A Deep Dive Into AIMs APAC REIT's Performance

In the first half of 2025, AAREIT reported a Distribution Per Unit (DPU) of SGD 4.67 cents, reflecting a modest increase of 0.4% year-over-year.

Aims Apac REIT (AAREIT) has recently published its 1H 2025 financial report. In this article, we will deep dive into its performances.

🏢 Market cap: $1.05B

🔥 Dividend yield: 7.3%

📒 Price to book: 0.99

📢 Gearing: 35%

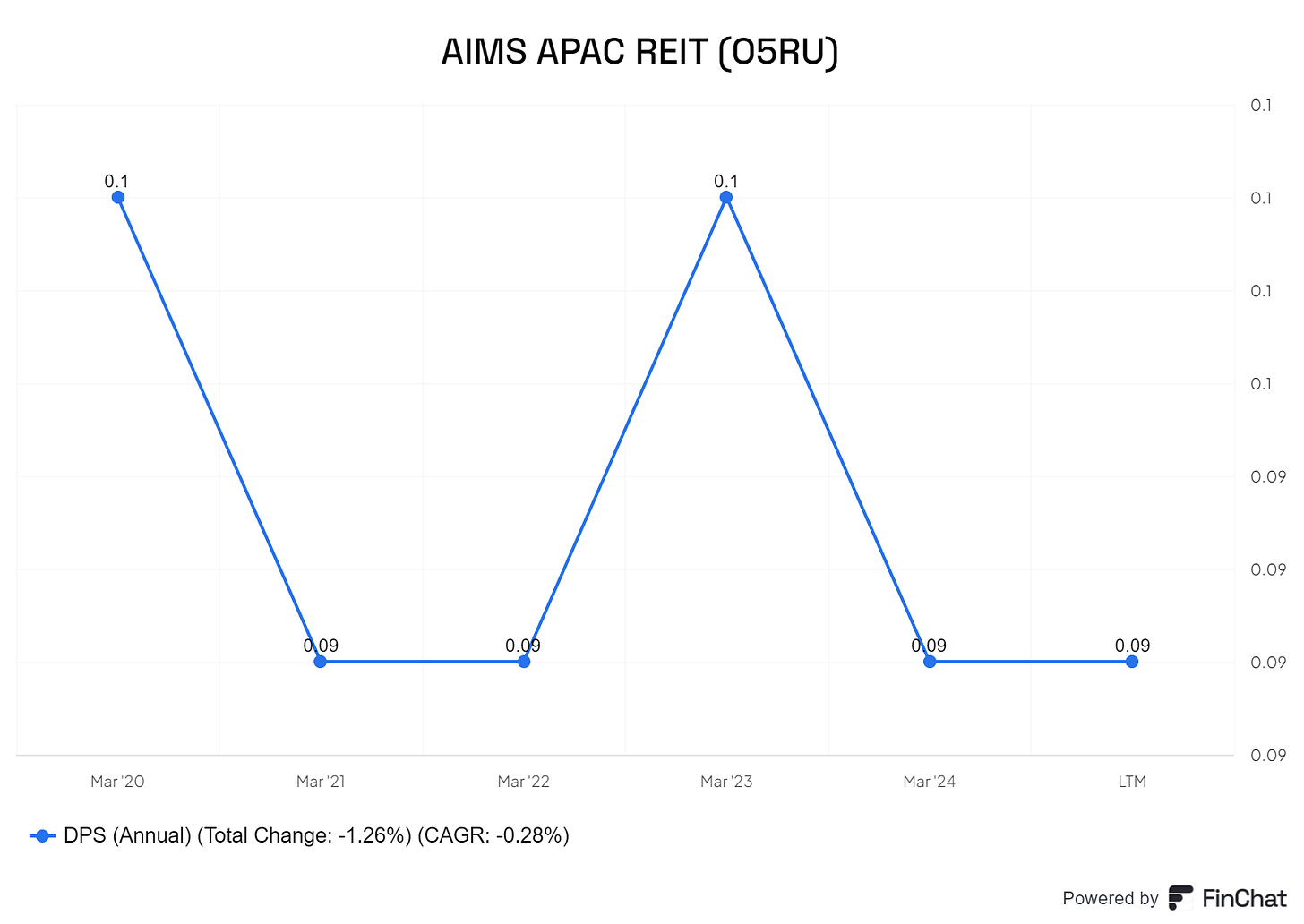

🔎 DPU 5Y Growth: -1.8%

Financial Highlights

In the first half of 2025, AAREIT reported a Distribution Per Unit (DPU) of SGD 4.67 cents, reflecting a modest increase of 0.4% year-over-year. This aligns closely with market consensus, albeit slightly below our forecasts. The uptick in DPU is primarily attributed to incremental contributions from electricity sales, reduced commissions, and insurance payouts, effectively offsetting leasing downtimes associated with two of our Asset Enhancement Initiative (AEI) assets.

The company’s revenue surged to SGD 93.5 million, with a Net Property Income (NPI) of SGD 67.6 million—representing increases of 7.7% and 5.1% year-over-year, respectively. However, a larger unitholder base following the equity fund raising (EFR) in June 2023 tempered the growth in distributable income, which saw a healthier rise of 6% year-over-year. Looking ahead, the newly signed anchor tenant at 15 Tai Seng Drive is set to contribute income in the third quarter of FY25, even as AEI works continue.

Additionally, in the second quarter of 2025, the DPU rose to SGD 2.4 cents, marking increases of 5.7% quarter-over-quarter and 2.6% year-over-year. This growth was buoyed by strong rental reversions of 23.9%, particularly in the logistics sector, which experienced a remarkable 29.1% spike. While the occupancy rate saw a slight decline of 2.3 percentage points due to ongoing AEI and transitional movements, it remains robust at 96.7% when including committed leases.

Dividend per share (DPU)

The company’s revenue surged to SGD 93.5 million, with a Net Property Income (NPI) of SGD 67.6 million—representing increases of 7.7% and 5.1% year-over-year, respectively. However, a larger unitholder base following the equity fund raising (EFR) in June 2023 tempered the growth in distributable income, which saw a healthier rise of 6% year-over-year. Looking ahead, the newly signed anchor tenant at 15 Tai Seng Drive is set to contribute income in the third quarter of FY25, even as AEI works continue.

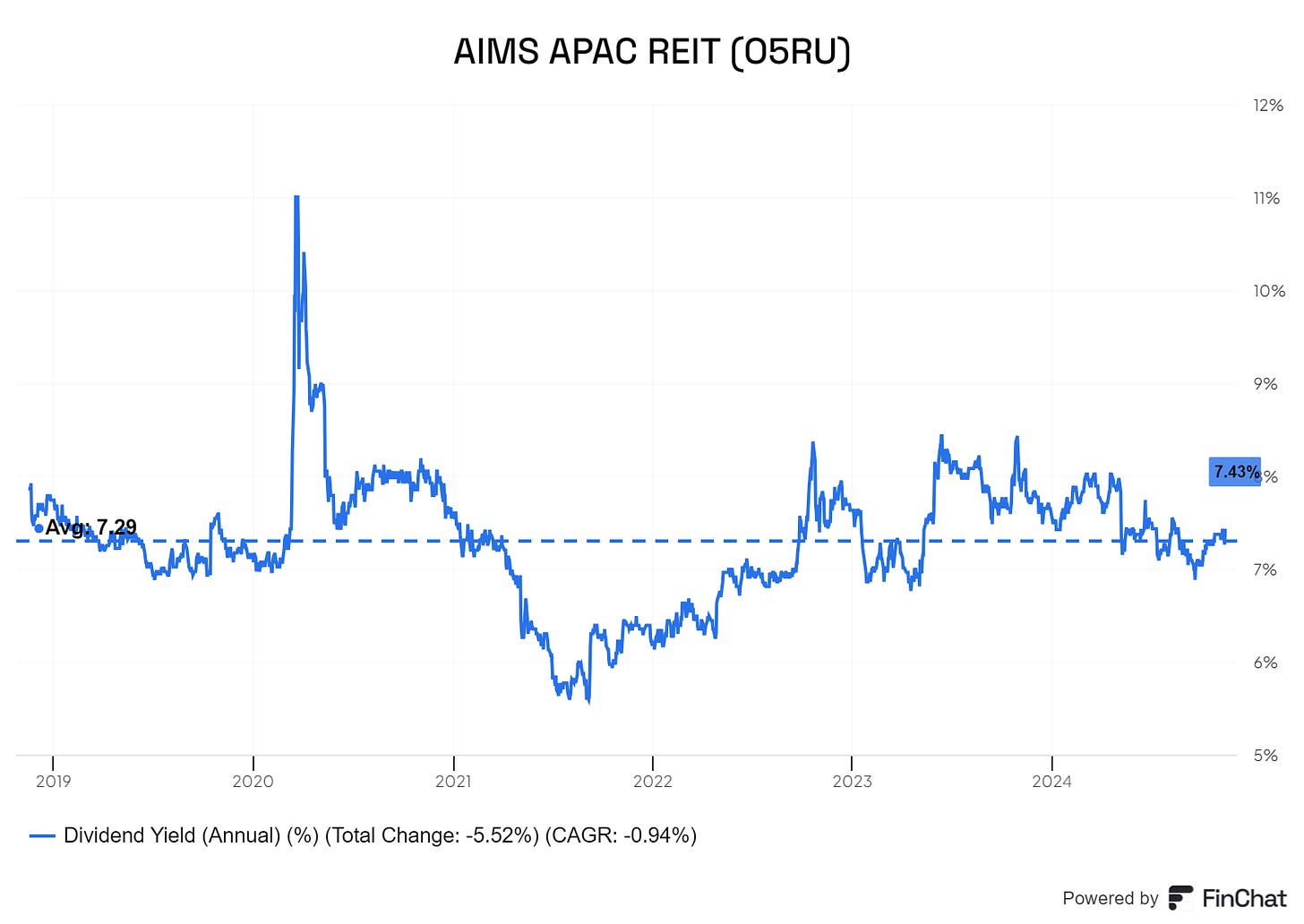

Yield

AAREIT is offering an attractive 7.3% yield after the recent correction. Its historical average yield is also 7.3%.

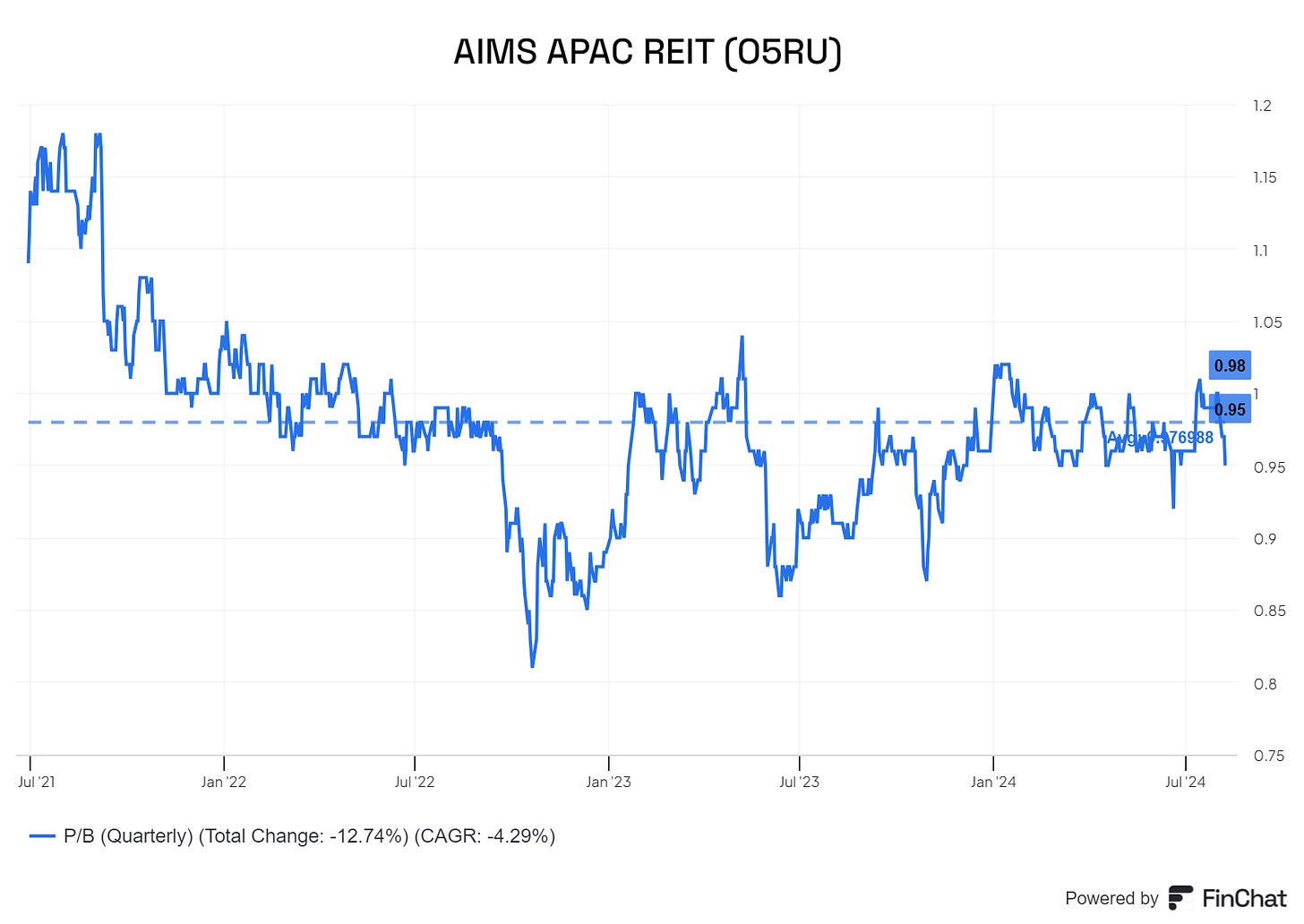

Price to book

In terms of net asset value valuation, AAREIT is at fair value.

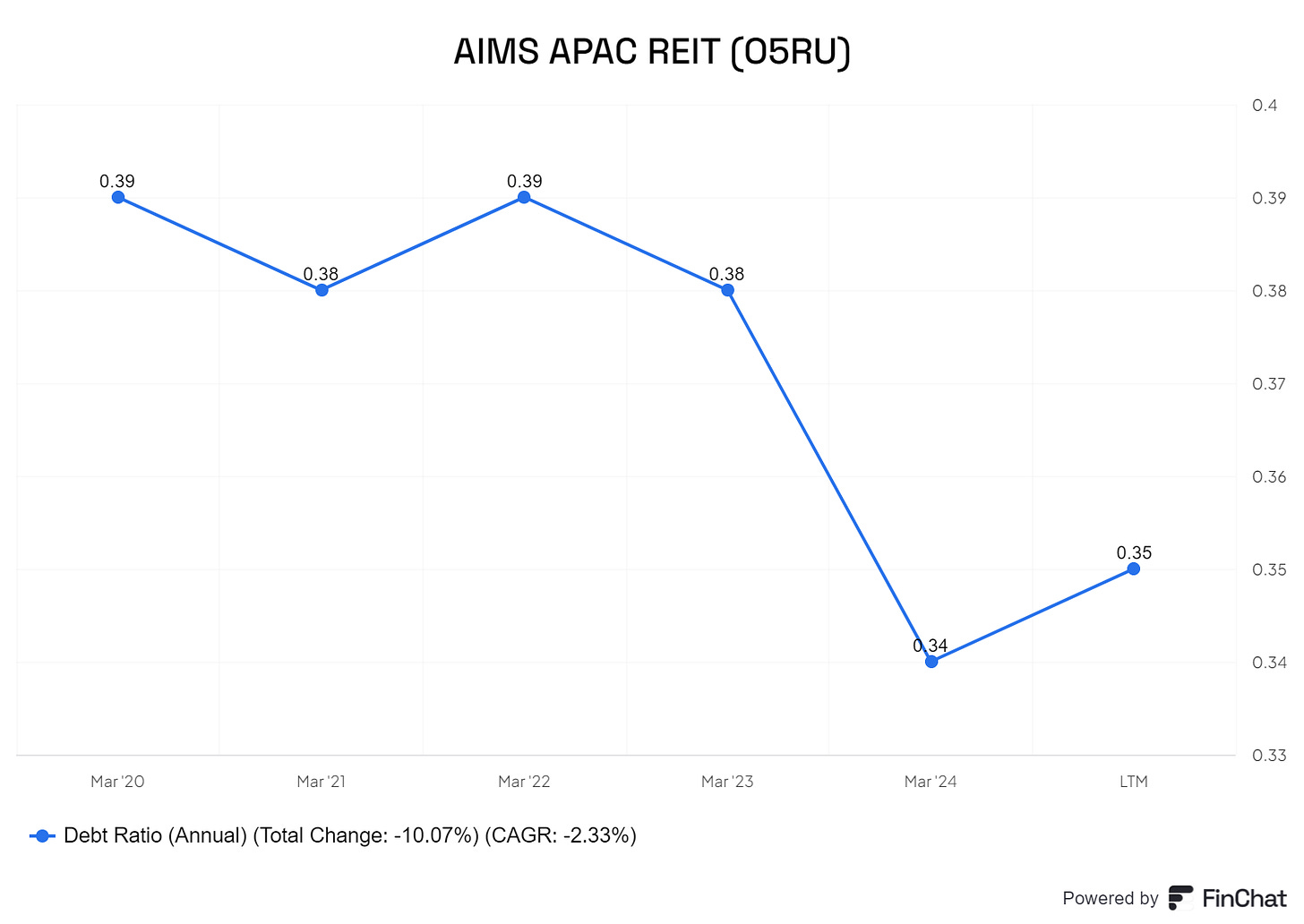

Gearing

Gearing is healthy at 34%. This gives the REIT ample headroom for future acquisitions.

Value Proposition

What sets AAREIT apart in today's competitive landscape? The value proposition lies in its diversified industrial property portfolio, which includes warehouses, light industrial buildings, and business parks. This strategic mix allows AAREIT to cater to a variety of industries, ensuring stability and resilience in its rental income.

For instance, the logistics assets accounted for 52% of rental income in Q4 2021, illustrating the firm’s strong foothold in a sector that shows no signs of slowing down. The proactive redevelopment initiatives have also led to a compounded annual growth rate (CAGR) in Net Asset Value (NAV) of approximately 8% over the last decade, a testament to the effective management and foresight of the AIMS Financial Group, the sponsor behind AAREIT.

Moreover, the company’s commitment to sustainability is notable. In the first half of 2025, AAREIT reported gains from the sale of electricity and renewable energy certificates, amounting to SGD 1.872 million. This not only enhances revenue streams but also aligns with global trends towards environmental responsibility, appealing to socially conscious investors.

Risk and Competitor Analysis: Navigating Challenges

Despite the promising outlook, AAREIT is not without its challenges. The ongoing AEI works at 7 Clementi Loop and 15 Tai Seng Drive could lead to temporary downtime, impacting rental income. Additionally, while rental reversions have been positive overall, there remains a risk of negative reversions in the near term, particularly as the market adjusts to new leasing conditions.

Competitively, AAREIT faces pressure from other real estate investment trusts (REITs) in the industrial sector. Companies that can adapt quickly to market changes and offer competitive rates for tenants will likely capture more market share. However, AAREIT's proactive approach in renewing contracts and securing long-term leases, such as the ongoing negotiations with Schenker, positions it well against competitors.

Furthermore, economic factors, including interest rate fluctuations and exchange rate volatility (notably between AUD and SGD), could influence AAREIT’s performance. While the company has made strides in maintaining a healthy gearing ratio of 33.4% and secured a sustainability-linked loan facility, external market conditions can still pose risks.

Conclusion:

In summary, AAREIT’s balanced approach to growth—through strategic acquisitions, redevelopment, and a keen eye on sustainability—offers a compelling investment narrative. With a robust financial performance in the first half of 2025 and plans for continued expansion, the future looks promising. While risks exist, the company’s proactive management and diverse asset base provide a solid foundation for navigating the ever-evolving financial landscape.

Sign up now and get our free REITs’ Numerical Ratings.

Disclaimer: This article constitutes the author’s personal views and is for entertainment and educational purposes only. It is not to be construed as financial advice in any form. Please do your own research and seek advice from a qualified financial advisor. From time to time, I have positions in all or some of the mentioned stocks when publishing this article. This is a disclosure - not a recommendation to buy or sell stocks.