.

Spending on OCBC credit cards.

Making regular contributions to an investment or insurance plan.

UOB One Account:

Interest Rate: Competitive with conditions to meet.

Requirements: Higher interest is earned by:

Making a minimum number of transactions with UOB credit cards.

Crediting your salary.

How to Get Maximum Returns from a Fixed Deposit

Choose the Right Tenure:

Fixed deposit interest rates often vary based on tenure. Generally, longer tenures may offer higher rates. Ensure you select a tenure that you are comfortable committing to, as withdrawing early can lead to a loss of interest.

Look for Promotional Rates:

Banks frequently offer promotional rates that can be significantly higher than standard rates. These often require higher minimum deposits, such as S$10,000 or S$20,000. Be prepared to lock in these amounts for the specified tenure to benefit from these rates.

Understand Minimum Deposit Requirements:

Be aware of the minimum deposit required to qualify for promotional rates. This amount can vary between banks and products.

Consider Fresh Funds:

Many promotional rates apply only to new funds. Ensure that the money you deposit is classified as fresh funds, meaning it cannot be transferred from existing accounts within the same bank.

Common Questions About Fixed Deposits

Can I Withdraw My Fixed Deposit Before the Tenure Is Up?

Yes, you can withdraw your fixed deposit early. However, you will likely lose any interest earned, and other penalties may apply based on the bank’s policies.

Can I Top Up a Fixed Deposit Account?

No, you cannot top up a fixed deposit once it is established. If you want to invest more money, you will need to open a new fixed deposit account, which may have different interest rates than your existing one.

What Are the Requirements to Open a Fixed Deposit Account?

To open a fixed deposit account, you typically need:

For Singaporeans/PRs: Front and back of your NRIC.

For Foreigners: Passport and Employment Pass, along with proof of address.

How Do I Apply for a Fixed Deposit Account?

You can apply through your bank’s internet banking platform or visit a branch. You will need to transfer funds into the fixed deposit account to start earning interest.

Are Fixed Deposits Taxable in Singapore?

No, the interest earned on fixed deposits with approved banks is not taxable.

Can Foreigners Open Fixed Deposits in Singapore?

Yes, foreigners can open fixed deposits. Required documents typically include a passport and proof of address.

Can I Open a Fixed Deposit Using Foreign Currency?

Yes, many banks offer fixed deposits in foreign currencies, such as USD, AUD, EUR, and GBP. Be mindful of terms related to conversion fees and renewal clauses.

Why Should I Open a Fixed Deposit Account?

Fixed deposits can be advantageous in several scenarios:

Higher Returns than Savings Accounts: If you’re earning minimal interest in a regular savings account, a fixed deposit can yield better returns.

Risk-Free Investment: Your deposits are protected up to S$75,000 by the Singapore Deposit Insurance Corporation (SDIC).

Regular Cash Flow: Depending on the bank, interest payments can be made quarterly or annually.

Liquidity: Although your funds are locked in, partial or full withdrawals are allowed, albeit with potential interest penalties.

When Is the Best Time to Open a Fixed Deposit Account?

The best time to open a fixed deposit account is when interest rates are favorable. In a low interest rate environment, you may encounter lower rates across the board.

Consider waiting for attractive promotional rates, which banks typically change monthly. Rates generally range from 0.6% to 1.5% p.a., but promotional offers can yield higher rates, albeit with increased minimum deposit requirements.

Note: Remember to check the latest details of FDs with the respective banks before signing up.

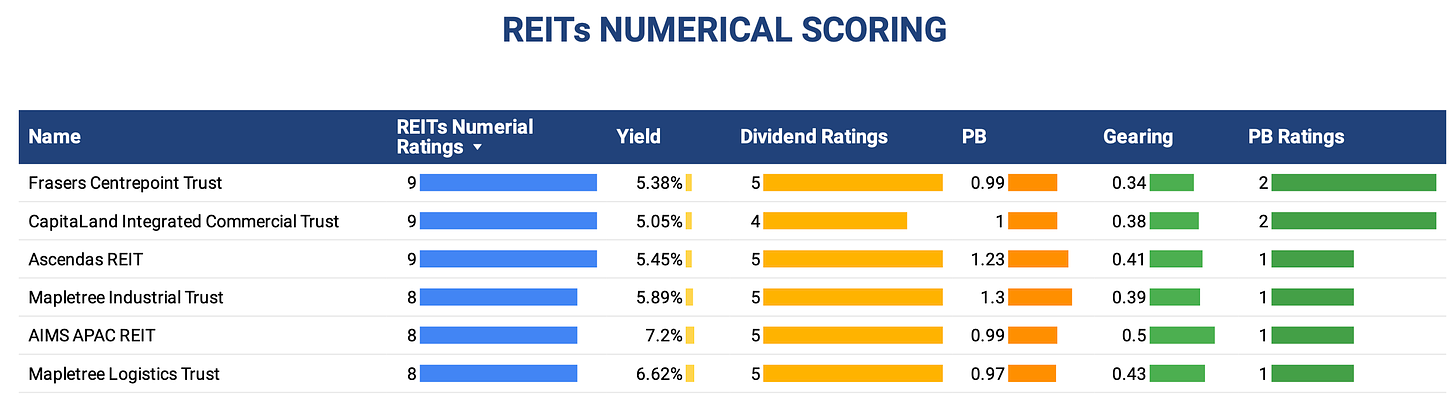

Interested in Singapore REITs but lazy to analyze all the numbers by yourself?

Subscribe our free newsletter below to get the latest REITs Numerical Scoring for free.

Disclaimer: This article constitutes the author’s personal views and is for entertainment and educational purposes only. It is not to be construed as financial advice in any form. Please do your own research and seek advice from a qualified financial advisor. From time to time, I have positions in all or some of the mentioned stocks when publishing this article. This is a disclosure - not a recommendation to buy or sell stocks.