8 High-Performing Stocks to Consider

In case you missed it:

As we move through 2024, savvy investors are on the lookout for stocks that can provide consistent, market-beating returns. Today, I want to highlight 8 top-notch companies that are delivering impressive financial results and could be worthy additions to your investment portfolio.

These aren't your run-of-the-mill stocks - they're industry leaders with strong fundamentals, high growth rates, and returns on invested capital (ROIC) that put them in the upper echelon. Let's dive in and take a closer look at why these 8 companies deserve your attention:

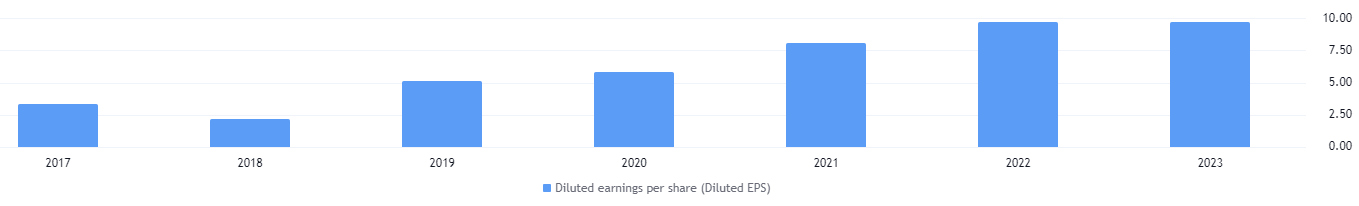

Microsoft (MSFT):

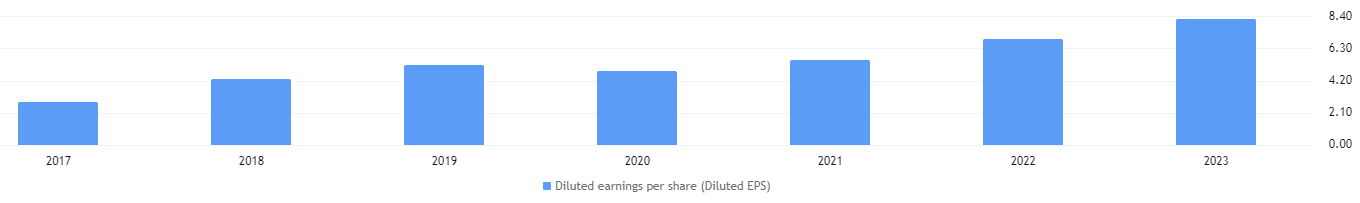

The tech juggernaut has transformed itself into a cloud computing powerhouse with its Azure platform, which is gaining market share against Amazon Web Services. Additionally, Microsoft's Office 365 productivity suite and Xbox gaming division continue to be reliable growth drivers. The company's diverse revenue streams, strong competitive moat, and disciplined capital allocation have allowed it to maintain an industry-leading ROIC above 29% and has grown earnings per share (EPS) by an outstanding 20% annually over the past three years.

NVIDIA (NVDA):

As the global leader in GPUs, NVIDIA is uniquely positioned to benefit from the exponential growth in AI, machine learning, and high-performance computing. The company's Ampere architecture has solidified its dominance in the data center market, while its GeForce line of consumer GPUs maintain a stronghold in PC gaming. NVIDIA's vertical integration and focus on cutting-edge technology have enabled it to sustain an ROIC of over 90%. and revenue growth of more than 125%!

Alphabet (GOOGL):

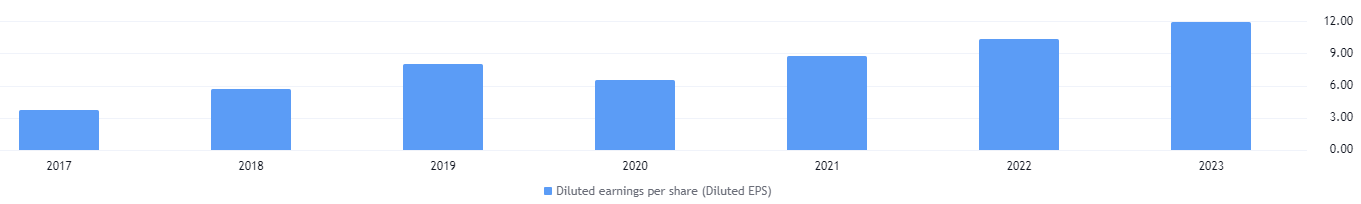

Google's search engine and digital advertising business continue to generate massive cash flows, but the company has also diversified into promising areas like cloud computing, autonomous vehicles (Waymo), and life sciences (Verily). Alphabet's willingness to invest in long-term growth initiatives, combined with its powerful market position, have allowed it to maintain an ROIC north of 27%. Alphabet has delivered over 27% annual EPS growth, maintains a best-in-class and continues to innovate with exciting projects in areas like autonomous vehicles and life sciences.

Meta Platforms (META):

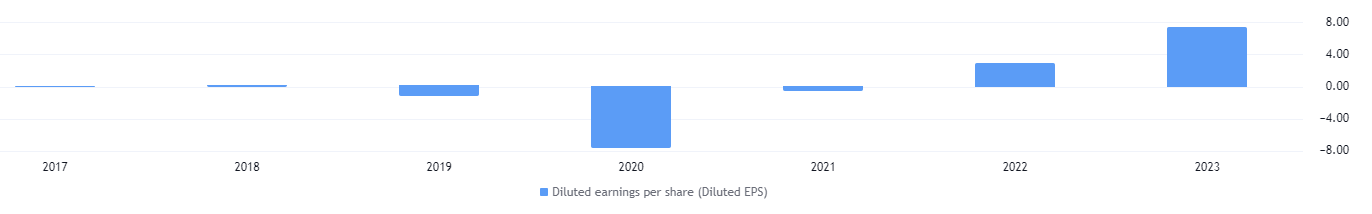

Despite the controversies surrounding Facebook, Meta's core social media platforms remain essential to billions of users worldwide. The company is leveraging its data and targeted advertising capabilities to drive 75%+ revenue growth. While concerns around privacy and regulation linger, Meta's strong ROIC of over 27% suggests it can navigate these headwinds and deliver value for shareholders.

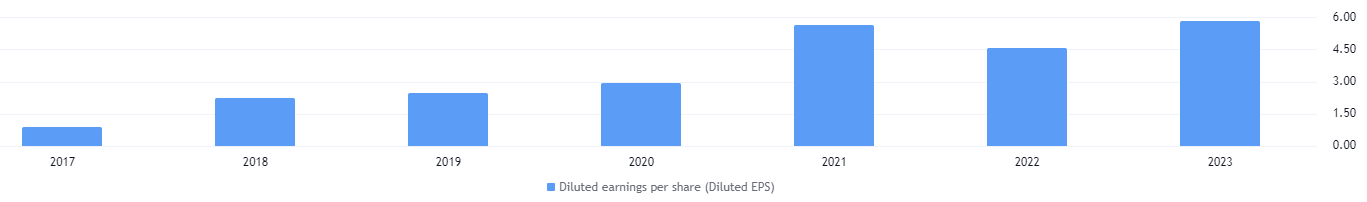

Visa (V):

As the world's largest payments network, Visa is expertly positioned to benefit from the ongoing shift away from cash and toward digital transactions. Visa's ROIC exceeds 30%, and the company has grown EPS by over 19% annually - making it a dependable choice for income-oriented investors.

Mastercard (MA):

Visa's chief rival, Mastercard, is another financial titan worth considering. With a similar business model, Mastercard boasts an ROIC above 57% and has delivered 15%+ EPS growth - underscoring its ability to generate outsized returns for shareholders.

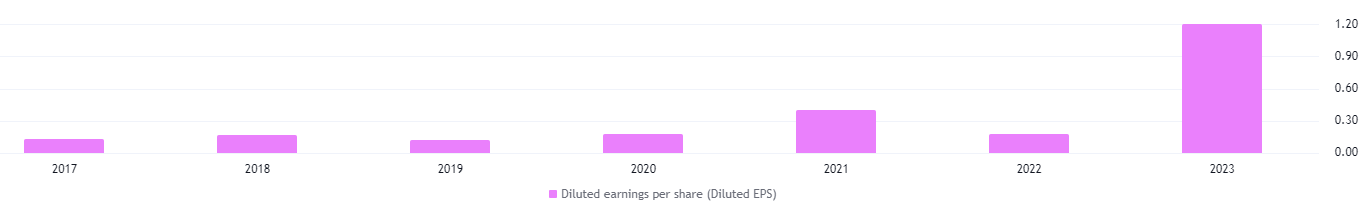

Airbnb (ABNB):

The travel and tourism industry has bounced back with a vengeance, and Airbnb is reaping the benefits. With an ROIC over 55% and revenue growth exceeding 40%, this accommodations platform is cashing in on the pent-up demand for unique travel experiences.

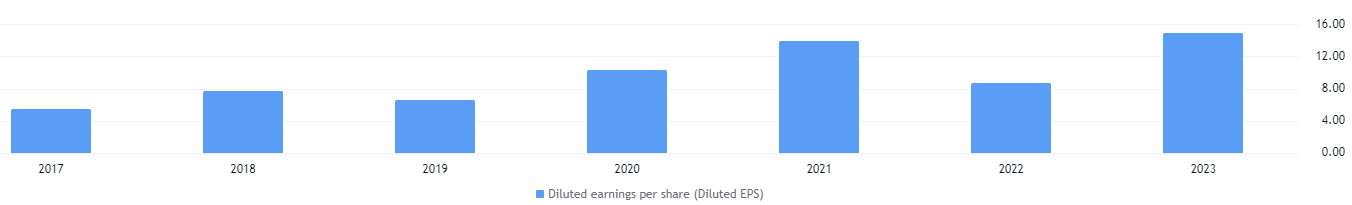

Cadence Design Systems (CDNS):

As the leading provider of electronic design automation (EDA) software, Cadence Design Systems is essential to the semiconductor industry. The company boasts an ROIC over 28% and has grown EPS by more than 23% per year - a potent combination for long-term investors.

Summary

These 8 stocks represent some of the most compelling investment opportunities on the market today. Each company has demonstrated the ability to generate consistently strong financial results, with a proven track record of outperforming the broader market.

Of course, no investment is without risk, and it's crucial to do your own due diligence before adding any of these stocks to your portfolio. But if you're looking to enhance your returns and position your investments for long-term success, these 8 high-performing companies are certainly worthy of your consideration.

Happy investing!

Disclaimer: This article constitutes the author’s personal views and is for entertainment and educational purposes only. It is not to be construed as financial advice in any form. Please do your own research and seek advice from a qualified financial advisor. From time to time, I have positions in all or some of the mentioned stocks when publishing this article. This is a disclosure - not a recommendation to buy or sell stocks.