5 REITs That Likely Benefit From Interest Rate Drop

As Fed Chair Powell opens door for 50bps rate cut open in Sep, which are the REITs that will benefit the most.

In case you missed it:

As bond yields have begun their descent from recent peaks, many investors are turning their attention to dividend stocks. This shift is not just a passing trend; it reflects a broader narrative about the changing landscape of investments and the opportunities that arise when traditional safety nets start to lose their luster.

The Current Landscape of Bond Yields

Let’s take a quick snapshot of the current bond market. The 10-year Treasury yield has fallen to about 3.8%, down from a peak of around 4.7% earlier this year and a multi-year high of approximately 5% at the end of 2023. When bond yields dip below 4%, it opens the door for investors to explore dividend-paying stocks that yield more than these government benchmarks. With lower bond yields, the perceived risk of investing in equities, especially dividend stocks, becomes more palatable.

But what’s driving this decline in bond yields? The Federal Reserve has indicated a readiness to cut the federal-funds rate in September, influenced by decreasing inflation rates and signs of economic slowdown. While there’s a ceiling on how much the 10-year yield can drop—since rate cuts could eventually spur stronger growth and slightly elevate inflation—the current environment suggests that yields may stabilize around the 4% mark for the time being.

The Impact of Rate Cuts on Real Estate Investment Trusts (REITs)

As we consider the broader implications of declining interest rates, it’s worth noting how this environment can also benefit Real Estate Investment Trusts (REITs). With the Fed signaling potential rate cuts, the cost of capital is expected to decrease, which could lead to improved fair value estimates for REITs. Each 50 basis points decrease in the discount rate can enhance fair value by about 10% on average.

Below are 5 REITs that are most likely benefit as interest rates drop. We mainly look at 3 key metrics: % fixed rate debt, debt to maturity and % debt maturing. During the high interest rate environment, we prefer REITs with high % fixed rate debt, high debt to maturity and low % debt maturing, which indicate that the REITs are more financially stable and least impacted by the interest rate hike. On the other hand, as the Fed is likely to cut interest rate soon, REITs with low % fixed rate debt, low debt to maturity and high % debt maturing might perform better.

1. Keppel REIT

% Fixed Rate Debt: 65%

Debt to Maturity: 3 years

% Debt Maturing in 2 Years: 23%

Keppel REIT focuses on high-quality commercial properties in prime locations. With 65% of its debt fixed, it offers stability against interest rate fluctuations. The debt to maturity of 3 years indicates a relatively manageable repayment schedule, while 23% of its debt maturing in the next two years suggests the REIT could potentially reduce its interest cost as the rates start to drop.

2. Suntec REIT

% Fixed Rate Debt: 55%

Debt to Maturity: 3.3 years

% Debt Maturing in 2 Years: 15%

Suntec REIT has a diversified portfolio that includes commercial and retail properties. With 55% of its debt fixed, it has some protection from interest rate hikes. The slightly longer debt maturity of 3.3 years and 15% of its debt maturing in two years provides flexibility in managing its financial obligations.

3. AIMS APAC REIT

% Fixed Rate Debt: 74%

Debt to Maturity: 2.1 years

% Debt Maturing in 2 Years: 27%

AIMS APAC REIT focuses on industrial properties, particularly logistics and warehouses. With a whopping 74% of its debt fixed, AIMS APAC is well-protected from interest rate volatility. Its 2.1 years debt to maturity and 27% of the debt maturing in the next two years means the REIT could potentially secure a lower interest cost.

4. Mapletree Pan Asia Commercial Trust (MPACT)

% Fixed Rate Debt: 79%

Debt to Maturity: 3.1 years

% Debt Maturing in 2 Years: 30%

MPACT invests across various commercial properties in Asia. With 79% of its debt fixed, it enjoys a high level of protection against interest rate increases. The 3.1 years debt to maturity provides a balanced approach, while a significant 30% of its debt maturing in the next two years could lead to strategic refinancing opportunities.

5. Frasers Centrepoint Trust (FCT)

% Fixed Rate Debt: 67%

Debt to Maturity: 2.8 years

% Debt Maturing in 2 Years: 16%

FCT focuses on suburban retail properties, making it a staple in the community. With 67% of its debt fixed, it provides a buffer against rising rates. The 2.8 years debt to maturity is manageable, and with 16% of its debt maturing in the next two years, FCT has a good handle on its financial planning.

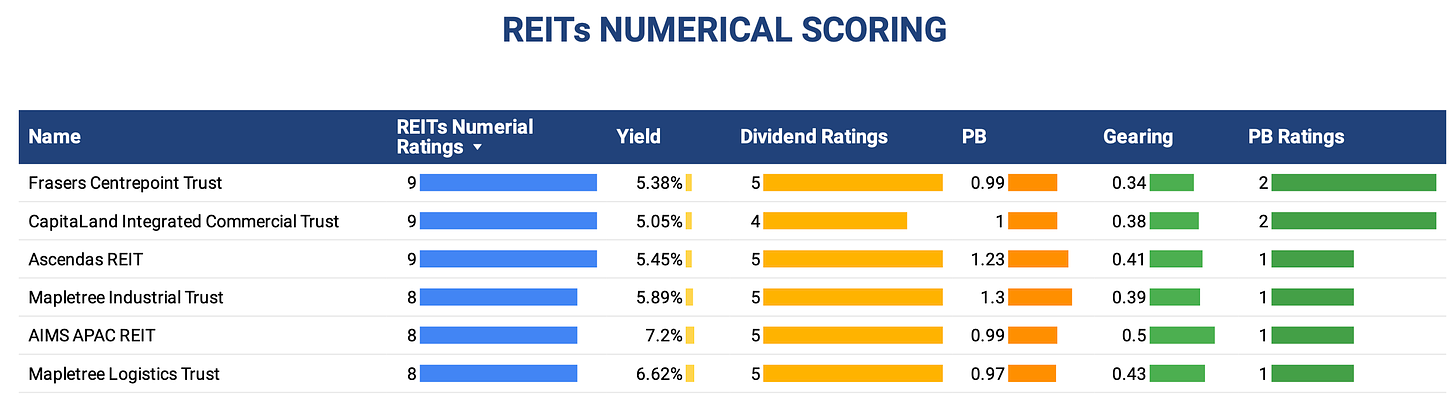

Subscribe our free newsletter below to get the latest REITs Numerical Scoring for free.

Disclaimer: This article constitutes the author’s personal views and is for entertainment and educational purposes only. It is not to be construed as financial advice in any form. Please do your own research and seek advice from a qualified financial advisor. From time to time, I have positions in all or some of the mentioned stocks when publishing this article. This is a disclosure - not a recommendation to buy or sell stocks.