10 Reasons Not to Panic During Market Downturns

1. Market Cycles are Normal

Downturns are a natural part of the market cycle. Selling during these times can lock in losses and prevent you from benefiting from future recoveries.

2. Historical Recovery

Bear markets typically last between 9-16 months, and markets generally recover over time. Patience is essential as history shows that downturns are often followed by rebounds.

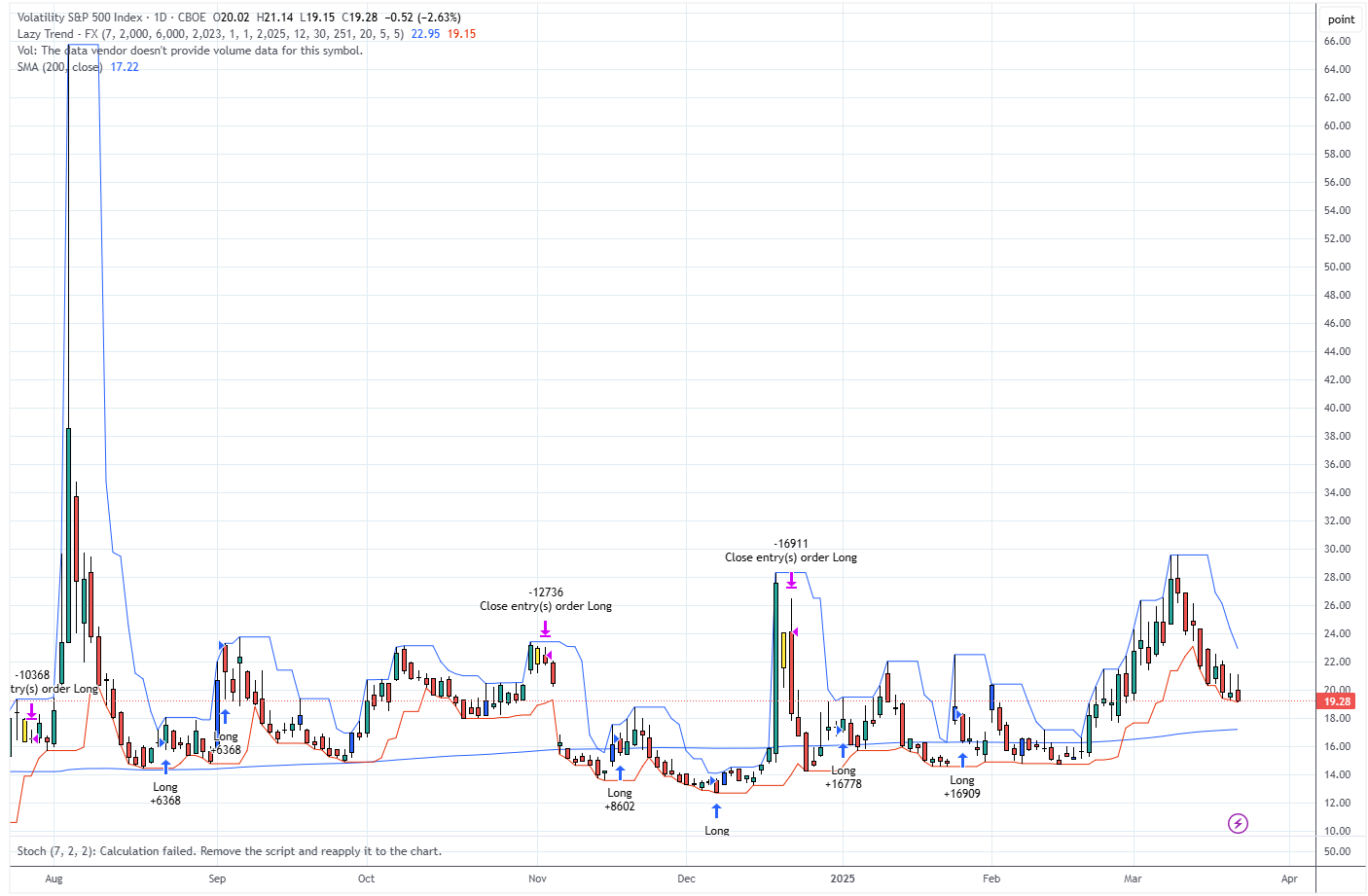

3. Unpredictability of Bottoms

It's challenging to determine the market bottom until after it has passed. Indicators like the volatility index (VIX) can signal fear, but timing the bottom is rarely precise. As a reference, VIX remains low despite market volatility recently.

4. Diversification is Key

If you're feeling nervous, reassess your asset allocation. A well-diversified portfolio across different asset classes can help manage volatility and reduce stress.

5. Opportunities in Declines

Market downturns can present buying opportunities. Quality assets often become available at discounted prices, allowing for potential long-term gains.

6. Potential Indicators of Recovery

Look for signs of a market turnaround, such as stabilizing corporate earnings, central banks signaling interest rate cuts, and improvements in economic indicators.

7. Global Investment Opportunities

While the U.S. market may be under pressure, international stocks, particularly in regions like Europe and China, may offer attractive valuations and growth potential.

8. Defensive Strategies

If you’re concerned about a recession, consider holding cash for flexibility, investing in defensive sectors, and maintaining a balanced portfolio to navigate potential downturns.

9. Focus on Fundamentals

In uncertain times, prioritize investments in companies with strong fundamentals and sustainable growth rather than getting caught up in momentum plays.

10. Risk Management Techniques

Incorporate strategies like dollar-cost averaging and portfolio rebalancing to protect against further losses and maintain a stable investment approach.

By staying informed and employing these strategies, you can navigate market fluctuations without succumbing to panic.

Disclaimer: This article constitutes the author’s personal views and is for entertainment and educational purposes only. It is not to be construed as financial advice in any form. Please do your own research and seek advice from a qualified financial advisor. From time to time, I have positions in all or some of the mentioned stocks when publishing this article. This is a disclosure - not a recommendation to buy or sell stocks.